- United States

- /

- Food

- /

- NYSE:ADM

Benign Growth For Archer-Daniels-Midland Company (NYSE:ADM) Underpins Its Share Price

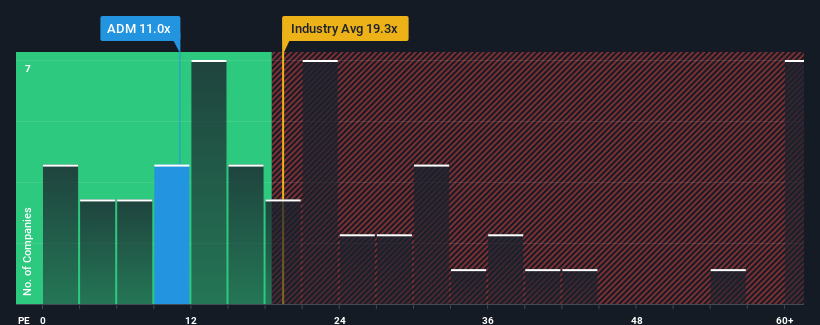

With a price-to-earnings (or "P/E") ratio of 11x Archer-Daniels-Midland Company (NYSE:ADM) may be sending bullish signals at the moment, given that almost half of all companies in the United States have P/E ratios greater than 19x and even P/E's higher than 34x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings that are retreating more than the market's of late, Archer-Daniels-Midland has been very sluggish. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for Archer-Daniels-Midland

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Archer-Daniels-Midland's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 33%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 32% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 0.8% each year as estimated by the ten analysts watching the company. With the market predicted to deliver 10% growth each year, that's a disappointing outcome.

In light of this, it's understandable that Archer-Daniels-Midland's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Archer-Daniels-Midland's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Archer-Daniels-Midland (1 makes us a bit uncomfortable) you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ADM

Archer-Daniels-Midland

Engages in the procurement, transportation, storage, processing, and merchandising of agricultural commodities, ingredients, flavors, and solutions in the United States, Switzerland, the Cayman Islands, Brazil, Mexico, Canada, the United Kingdom, and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives