- United States

- /

- Food

- /

- OTCPK:TTCF.Q

Tattooed Chef's (NASDAQ:TTCF) Cash Burn Should Not Hinder Growth Plans

Plant-based diets are blooming in the 2020s, so seeing a SPAC deal in that domain was not surprising. However, shares of Tattooed Chef (NASDAQ: TTCF) remain range-bound after the first 10 months of listing on Nasdaq.

The company's last earnings report certainly didn't help the cause, so that we will be examining the cash burn rate of this yet unprofitable, sustainable healthy food player.

Latest developments

The latest earnings release failed to deliver as the decline in sales, quarter-over-quarter rang the alarm bells among the investors, despite the fact that year-over-year growth was over 45%. While it can be partially explained as a seasonality effect, continuous, predictable growth remains of extreme importance for unprofitable companies.

On the positive side, the company is starting to offer its products in Kroger (NYSE: KR) stores. A 1,800 store nationwide launch should boost the total revenue and increase the brand reach.

Furthermore, the company just announced that members of their management will participate at the Cowen Health, Wellness & Beauty Summit on Tuesday, September 14, 2021, at 3:20 pm ET. Investors and other interested parties can access the webcast at the company's investor relations page.

Examining the Cash Burn

So should the shareholders be worried about its cash burn? For this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway.'

See our latest analysis for Tattooed Chef

When Might Tattooed Chef Run Out Of Money?

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate.

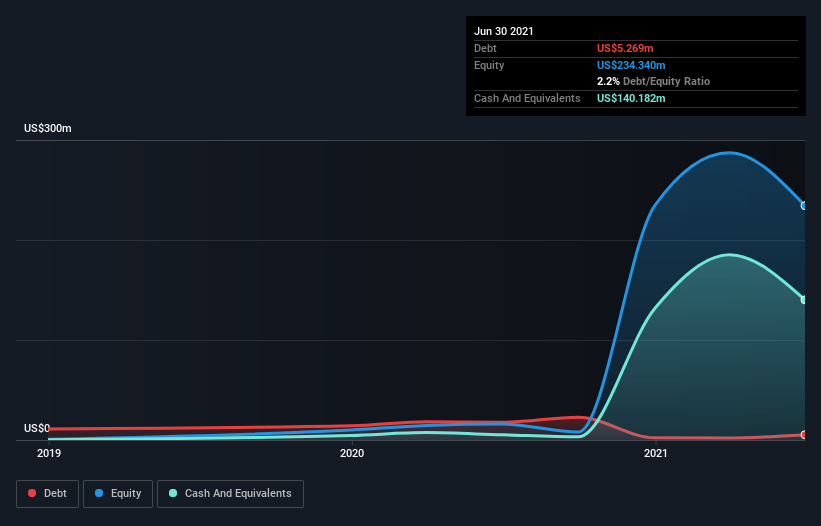

As of June 2021, Tattooed Chef had cash of US$140m and rather low debt at US$5.3m, which we can ignore for this analysis.

Importantly, its cash burn was US$53m over the trailing twelve months. That means it had a cash runway of about 2.6 years as of June 2021. Arguably, that's a prudent and sensible length of the runway to have. You can see how its cash balance has changed over time in the image below.

How Well Is Tattooed Chef Growing?

We take a lot of comfort in the strong annual revenue growth of 54%, although only a few reported quarters are behind us.

In light of the data above, we're fairly sanguine about the business growth trajectory. Clearly, the crucial factor is whether the company will grow its business from now on. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Easily Can Tattooed Chef Raise Cash?

While Tattooed Chef seems to be in a fairly good position, it's still worth considering how easily it could raise more cash, even to fuel faster growth.

Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. One of the main advantages of publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By comparing a company's annual cash burn to its total market capitalization, we can estimate roughly how many shares it would have to issue to run the company for another year (at the same burn rate).

Tattooed Chef's cash burn of US$53m is about 2.9% of its US$1.8b market capitalization. That means it could easily issue a few shares to fund more growth and might well be in a position to borrow cheaply.

Is Tattooed Chef's Cash Burn A Worry?

As you can probably tell by now, we're not too worried about Tattooed Chef's cash burn. In particular, we think its revenue growth stands out as evidence that the company is well on top of its spending.

Although we do find its increasing cash burn to be a bit of a negative, once we consider the other metrics mentioned in this article together, the overall picture is one we are comfortable with. The company is expanding and reaching more and more customers every day, on the tailwind of a growing trend for a healthier, sustainable diet. If you are interested in the stock, we'd recommend you to go out and test their products, just like legendary Peter Lynch would advise. Investing in the company whose products you want to use every day is certainly one way to find outperformance.

Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. On another note, Tattooed Chef has 3 warning signs (and 1 which is significant) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

If you're looking to trade Tattooed Chef, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tattooed Chef might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About OTCPK:TTCF.Q

Tattooed Chef

A plant-based food company, produces and sells a portfolio of frozen foods.

Low with weak fundamentals.

Similar Companies

Market Insights

Community Narratives