- United States

- /

- Beverage

- /

- NasdaqGS:PEP

Investors in PepsiCo (NASDAQ:PEP) have seen decent returns of 61% over the past five years

If you buy and hold a stock for many years, you'd hope to be making a profit. Furthermore, you'd generally like to see the share price rise faster than the market. Unfortunately for shareholders, while the PepsiCo, Inc. (NASDAQ:PEP) share price is up 40% in the last five years, that's less than the market return. Zooming in, the stock is actually down 6.4% in the last year.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

See our latest analysis for PepsiCo

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

PepsiCo's earnings per share are down 5.7% per year, despite strong share price performance over five years.

Essentially, it doesn't seem likely that investors are focused on EPS. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

In contrast revenue growth of 8.0% per year is probably viewed as evidence that PepsiCo is growing, a real positive. In that case, the company may be sacrificing current earnings per share to drive growth.

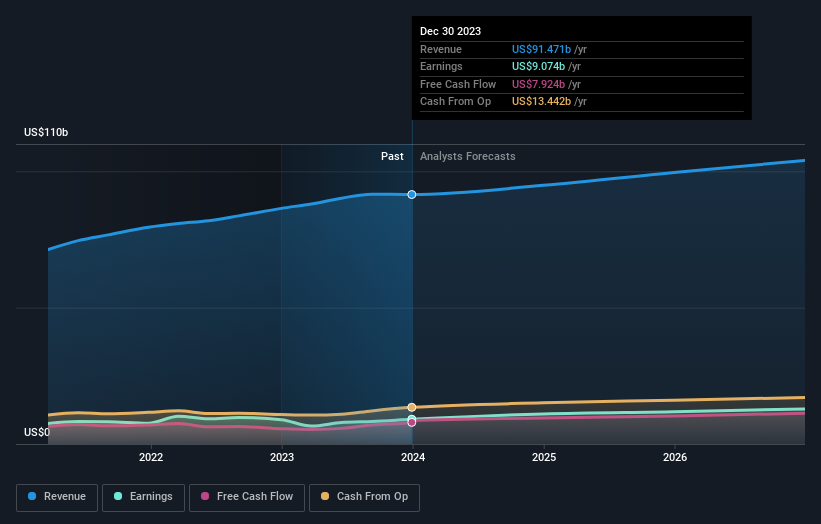

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

PepsiCo is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for PepsiCo in this interactive graph of future profit estimates.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for PepsiCo the TSR over the last 5 years was 61%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

PepsiCo shareholders are down 3.6% for the year (even including dividends), but the market itself is up 34%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 10% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand PepsiCo better, we need to consider many other factors. To that end, you should be aware of the 2 warning signs we've spotted with PepsiCo .

But note: PepsiCo may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PEP

PepsiCo

Engages in the manufacture, marketing, distribution, and sale of various beverages and convenient foods worldwide.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives