- United States

- /

- Food

- /

- NYSE:ADM

Archer-Daniels-Midland (NYSE:ADM) Completes Share Buyback Of 33% For US$10,123 Million

Reviewed by Simply Wall St

Archer-Daniels-Midland (NYSE:ADM) experienced a price move of 1.84% over the past week, which may be associated with updates to its stock buyback program. The company recently clarified that it has yet to repurchase any shares in the latest tranche, though it has completed 33% of its buyback program announced in 2014. This buyback activity reflects ADM’s broader capital allocation strategy and coincides with a market environment where major indexes like the Dow Jones, S&P 500, and Nasdaq experienced declines. These declines were driven by issues such as UnitedHealth's investigation impacting health insurers and tech stocks facing pressure. Despite a flat market week and broader market volatility, ADM's share performance demonstrates resilience, possibly influenced by its buyback strategy, even as the S&P 500 touched record highs earlier in the period and appears set to post weekly losses.

Take a closer look at Archer-Daniels-Midland's potential here.

Over the past five years, Archer-Daniels-Midland (ADM) achieved a total shareholder return of 41.99%, underlining a stable growth trajectory. Relative to the broader market, ADM's recent performance has been less compelling, with the company's one-year returns underperforming the US market's 20.8% gain and slightly lagging behind the US Food industry's negative 6.4% return.

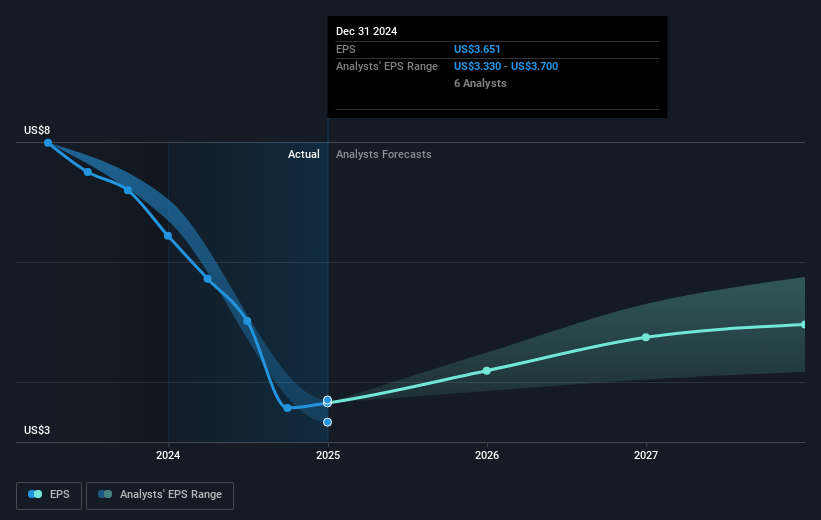

Several factors have contributed to ADM's longer-term performance. Although recently its annual net income fell to US$1.8 billion from US$3.48 billion in the previous year, the company's earnings per share grew from US$1.06 to US$1.17 in the last quarter. Furthermore, the company maintains an attractive dividend yield of 4.38% and continues expanding its operations, including a strategic partnership with Vestaron Corporation announced in October 2024. Despite ongoing challenges, including a class action lawsuit over securities fraud allegations in January 2024, ADM's ability to sustain dividends through a disciplined approach reflects positively on its total shareholder returns.

- Unlock the insights behind Archer-Daniels-Midland's valuation and discover its true investment potential

- Discover the key vulnerabilities in Archer-Daniels-Midland's business with our detailed risk assessment.

- Invested in Archer-Daniels-Midland? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ADM

Archer-Daniels-Midland

Engages in the procurement, transportation, storage, processing, and merchandising of agricultural commodities, ingredients, flavors, and solutions in the United States, Switzerland, the Cayman Islands, Brazil, Mexico, Canada, the United Kingdom, and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives