- United States

- /

- Food

- /

- NasdaqGS:STKL

While shareholders of SunOpta (NASDAQ:STKL) are in the black over 5 years, those who bought a week ago aren't so fortunate

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But when you pick a company that is really flourishing, you can make more than 100%. Long term SunOpta Inc. (NASDAQ:STKL) shareholders would be well aware of this, since the stock is up 161% in five years. It's also good to see the share price up 17% over the last quarter.

While the stock has fallen 5.7% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

Check out our latest analysis for SunOpta

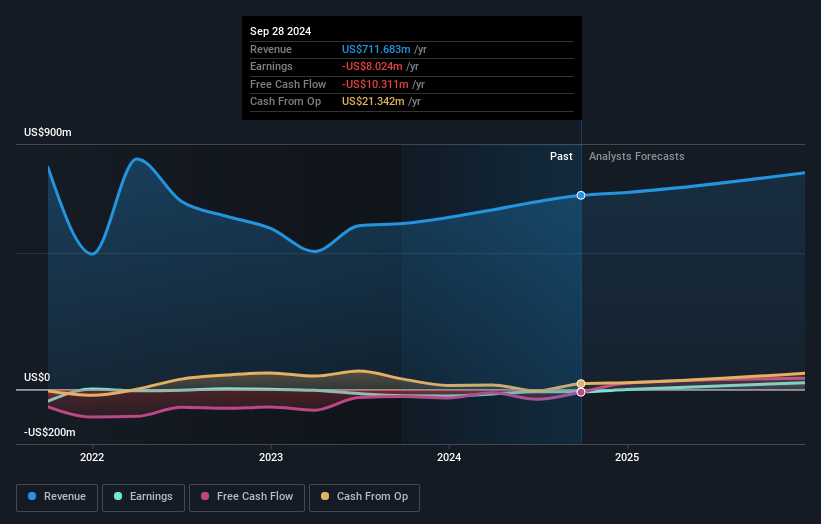

Because SunOpta made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last half decade SunOpta's revenue has actually been trending down at about 4.5% per year. On the other hand, the share price done the opposite, gaining 21%, compound, each year. It just goes to show tht the market is forward looking, and it's not always easy to predict the future based on past trends. Still, we are a bit cautious in this kind of situation.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

We're pleased to report that SunOpta shareholders have received a total shareholder return of 34% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 21% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand SunOpta better, we need to consider many other factors. Even so, be aware that SunOpta is showing 2 warning signs in our investment analysis , you should know about...

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:STKL

SunOpta

Engages in manufacture and sale of plant-based and fruit-based food and beverage products in the United States, Canada, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives