- United States

- /

- Beverage

- /

- NasdaqGS:PEP

What PepsiCo (PEP)'s Bottling Spin-Off Proposal From Activist Elliott Means For Shareholders

Reviewed by Sasha Jovanovic

- In September 2025, Elliott Investment Management revealed a US$4 billion stake in PepsiCo and publicly proposed a spin-off of its North American bottling operations, seeking to boost accountability and compete more effectively with Coca-Cola’s refranchised bottler model.

- This activist push has prompted increased attention on potential operational restructuring at PepsiCo and signals the influence major shareholders can exert on longstanding business models.

- We'll explore how Elliott's advocacy for a bottling spin-off could alter PepsiCo's investment narrative and future growth outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

PepsiCo Investment Narrative Recap

To be a PepsiCo shareholder, you need to believe in the company's ability to drive productivity, innovate in healthier products, and expand internationally, while maintaining resilience through economic cycles. The Elliott Investment Management push for a North American bottling spin-off adds a layer of uncertainty around operational structure, but for now, does not materially change the short-term catalyst: progress toward margin improvement from integration and technology, alongside the risk of underperformance in permissible snacks as consumer preferences evolve.

Among recent company updates, PepsiCo’s collaboration with Unilever on the STEP Up for Agriculture initiative stands out. This move shows ongoing investment in sustainable supply chains, which is relevant as PepsiCo manages both cost efficiency and compliance with evolving environmental and regulatory requirements, factors that could impact margins as it considers activist proposals.

By contrast, investors should also be aware of the risk that PepsiCo’s heavy focus on cost-cutting and plant closures could ...

Read the full narrative on PepsiCo (it's free!)

PepsiCo's outlook suggests $101.5 billion in revenue and $11.8 billion in earnings by 2028. This scenario assumes 3.4% annual revenue growth and a $4.2 billion increase in earnings from the current $7.6 billion.

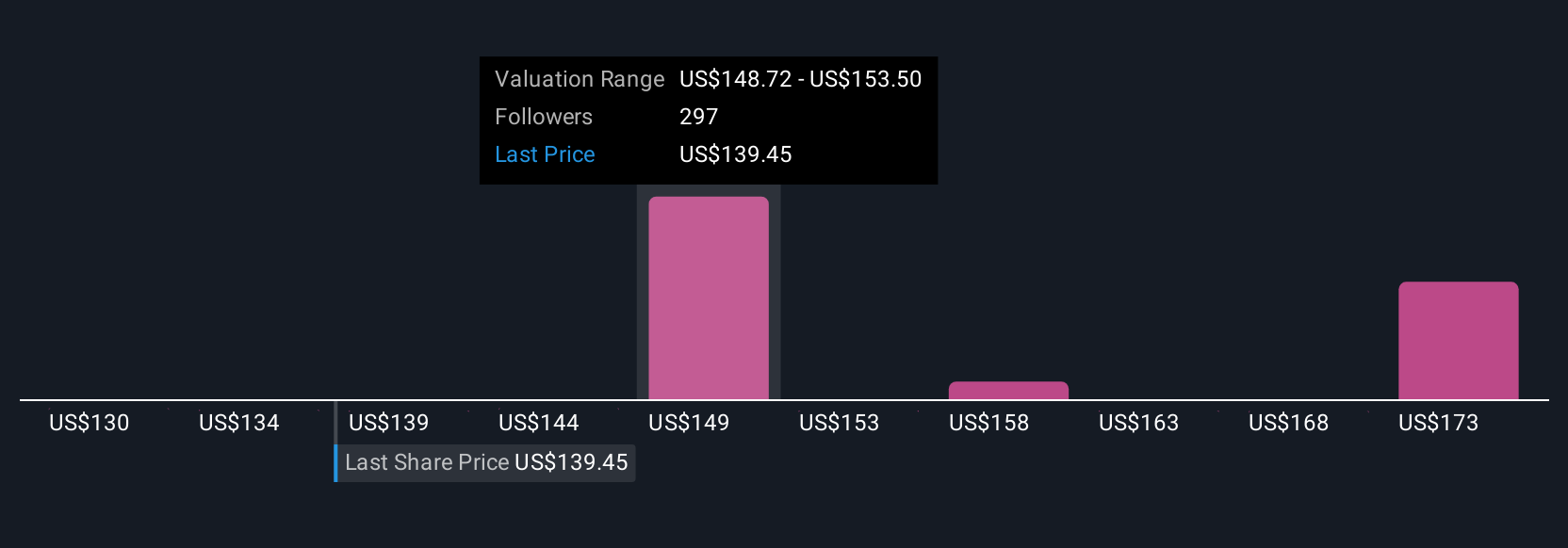

Uncover how PepsiCo's forecasts yield a $152.57 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Community members on Simply Wall St estimate PepsiCo's fair value between US$120.49 and US$268.57, with 41 distinct views represented. These wide-ranging opinions appear as the company faces execution risk from aggressive cost initiatives, which could affect longer-term growth potential and market confidence.

Explore 41 other fair value estimates on PepsiCo - why the stock might be worth as much as 89% more than the current price!

Build Your Own PepsiCo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PepsiCo research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free PepsiCo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PepsiCo's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PEP

PepsiCo

Engages in the manufacture, marketing, distribution, and sale of various beverages and convenient foods worldwide.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives