- United States

- /

- Food

- /

- NasdaqGS:MDLZ

Mondelez International (NasdaqGS:MDLZ) Teams Up With J Balvin For Sour Patch Kids Promo

Reviewed by Simply Wall St

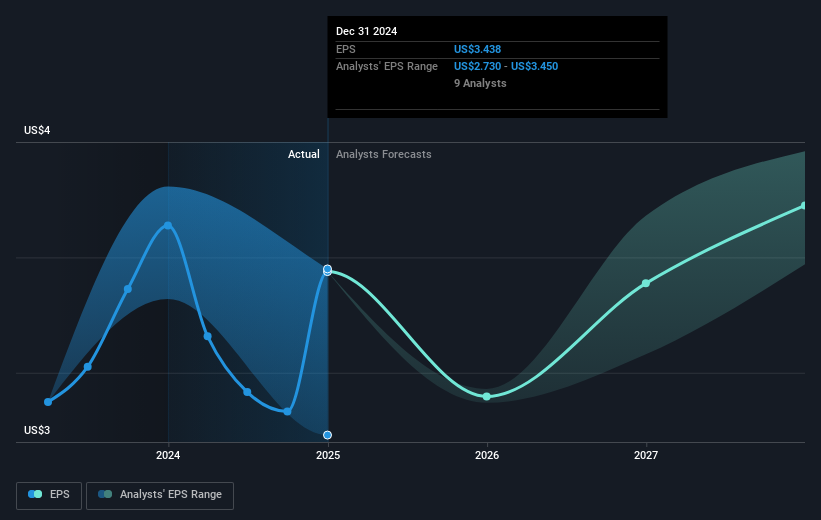

Mondelez International (NasdaqGS:MDLZ) experienced a 13% price increase over the last quarter, potentially fueled by its product-related initiatives, such as SOUR PATCH KIDS' collaboration with J Balvin. This partnership showcases the company's efforts to bolster customer engagement and visibility. Meanwhile, Mondelez's Q4 earnings report highlighted notable growth, with improved sales and net income, indicating solid financial health against volatile market conditions, marked by a 5.6% market decline amid global trade uncertainties. Despite the broader market's challenges, Mondelez demonstrated resilience, partially through new product innovations and robust financial results.

Mondelez International's shares have delivered a total return of 46.02% over the last five years, a testament to the company's ability to navigate various market challenges and capitalize on growth opportunities. In the past year, Mondelez has outperformed the US Food industry, which saw a 5.9% decline, highlighting its robust business strategies and market positioning.

Key contributors to Mondelez's longer-term performance include its focus on brand reinvestments and innovative collaborations, such as the Oreo partnership with Post Malone in January 2025. Additionally, significant share buybacks that saw 58.72 million shares repurchased as of late 2025 have also supported shareholder returns. Mondelez's expansion in digital channels with double-digit growth in e-commerce during 2024 further exemplifies the firm's adaptability and consumer engagement strategies, emphasizing its broader commitment to sustainability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MDLZ

Mondelez International

Through its subsidiaries, manufactures, markets, and sells snack food and beverage products in the Latin America, North America, Asia, the Middle East, Africa, and Europe.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives