- United States

- /

- Beverage

- /

- NYSE:BF.B

Declining Revenue and Margin Pressures Might Change the Case for Investing in Brown-Forman (BF.B)

Reviewed by Sasha Jovanovic

- In recent weeks, Brown-Forman has faced concerns over declining financial strength and reduced growth prospects, driven by weaker organic revenue and reliance on established brands.

- Despite its 41-year streak of dividend increases, the company's limited expansion avenues and decreased operating margin highlight challenges in maintaining long-term growth.

- We'll examine how Brown-Forman's softer organic revenue and margin contraction may alter its investment narrative and growth outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Brown-Forman Investment Narrative Recap

To be a shareholder in Brown-Forman, you need to believe in the enduring appeal of its flagship spirits brands and the company's proven capital return through dividends, even as near-term pressures mount. The latest news of softer organic revenue and reduced margins directly impacts the most important catalyst, a return to organic sales growth, and amplifies the main risk: the company's reliance on established markets and brands as consumer preferences shift. The short-term narrative is now more sensitive to competitive threats and demand volatility than before, but the core investment case still hinges on long-term brand resilience and cash flow discipline.

Among the recent announcements, Brown-Forman's consistent dividend increases, including the latest approved payout of US$0.2265 per share, stand out against current earnings and organic sales declines. This move underscores the management's focus on delivering shareholder value, but it also puts a spotlight on sustainability if top-line weakness persists. Yet for investors, the ability to support rising dividends in the face of margin pressure and stagnant revenue will remain under scrutiny...

Read the full narrative on Brown-Forman (it's free!)

Brown-Forman's outlook anticipates $4.1 billion in revenue and $870.2 million in earnings by 2028. This scenario is based on a 1.5% annual revenue growth rate and a $26.2 million increase in earnings from the current level of $844.0 million.

Uncover how Brown-Forman's forecasts yield a $30.91 fair value, a 10% upside to its current price.

Exploring Other Perspectives

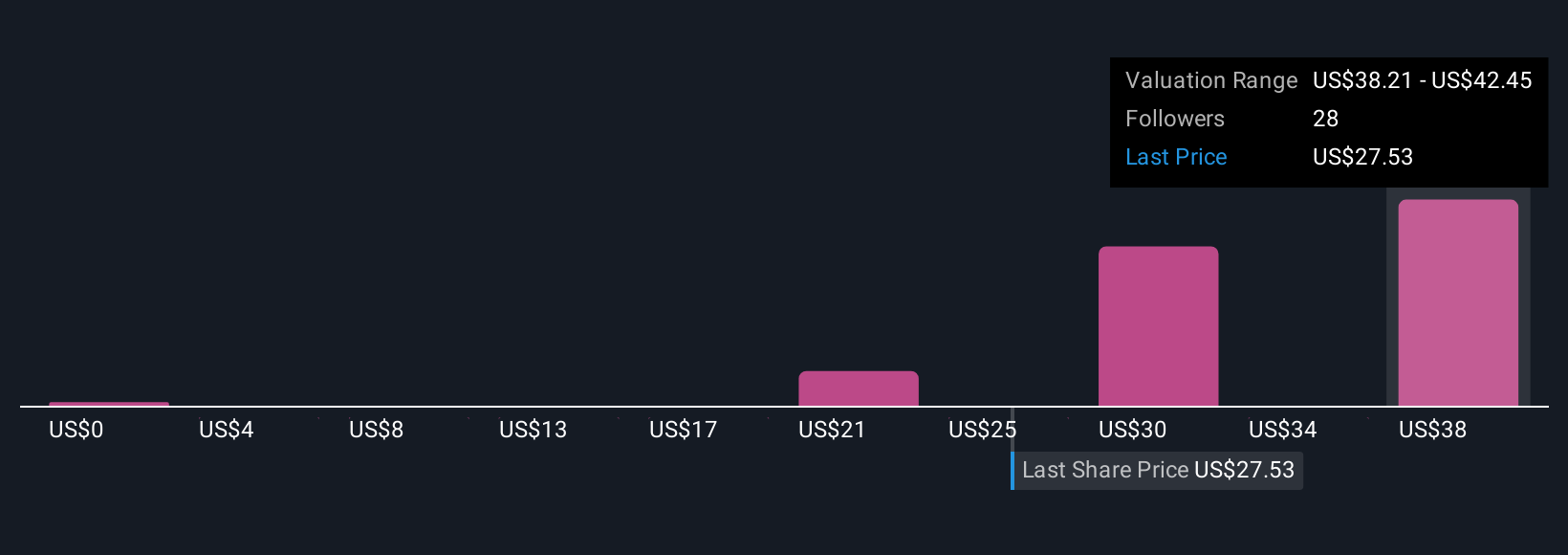

Simply Wall St Community members offered nine fair value estimates for Brown-Forman, ranging from US$4.25 to US$42.45 per share. While these varied views reflect strong differences about the company's outlook, concerns over shrinking margins and limited revenue growth continue to shape the broader conversation on future performance.

Explore 9 other fair value estimates on Brown-Forman - why the stock might be worth as much as 51% more than the current price!

Build Your Own Brown-Forman Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brown-Forman research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Brown-Forman research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brown-Forman's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brown-Forman might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BF.B

Brown-Forman

Manufactures, distills, bottles, imports, exports, markets, and sells a variety of alcohol beverages.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives