- United States

- /

- Beverage

- /

- NasdaqGS:KDP

Keurig Dr Pepper (KDP): Reevaluating Valuation After Recent 15% Year-to-Date Share Price Decline

Reviewed by Simply Wall St

Keurig Dr Pepper (KDP) has caught investors' attention after recent trading brought the stock down just over 15% year-to-date. The company’s year-long performance has prompted some to reassess its current valuation and growth prospects.

See our latest analysis for Keurig Dr Pepper.

Keurig Dr Pepper’s share price has drifted lower in recent months, with momentum fading as the stock posted a 23% decline over the last 90 days and a 15% drop year-to-date. Even including dividends, the total shareholder return over the past year is down more than 11%, pointing to a shift in sentiment as investors weigh current risks against the company’s growth potential.

If you’re looking to discover what else might be gaining traction, this could be a smart time to explore fast growing stocks with high insider ownership

With shares sitting about 31% below analyst price targets and fundamentals showing resilience, is Keurig Dr Pepper currently undervalued, or are investors right to assume future growth is already reflected in its stock price?

Most Popular Narrative: 23.9% Undervalued

At $26.96, Keurig Dr Pepper's share price sits well below the most widely tracked fair value estimate of $35.44. This sets the stage for a deeper look at the catalysts behind the valuation gap.

The integration of GHOST Energy and the establishment of an energy platform with significant market share are expected to contribute to revenue growth, thanks to expanded distribution and solid partnerships. Efficiency measures in overhead cost management and strategic capital allocation, including the monetization of the Vita Coco investment, are likely to positively impact net margins by reducing expenses and optimizing resource use.

Curious about what’s really fueling this valuation? The narrative suggests a bold transformation, highlighting major cost efficiencies, ambitious expansion in energy drinks, and capital moves that could alter KDP’s profit trajectory. Want to see which forecasts and future profit margins support this outlook? Find out exactly what’s powering that premium fair value.

Result: Fair Value of $35.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing declines in coffee segment sales and rising costs related to commodity inflation remain significant risks that could challenge the bullish outlook.

Find out about the key risks to this Keurig Dr Pepper narrative.

Another View: Sizing Up the Numbers

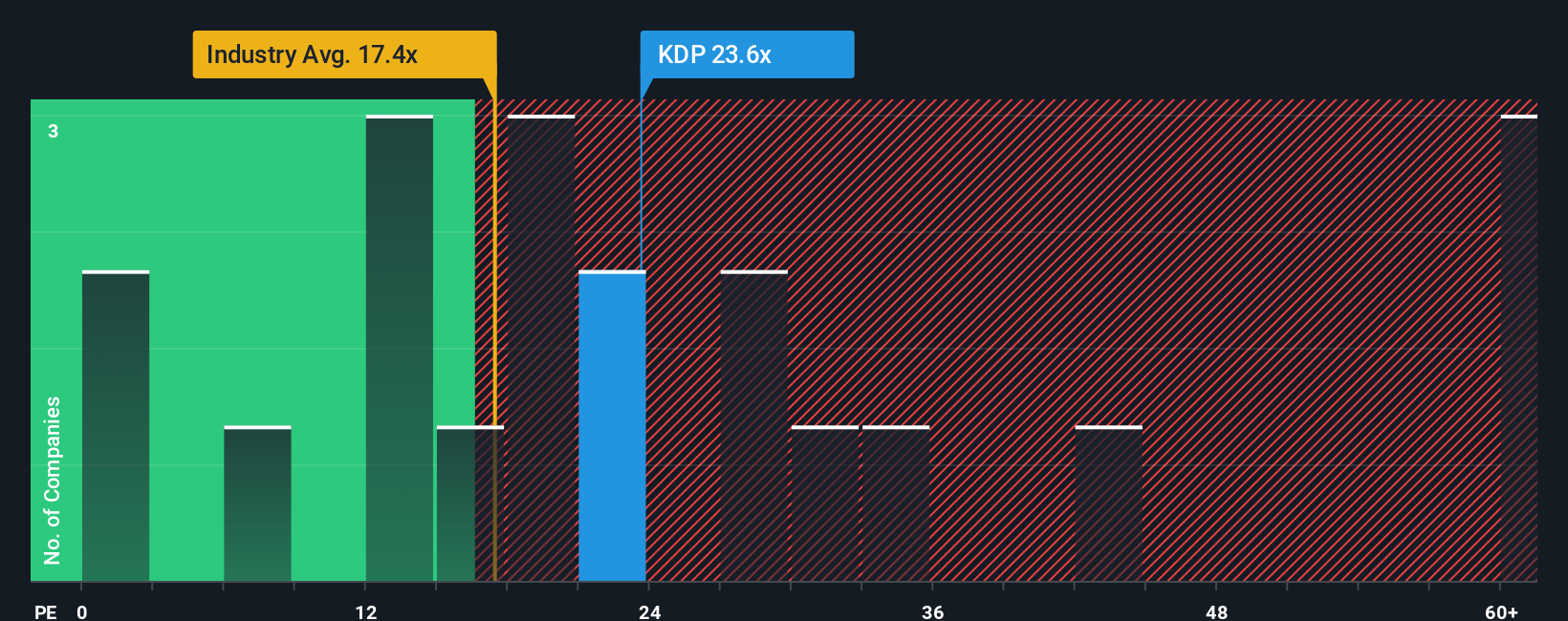

To challenge the fair value perspective, let's look at how Keurig Dr Pepper is priced compared to its earnings. Its price-to-earnings ratio of 23.2x is higher than the global beverage industry average of 18.1x, suggesting investors may be paying a premium. However, the ratio is below the peer average (26.3x) and under the fair ratio the market could move towards (27.4x). This leaves a valuation gap that could signal caution or opportunity depending on how the story plays out. Could market sentiment or business fundamentals tip the balance?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Keurig Dr Pepper Narrative

If you have a different take or want to review the numbers firsthand, you can shape your own perspective in just a few minutes with Do it your way.

A great starting point for your Keurig Dr Pepper research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Ways to Stay Ahead?

Make your next move count and get a leg up on other investors. Use these smart screeners now, or risk missing out on tomorrow’s winners.

- Tap into future healthcare breakthroughs by assessing opportunities in these 31 healthcare AI stocks which is shaping AI-driven medicine and diagnostics.

- Accelerate your portfolio’s income with these 18 dividend stocks with yields > 3% that offers robust yields and can make a real difference in compounding returns.

- Spot untapped market value quickly with these 895 undervalued stocks based on cash flows that is designed to highlight stocks trading below their fundamental worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Keurig Dr Pepper might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KDP

Keurig Dr Pepper

Owns, manufactures, and distributors beverages and single serve brewing systems in the United States and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives