- United States

- /

- Food

- /

- NasdaqCM:SANW

The Market Lifts S&W Seed Company (NASDAQ:SANW) Shares 27% But It Can Do More

S&W Seed Company (NASDAQ:SANW) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 62% share price drop in the last twelve months.

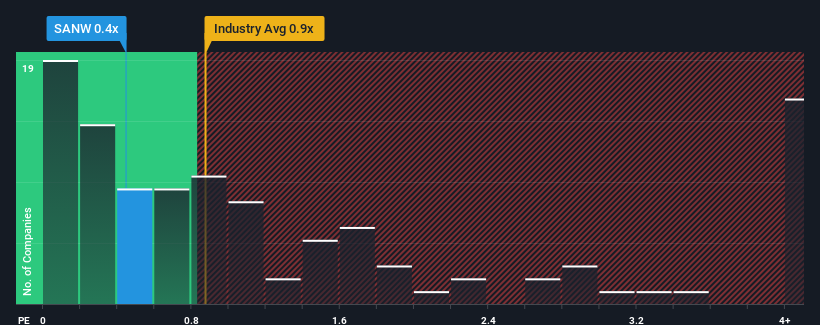

Even after such a large jump in price, it's still not a stretch to say that S&W Seed's price-to-sales (or "P/S") ratio of 0.4x right now seems quite "middle-of-the-road" compared to the Food industry in the United States, where the median P/S ratio is around 0.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for S&W Seed

What Does S&W Seed's Recent Performance Look Like?

S&W Seed could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think S&W Seed's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For S&W Seed?

There's an inherent assumption that a company should be matching the industry for P/S ratios like S&W Seed's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's top line. As a result, revenue from three years ago have also fallen 19% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 19% during the coming year according to the only analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 1.7%, which is noticeably less attractive.

In light of this, it's curious that S&W Seed's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Its shares have lifted substantially and now S&W Seed's P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that S&W Seed currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

There are also other vital risk factors to consider and we've discovered 5 warning signs for S&W Seed (3 are a bit unpleasant!) that you should be aware of before investing here.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SANW

S&W Seed

An agricultural company, engages in breeding, growing, processing, and sale of alfalfa and sorghum seeds in North and South America, Australia, and internationally.

Slight and slightly overvalued.

Similar Companies

Market Insights

Community Narratives