- United States

- /

- Beverage

- /

- NasdaqGS:PEP

Enter the Emerging Market by Proxy. PepsiCo (NASDAQ:PEP) Pays a Nice Dividend and is Growing Internationally

Today, we'll take a closer look at PepsiCo, Inc. (NASDAQ:PEP) from a dividend investor's perspective. PepsiCo released their latest Q3 earnings report, where they outline a continuation of revenue growth at 11.6% and EPS of US$1.6. This puts the company in a steady low growth rate, which can be a great moment to examine dividends.

The main sources of growth for PepsiCo are emerging markets:

- Latin America with 27% quarterly revenue growth

- Africa, Middle East and South Asia with 33% quarterly revenue growth

- Asia Pacific, Australia and New Zealand and China Region with 27% quarterly revenue growth

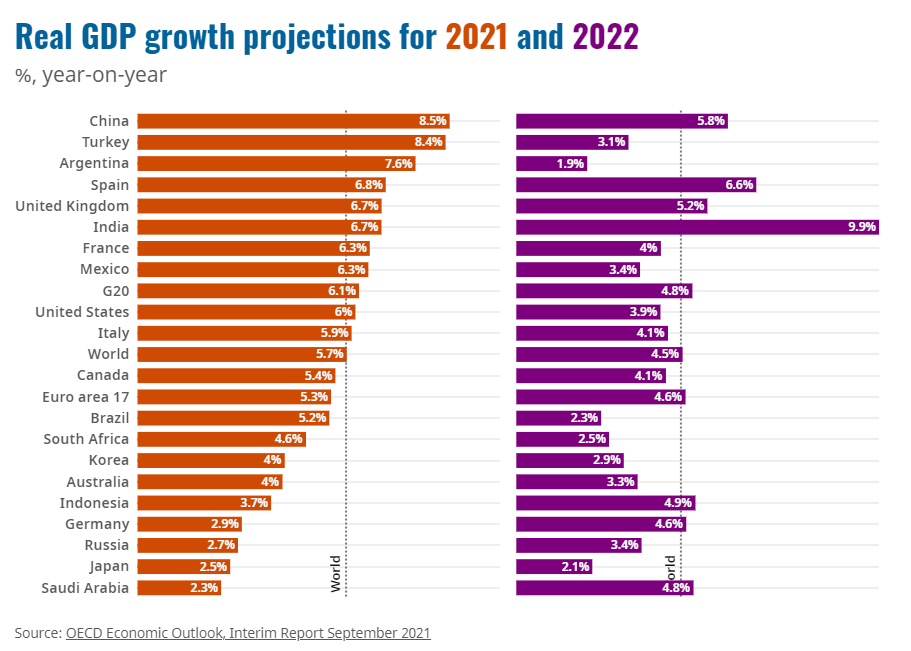

The company is poised to grow in parallel with the growth of emerging economies, which puts it in markets that are expected to have stronger growth than western markets in the coming years. This report, by OCED, outlines how emerging markets are expected to grow GDP in 2021 and 2022:

For investors, this means that the company still has sources from which it can deliver growth and can sustain the slow but stable return rate of the stock.

Reviewing Dividends

Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth.

A slim 2.9% yield is hard to get excited about, but the long payment history is respectable. At the right price, or with strong growth opportunities, PepsiCo could have potential.

Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

Explore this interactive chart for our latest analysis on PepsiCo!

Payout Ratios

Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable.

Looking at the data, we can see that 70% of PepsiCo's profits were paid out as dividends in the last 12 months. This is a healthy payout ratio, and while it does limit the amount of earnings that can be reinvested in the business, there is also some room to lift the payout ratio over time.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. The company paid out 80% of its free cash flow as dividends last year, which is adequate, but reduces the wriggle room in the event of a downturn. It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

We update our data on PepsiCo every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend.

During the last 10 years, the dividend has been stable, which could imply the business could have relatively consistent earnings power. In this period, the first annual payment was US$1.9 in 2011, compared to US$4.3 last year. Dividends per share have grown at approximately 8.4% per year over this time.

PepsiCo has grown its earnings per share at 11% per annum over the past five years, which gives solid ground for the mentioned annual dividend increases.

Conclusion

PepsiCo is continuing to grow its business with a focus on emerging markets where their products have a higher uptake on the back of the stronger expected GDP growth. The company is delivering both revenue growth and earnings per share, as evident in their last Q3 report.

Businesses that can grow their dividends at a decent rate and maintain a stable payout can generate substantial wealth for shareholders over the long term.

Dividend investors should always want to know if:

- A company's dividends are affordable

- If there is a track record of consistent payments

- If the dividend is capable of growing.

PepsiCo's is paying out more than half its income as dividends, but at least the dividend is covered by both reported earnings and cashflow. We like that it has been delivering solid improvement in its earnings per share, and relatively consistent dividend payments.

Taking the debate a bit further, we've identified 2 warning signs for PepsiCo that investors need to be conscious of moving forward.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:PEP

PepsiCo

Engages in the manufacture, marketing, distribution, and sale of various beverages and convenient foods worldwide.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives