- United States

- /

- Beverage

- /

- NasdaqGS:KDP

Does the Recent 6.5% Rally Signal a Fair Price for Keurig Dr Pepper in 2025?

Reviewed by Bailey Pemberton

If you are weighing whether to buy, sell, or simply hold onto your Keurig Dr Pepper shares, you are not alone. This stock has seen its fair share of ups and downs lately, leaving plenty of us poring over charts and headlines. In just the past month, Keurig Dr Pepper rebounded a healthy 6.5%, which is an encouraging sign after a soft patch that saw returns dip 3.1% in the past week and slide to -14.5% year-to-date. Looking back a year, the stock is still down 19.1%. However, over five years, investors have eked out a 14% gain. It has been quite the ride.

Recent headlines have focused on the company’s long-term strategy. This includes everything from new beverage launches to shifting consumer trends and its activity in distribution partnerships. While none of this news has caused dramatic swings, it sets the backdrop for how investors are thinking about risk and growth potential in the current market environment. Importantly, these strategic pivots give context to the generally cautious approach some investors are taking after the rough stretches of recent years.

Now, here is where things get interesting. By most valuation checks, Keurig Dr Pepper looks undervalued. Out of six key criteria, the company meets five. That gives it a strong value score of 5 out of 6, which makes it hard to ignore for anyone looking to spot opportunities in consumer staples stocks.

Next, let’s break down the valuation approaches that experts use to come up with these scores. But stick around, because by the end of this article, you will discover an even clearer way to see whether Keurig Dr Pepper is truly undervalued now.

Why Keurig Dr Pepper is lagging behind its peers

Approach 1: Keurig Dr Pepper Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a common method for estimating a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. This approach helps determine what the business is truly worth, rather than just relying on market sentiment or short-term financial metrics.

For Keurig Dr Pepper, the latest reported Free Cash Flow (FCF) stands at $1.59 Billion. Analysts provide detailed estimates for the next five years, with projections then extended using reasonable assumptions. According to these forecasts, Free Cash Flow is expected to reach approximately $4.33 Billion by 2035. All cash flows are calculated in US Dollars and adjusted using a two-stage Free Cash Flow to Equity method to better account for the growth phase and subsequent stabilization of cash flows over time.

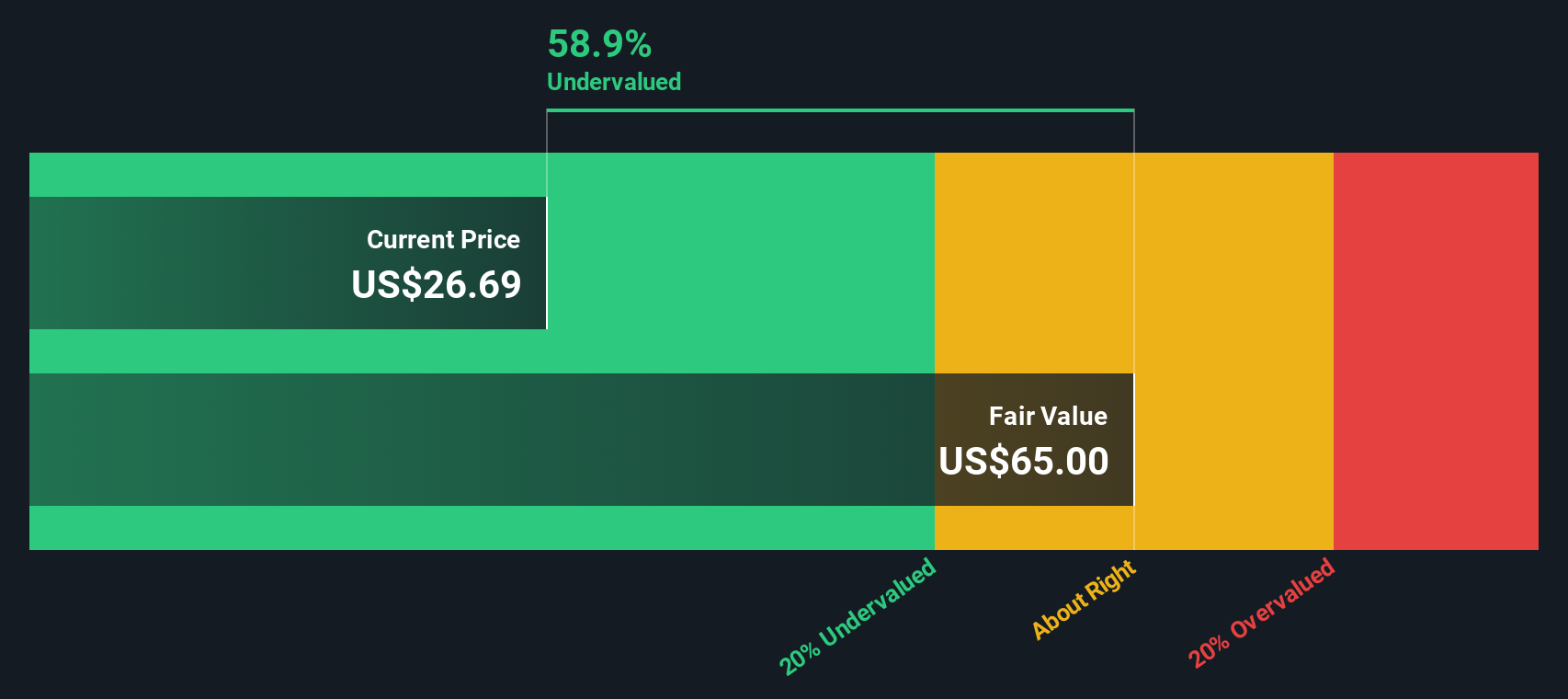

The DCF model estimates the company's intrinsic fair value at $64.96 per share. This indicates the stock is trading at a 58.2% discount to its DCF-implied value, making it appear significantly undervalued compared to where analysts believe its true worth lies based on long-term cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Keurig Dr Pepper is undervalued by 58.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Keurig Dr Pepper Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is one of the most popular ways to value profitable businesses like Keurig Dr Pepper. It works well because it directly compares what investors are willing to pay for each dollar of current earnings, making it a straightforward way to gauge if a stock is attractively priced relative to its profits.

However, the "right" PE ratio is not a one-size-fits-all number. Growth expectations play a big part. Companies with faster earnings growth usually deserve higher PE ratios. Risk factors, such as debt levels or industry uncertainty, can push the ratio lower. It is also important to consider the context of the broader Beverage industry and Keurig Dr Pepper’s competitive peers.

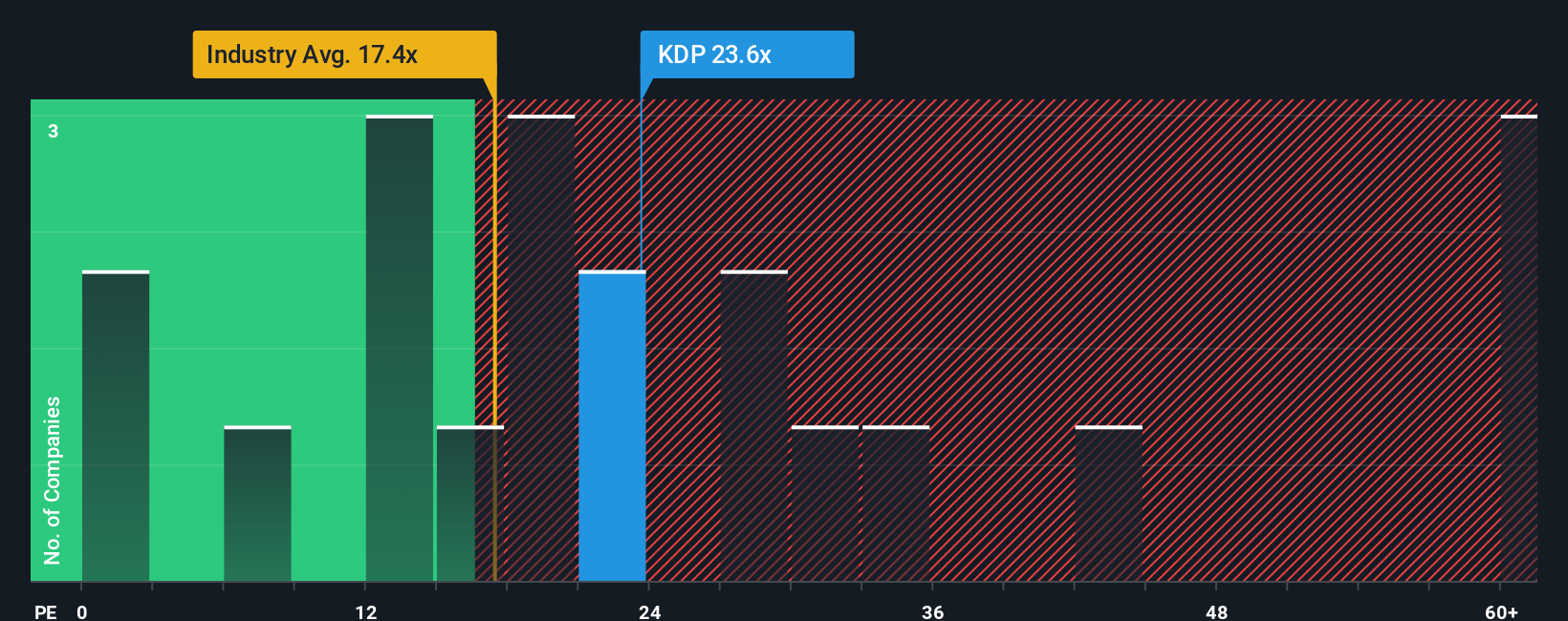

Currently, Keurig Dr Pepper trades at a PE of 24x. This sits above the Beverage industry average of 17.7x, yet below the peer group average of 61.7x. This paints a picture of moderate growth and risk. To get a more nuanced view, Simply Wall St’s proprietary "Fair Ratio" aims to pinpoint the most appropriate multiple by weighing factors unique to the company, such as profit margins, earnings growth, its spot in the Beverage sector, and overall market capitalization. Unlike broad industry or peer comparisons, the Fair Ratio offers a customized perspective that is more reliable for investors.

The Fair Ratio for Keurig Dr Pepper sits at 29.7x. Since this is fairly close to the current PE of 24x, the stock appears to be somewhat undervalued by this measure, suggesting shareholders could be getting more than fair value for current earnings.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Keurig Dr Pepper Narrative

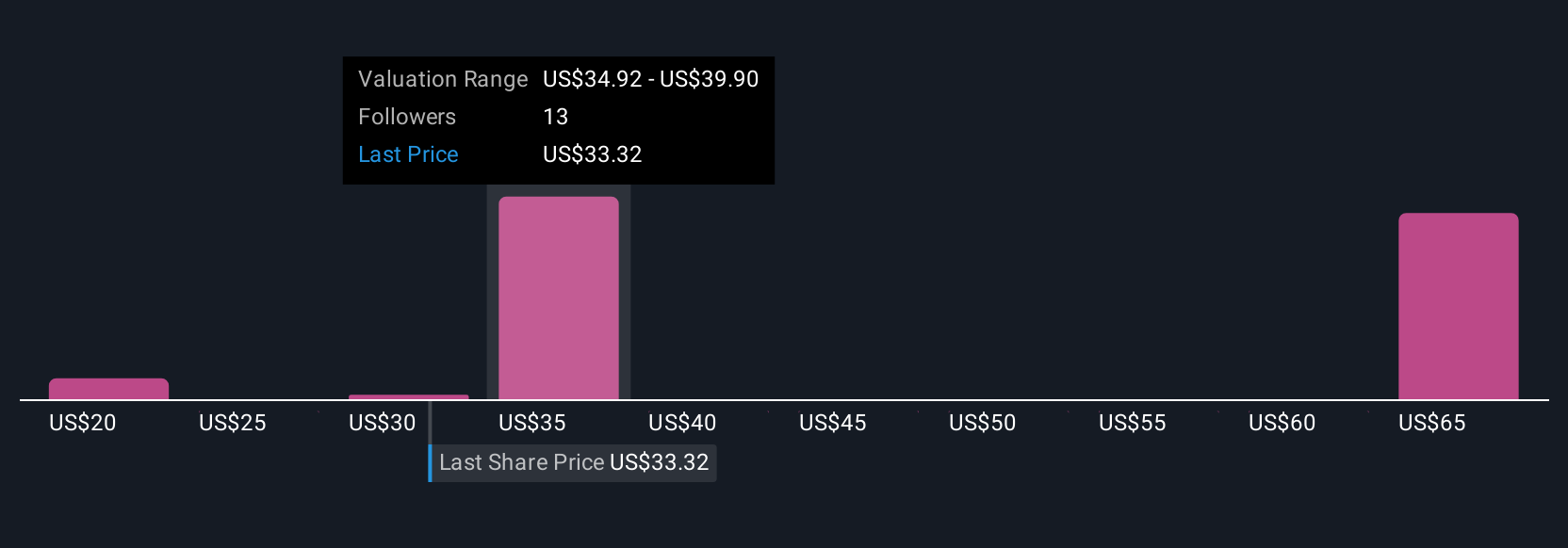

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative goes beyond the numbers and lets you tell the story—your perspective about Keurig Dr Pepper, based on your own expectations for its future revenue, earnings, margins and fair value. By connecting what’s happening in the business or industry with specific, forward-looking financial forecasts, Narratives let you see not just what a company is worth, but why.

Narratives are a tool available right now to every investor through Simply Wall St’s Community page. Used by millions of investors, Narratives make it easy to create, share and compare your view of a company with others. They help you decide when to buy or sell by comparing your Fair Value estimate (based on your story and forecasts) to today’s share price. These Narrative values automatically update when news or financial results change the outlook.

For example, some investors see Keurig Dr Pepper’s global beverage expansion and new energy platform as catalysts for long-term growth, estimating fair values near $42. Others, focusing on inflationary pressures in the coffee segment and merger uncertainty, see a much lower fair value closer to $30. Narratives let you explore these different outlooks and find the one that best fits your belief, so you can invest with confidence and clarity.

Do you think there's more to the story for Keurig Dr Pepper? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Keurig Dr Pepper might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KDP

Keurig Dr Pepper

Owns, manufactures, and distributors beverages and single serve brewing systems in the United States and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives