- United States

- /

- Food

- /

- NasdaqGS:HAIN

Further weakness as Hain Celestial Group (NASDAQ:HAIN) drops 6.5% this week, taking three-year losses to 80%

As every investor would know, not every swing hits the sweet spot. But you have a problem if you face massive losses more than once in a while. So spare a thought for the long term shareholders of The Hain Celestial Group, Inc. (NASDAQ:HAIN); the share price is down a whopping 80% in the last three years. That'd be enough to cause even the strongest minds some disquiet. And the share price decline continued over the last week, dropping some 6.5%. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Check out our latest analysis for Hain Celestial Group

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Hain Celestial Group has made a profit in the past. On the other hand, it reported a trailing twelve months loss, suggesting it isn't reliably profitable. Other metrics might give us a better handle on how its value is changing over time.

We think that the revenue decline over three years, at a rate of 3.7% per year, probably had some shareholders looking to sell. And that's not surprising, since it seems unlikely that EPS growth can continue for long in the absence of revenue growth.

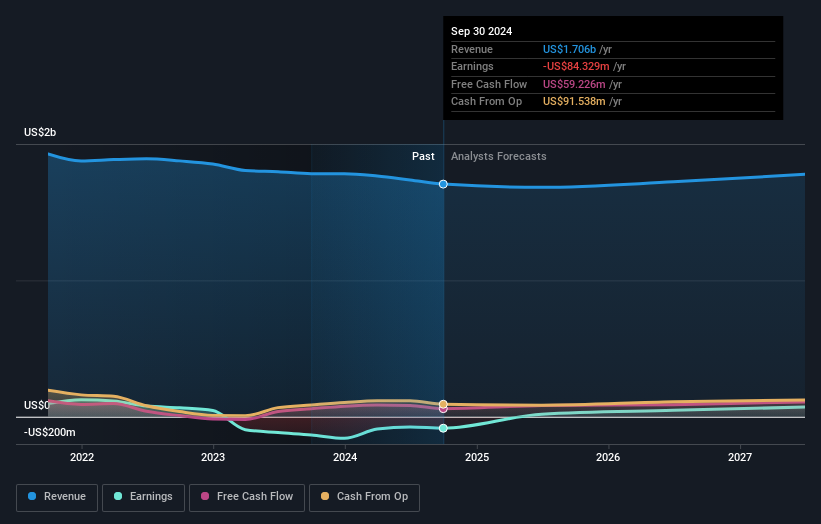

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. This free report showing analyst forecasts should help you form a view on Hain Celestial Group

A Different Perspective

Hain Celestial Group shareholders are down 19% for the year, but the market itself is up 34%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 11% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Hain Celestial Group you should know about.

Hain Celestial Group is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hain Celestial Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:HAIN

Hain Celestial Group

Manufactures, markets, and sells organic and natural products in United States, United Kingdom, Europe, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives