- United States

- /

- Food

- /

- NasdaqGS:JJSF

Assessing J&J Snack Foods (JJSF) Valuation After a Steep Share Price Reset

Reviewed by Simply Wall St

J&J Snack Foods (JJSF) has been grinding through a tough stretch, with the stock down sharply this year even as revenue and net income still show modest growth. That disconnect is where things get interesting.

See our latest analysis for J&J Snack Foods.

Despite modest business growth, sentiment has swung hard against J&J Snack Foods, with a roughly 40% year to date share price decline and a near 45% one year total shareholder return loss. This suggests investors are questioning how durable its earnings runway really is, even after a recent one month share price rebound of almost 8%.

If this kind of reset has you rethinking where growth and conviction really sit in your portfolio, it might be worth exploring fast growing stocks with high insider ownership as a source of fresh stock ideas.

With earnings still growing, the share price reset, and a sizable discount to analyst targets, the key question now is whether J&J Snack Foods is quietly undervalued or if the market is already baking in its future growth.

Most Popular Narrative Narrative: 16.7% Undervalued

With J&J Snack Foods last closing at $91.64 against a narrative fair value of $110, the story hinges on how efficiently it can turn growth into profit.

Operational improvements through supply chain optimization, automation, and facility consolidation (for example, shifting handhelds production to a more efficient plant and reducing distribution and freight costs) are expected to drive higher net margins and earnings over time.

Ongoing product innovation and the expansion of better-for-you offerings, such as high-protein and whole-grain items, clean label novelties, and the removal of artificial colors, expands the accessible market and aligns with evolving consumer preferences, paving the way for sustained top-line growth.

Curious how modest revenue growth, rising margins, and a richer earnings multiple can still add up to meaningful upside from here? See the exact assumptions powering this fair value call and how they balance growth, profitability, and time.

Result: Fair Value of $110 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ingredient cost inflation and weak retail sales, especially in frozen novelties and handhelds, could undermine margin expansion and stall the upside case.

Find out about the key risks to this J&J Snack Foods narrative.

Another View: Market Multiple Sends a Different Signal

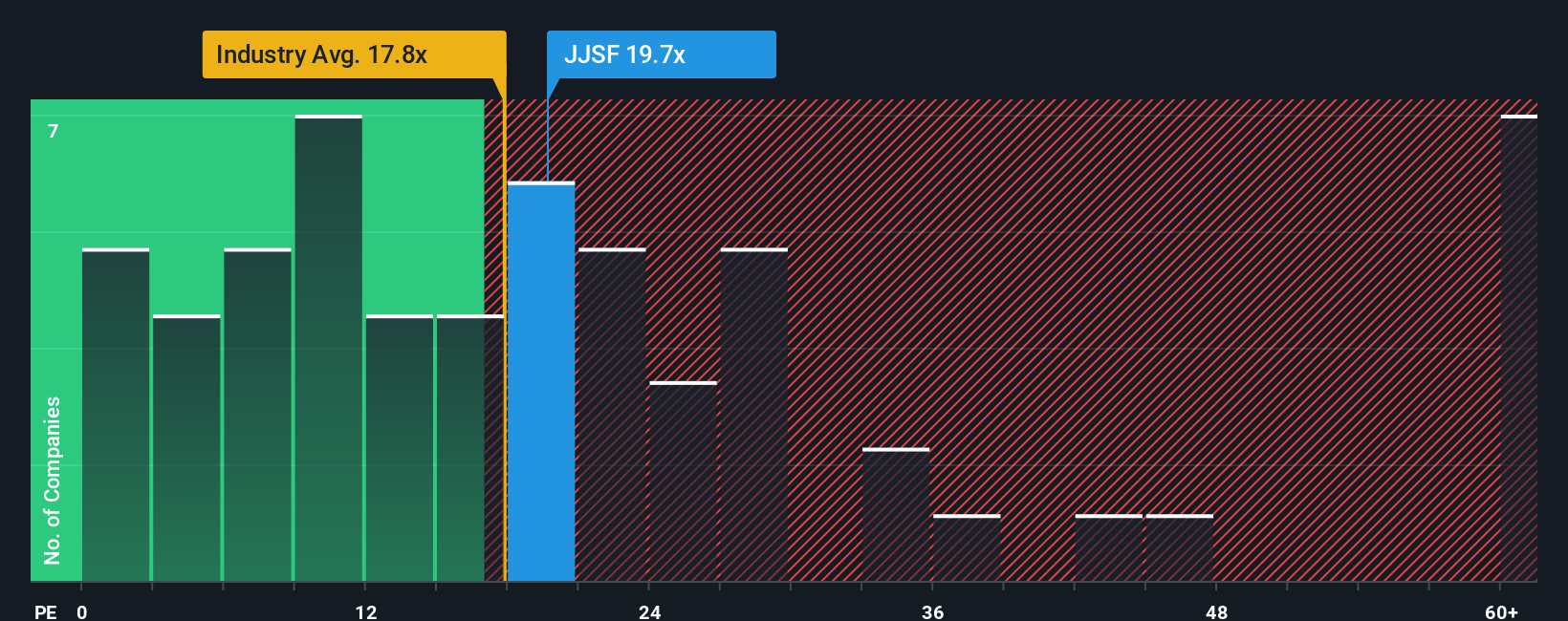

While the narrative fair value suggests upside, the current 27x earnings ratio looks stretched against the US Food industry at 20.6x, peers at 12.3x, and even a fair ratio of 16.4x. That gap points to valuation risk, not opportunity, if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own J&J Snack Foods Narrative

If you see the story differently or prefer to lean on your own research, you can build a custom narrative in just a few minutes with Do it your way.

A great starting point for your J&J Snack Foods research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, explore your next opportunities by using the Simply Wall St Screener to find ideas that match your strategy and risk profile.

- Capture early stage potential with these 3575 penny stocks with strong financials that already show strong balance sheets and real business traction behind their small price tags.

- Focus on structural growth trends by targeting these 30 healthcare AI stocks that contribute to advances in diagnostics, treatment pathways, and medical efficiency.

- Strengthen your income stream by zeroing in on these 14 dividend stocks with yields > 3% that combine dividend payouts with underlying business fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:JJSF

J&J Snack Foods

Manufactures, markets, and distributes nutritional snack food and beverages to the food service and retail supermarket industries in the United States, Mexico, and Canada.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026