- United States

- /

- Beverage

- /

- NasdaqGS:PEP

Can Pepsi Stock Rebound After Elliott’s $4B Stake and Recent Share Price Slide?

Reviewed by Bailey Pemberton

Trying to decide what to do with PepsiCo stock can feel a bit like staring at the vending machine and weighing your options. There is no denying the iconic brand power, or the recent twists and turns that might make you second-guess your move. Over the past month, PepsiCo's shares have slipped by 4.6%, with a year-to-date return showing a 7.0% dip and a rather striking 13.2% decline over the past year. But scratch the surface, and you will spot a few dynamic shifts that could change the narrative.

First, the recent buzz comes from Elliott Investment Management, a heavyweight activist investor, making headlines with a $4 billion stake. Their push for a "reset" of PepsiCo’s strategy suggests there is value waiting to be unlocked, especially as they encourage management to tighten up its brand focus and consider ditching underperforming products. Meanwhile, PepsiCo has not lost its appetite for growth, upping its stake in Celsius Holdings and announcing upcoming price hikes on soft drinks in the U.S. While these moves have yet to reflect in a sustained rally, they do hint at underlying growth ambitions and a shift in risk perception among investors.

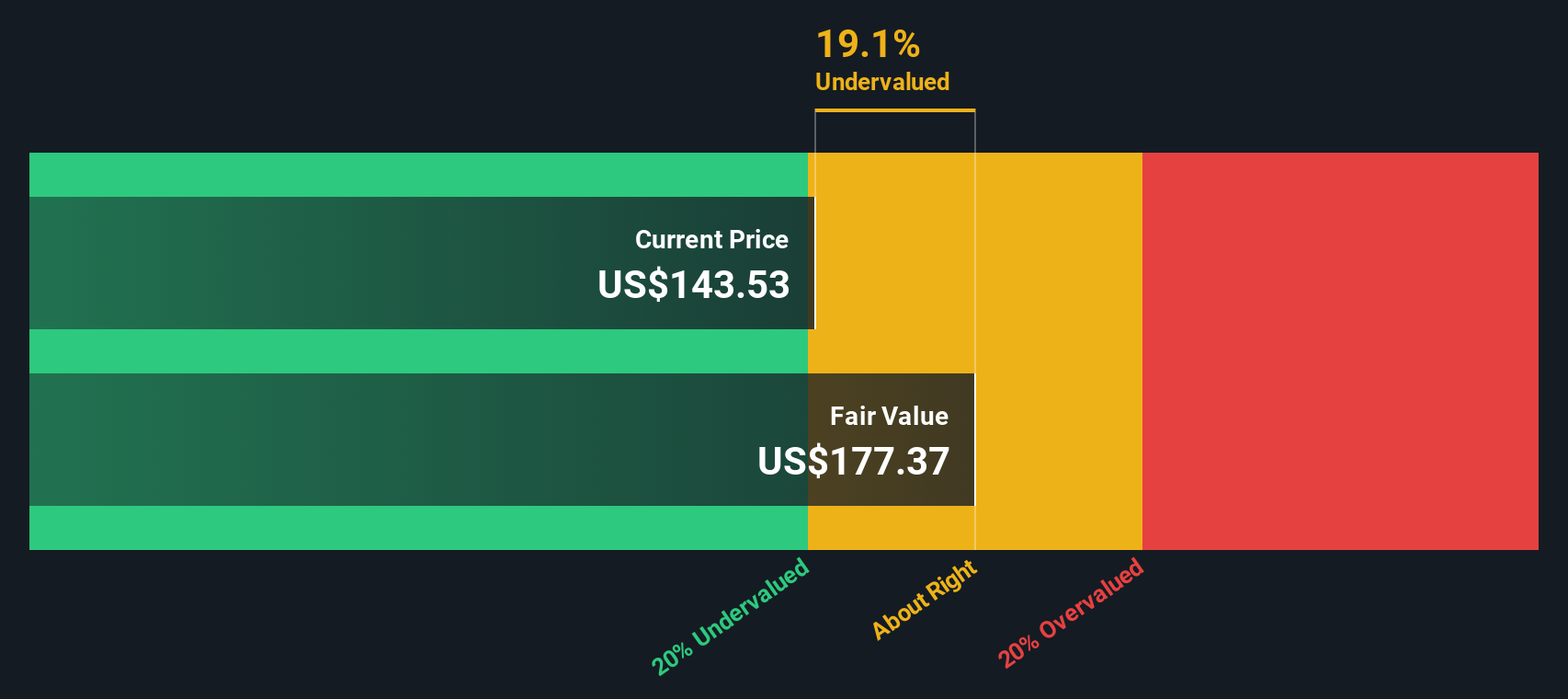

When it comes to valuation, PepsiCo currently gets a valuation score of 3 out of 6 based on our checks, meaning it appears undervalued in three separate assessment categories. But how reliable are those traditional valuation models for a company with these kinds of headlines, risks, and opportunities? Let’s break down each method. Later on, I will let you in on an even better way to think about whether PepsiCo is a bargain or not.

Why PepsiCo is lagging behind its peers

Approach 1: PepsiCo Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company's business is worth by projecting its future cash flows and then discounting those values back to their present worth. This method is widely used by investors to judge if a stock is priced attractively relative to its fundamentals.

For PepsiCo, the latest trailing-twelve-month Free Cash Flow (FCF) clocks in at $6.8 Billion. Analyst projections see this figure consistently rising, with ten-year estimates, including both analyst forecasts and additional extrapolations, reaching nearly $18.3 Billion by 2035. These forecasts reflect expectations for ongoing business growth, with Simply Wall St carrying estimates beyond the typical five-year analyst window.

Based on the 2 Stage Free Cash Flow to Equity model, PepsiCo's intrinsic value comes out to $268.46 per share. This finding suggests a striking 48.0% discount compared to the current market price, signaling the stock may be significantly undervalued at present.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests PepsiCo is undervalued by 48.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

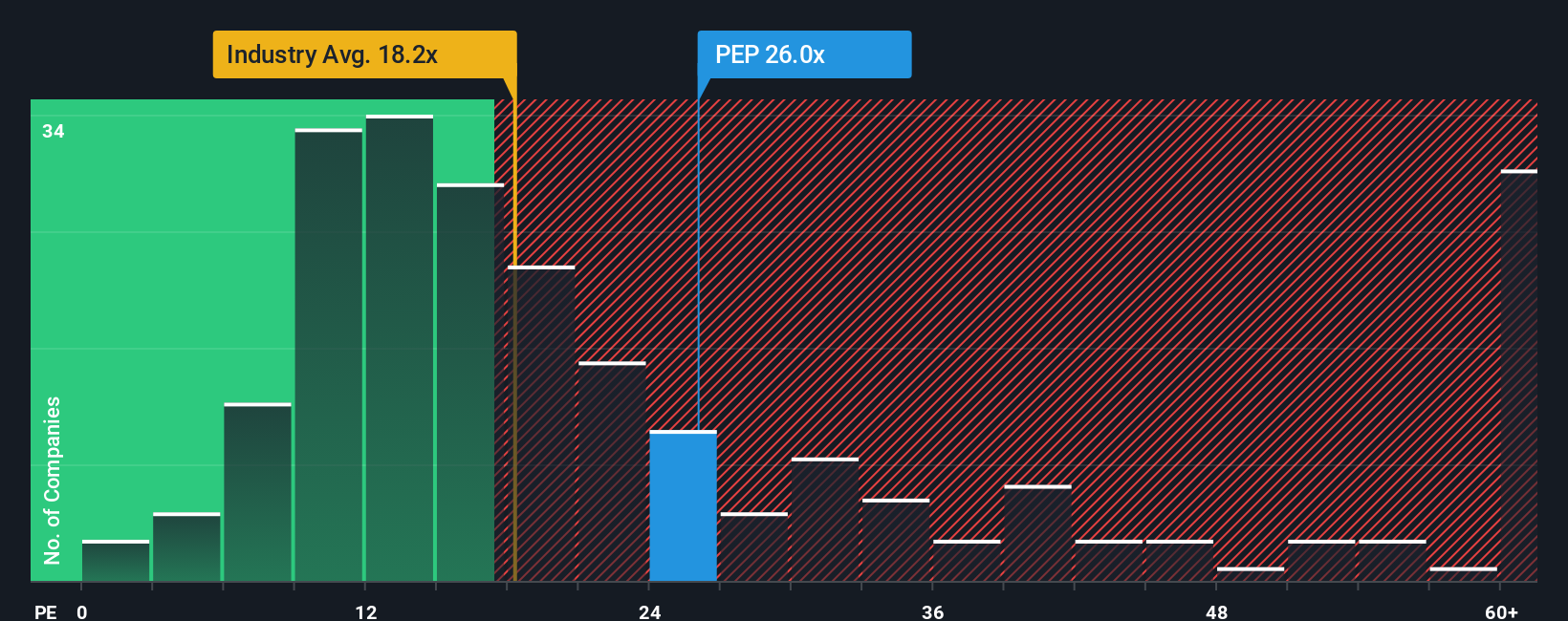

Approach 2: PepsiCo Price vs Earnings

For companies like PepsiCo that consistently generate profits, the Price-to-Earnings (PE) ratio is one of the most insightful ways to assess valuation. This metric is widely used because it directly connects the company’s market price to its ability to earn profits. This makes it especially useful when evaluating steady, profitable industry leaders.

A typical or “fair” PE ratio depends on how much investors expect a company’s earnings to grow and how much risk they perceive. Higher growth prospects and lower risks usually justify a bigger multiple. Slower growth or more uncertainty pull it lower.

PepsiCo’s current PE ratio is 25x. This compares closely to the average PE among its global beverage peers, which stands at 25x. It is noticeably higher than the broader industry average of 18x. However, to get an even sharper perspective, Simply Wall St’s Fair Ratio model accounts for PepsiCo’s earnings growth, industry dynamics, profit margins, market capitalization, and risk profile. For PepsiCo, the Fair PE Ratio comes out to 27x. Unlike industry or peer comparisons, this proprietary approach is tailored to the company and its outlook. This offers a smarter standard for measuring value.

With PepsiCo’s 25x PE ratio sitting just below the 27x Fair Ratio, the stock appears valued about right when accounting for its specific opportunities and risks.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your PepsiCo Narrative

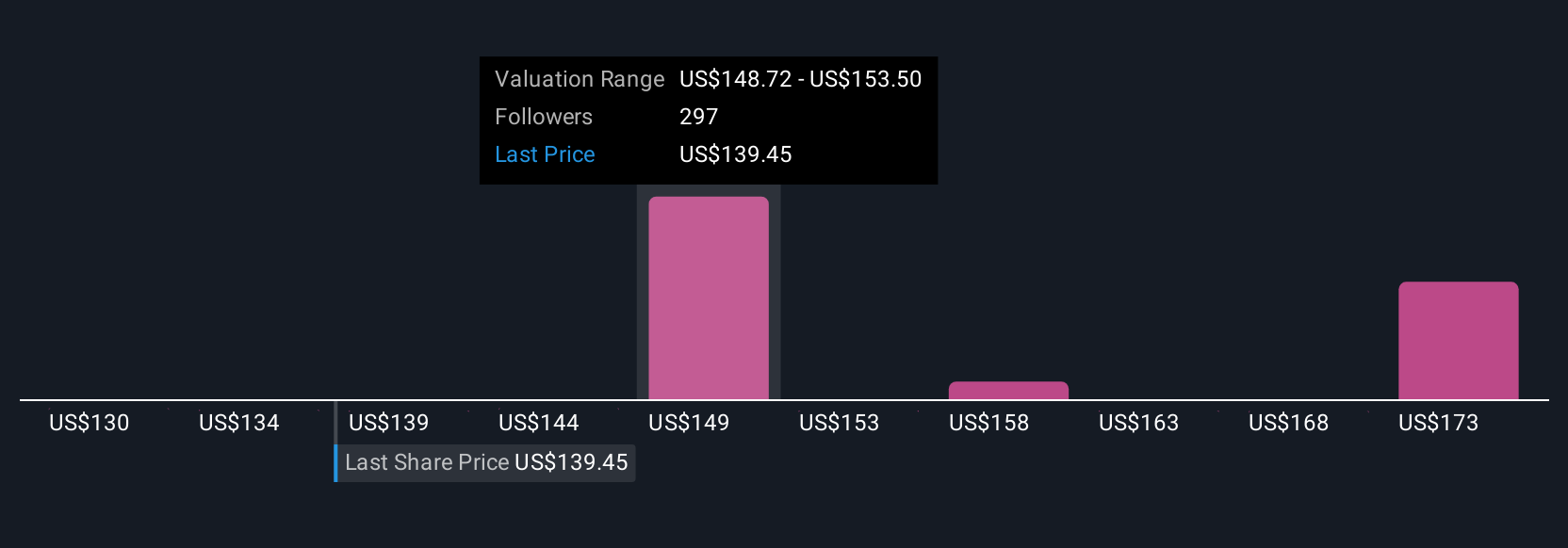

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story or perspective about a company. It connects the latest headlines, business strategy, and industry trends to realistic financial forecasts and a calculated fair value.

Instead of just looking at numbers in isolation, Narratives let you see how a company’s journey—including its growth plans, challenges, and industry shifts—translates into future revenue, margins, and profit estimates. This empowers you to link your view of PepsiCo’s future, such as international expansion or innovation in healthier products, directly to a fair value target. This helps you decide whether to buy, sell, or hold based on the gap between Fair Value and the current Price.

Simply Wall St makes it simple to build or select Narratives on the Community page, which is used by millions of investors worldwide. Narratives are updated automatically when important news, earnings, or analyst changes occur, ensuring your decisions are always based on the most current information.

For example, some PepsiCo Narratives see fair value as high as $160.43, highlighting optimism around digitalization and global growth. Others see it as low as $115.00, pointing to concerns about evolving health trends and international market challenges.

Do you think there's more to the story for PepsiCo? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PEP

PepsiCo

Engages in the manufacture, marketing, distribution, and sale of various beverages and convenient foods worldwide.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives