- United States

- /

- Food

- /

- NasdaqGS:KHC

How Kraft Heinz's (KHC) Sports Arena Partnership Could Influence Its Brand Power and Fan Engagement Strategy

Reviewed by Sasha Jovanovic

- Kraft Heinz Canada and Maple Leaf Sports & Entertainment recently announced a multi-year partnership that brings HEINZ ketchup and mustard back to major Canadian sporting venues, including Scotiabank Arena, beginning with the 2025-2026 NHL season.

- This collaboration follows more than six years of fan demand and introduces innovative condiment stations, further highlighting Kraft Heinz's focus on enhancing its brand presence and consumer experience in Canada.

- We'll take a look at how renewed sports arena visibility and fan engagement could shape Kraft Heinz's broader investment narrative moving forward.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Kraft Heinz Investment Narrative Recap

If you’re considering Kraft Heinz as a potential investment, the central thesis relies on believing that the company can restore strong brand value and stem volume declines, particularly in its key North American market. The new partnership with Maple Leaf Sports & Entertainment may strengthen brand visibility in Canada, but it does not materially impact the major short-term catalysts or the core risk of continued volume contraction in North America retail.

Looking beyond this sports marketing push, the recent announcement of Kraft Heinz’s planned split into two separate publicly traded companies stands out. This move introduces significant uncertainty around integration and execution, making it highly relevant for investors tracking both potential earnings recovery and heightened risks to operational stability.

By contrast, it’s worth highlighting that ongoing volume softness in North America retail remains a critical factor investors should not overlook...

Read the full narrative on Kraft Heinz (it's free!)

Kraft Heinz's outlook anticipates $26.1 billion in revenue and $3.3 billion in earnings by 2028. This projection assumes a 1.0% annual revenue growth rate and a $8.6 billion increase in earnings from the current level of -$5.3 billion.

Uncover how Kraft Heinz's forecasts yield a $29.71 fair value, a 18% upside to its current price.

Exploring Other Perspectives

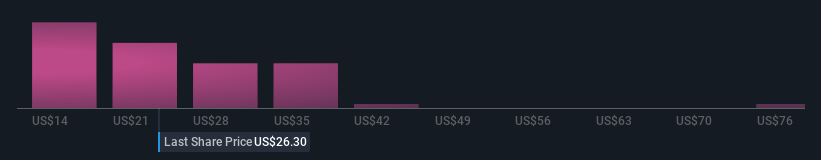

The Simply Wall St Community produced 22 fair value estimates for Kraft Heinz, ranging from US$23.95 to US$80.66 per share. Many see opportunity with the shares trading well below consensus price targets, even as core North America volume trends point to continued headwinds for growth and profitability. Explore several perspectives on what this could mean for your approach.

Explore 22 other fair value estimates on Kraft Heinz - why the stock might be worth over 3x more than the current price!

Build Your Own Kraft Heinz Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kraft Heinz research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Kraft Heinz research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kraft Heinz's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kraft Heinz might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KHC

Kraft Heinz

Manufactures and markets food and beverage products in North America and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives