- United States

- /

- Food

- /

- NasdaqGM:FRPT

Has Freshpet’s Sharp Rebound Created a Fresh Opportunity for Investors in 2025?

Reviewed by Bailey Pemberton

If you are following Freshpet's stock, you probably know what a rollercoaster it has been lately. Over the last week, shares jumped 7.7%, giving a glimmer of hope to holders who have weathered a tough stretch. But zoom out, and you can see that Freshpet is still down a steep 62.9% since the start of the year and about 62.3% over the past twelve months. Even the longer-term picture is uneven, with a 56% drop over five years and a mild dip of 11.1% over three years. Digging into what is driving these moves, it is clear that the market is still figuring out how to value Freshpet and gauge its future growth story.

Some of the volatility may stem from changing perspectives around the pet food industry as consumer demand, cost pressures, and market competition shift. Investors are left weighing both the potential for a rebound and signs of elevated risk. With Freshpet's valuation score sitting at 2 out of a possible 6, meaning the company appears undervalued in just two of the six standard checks, deciding what to do next is not so straightforward.

If you are wondering what those six valuation lenses reveal about Freshpet, you are in good company. Next, we will unpack how each method stacks up against the company's current fundamentals and what that could mean for the stock's fair value. But there is also a smarter, more insightful way to frame valuation that we will get to at the end. This approach could change how you look at Freshpet entirely.

Freshpet scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Freshpet Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a fundamental valuation method that estimates a company's intrinsic value based on its future free cash flows by extrapolating those figures and discounting them back to today. For Freshpet, the DCF approach uses a 2 Stage Free Cash Flow to Equity model to project how much money the company could generate over the coming years.

Currently, Freshpet's last twelve months of free cash flow stand at -$105.6 million. While this is a negative number, analyst forecasts expect meaningful improvement. For example, projections estimate Freshpet could generate $34.9 million in free cash flow by 2026, rising steadily each year. By 2029, analysts and extrapolation suggest free cash flow could reach $200 million, with extended projections by Simply Wall St forecasting even higher annual amounts in the early 2030s.

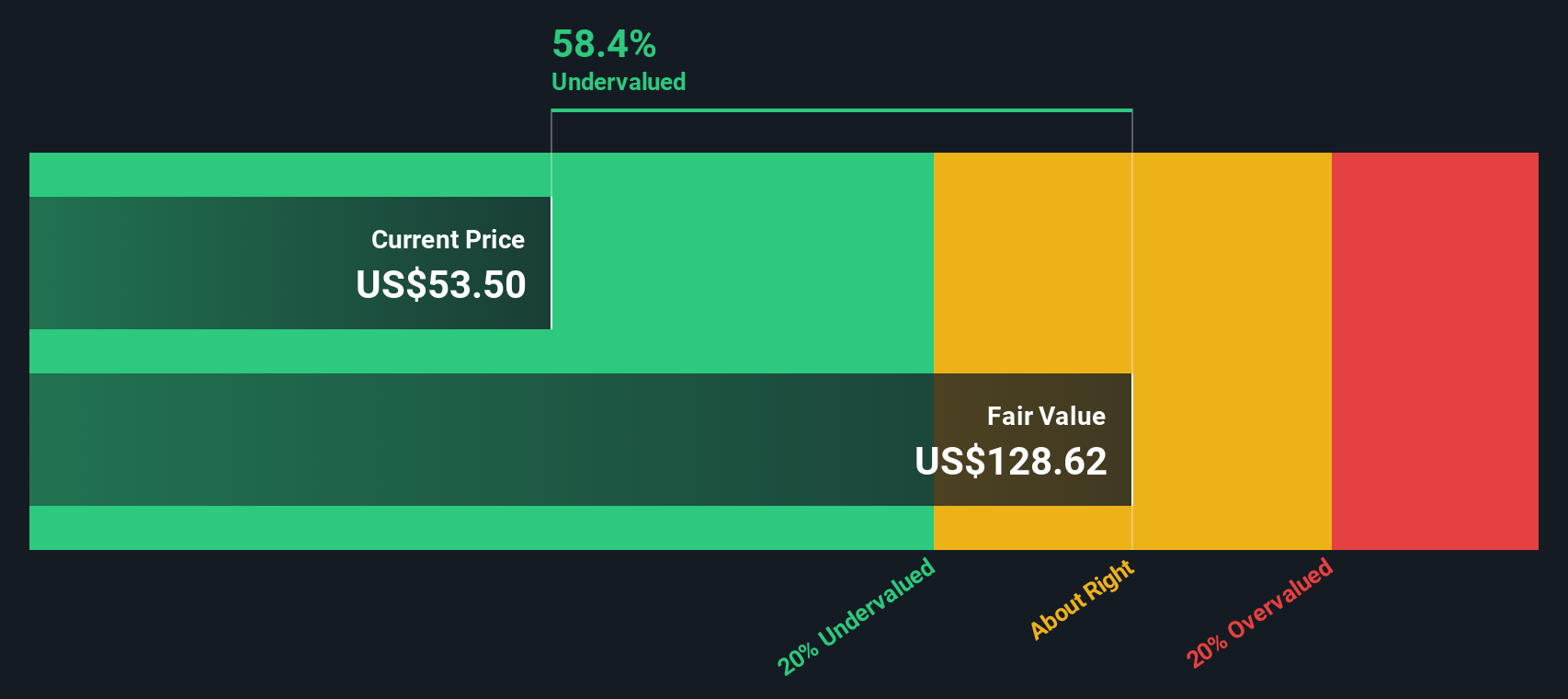

After discounting these future cash flows back to present-day dollars, the model calculates an intrinsic value of about $128.62 per share. This is roughly 58.4% higher than the current market price, indicating that Freshpet is substantially undervalued according to the DCF method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Freshpet is undervalued by 58.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Freshpet Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies, as it provides a straightforward way to compare what investors are willing to pay today for a dollar of current or future earnings. When a company is generating profits, the PE ratio serves as a quick reference to judge whether its shares offer good value versus similar businesses.

It is important to recognize that growth expectations and perceived business risks play a major role in what constitutes a “normal” or “fair” PE ratio. Higher growth potential and lower risk typically result in a higher acceptable PE, while slower-growing or riskier companies trade at lower ratios.

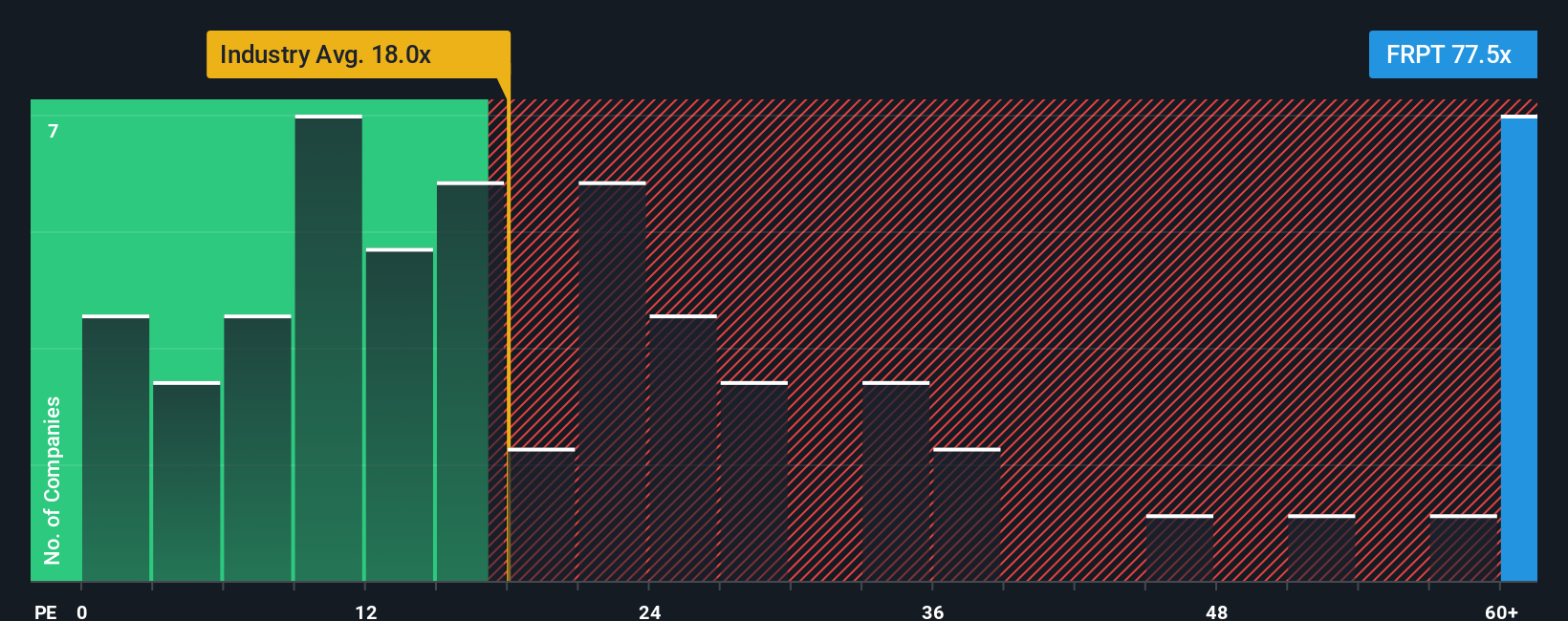

Right now, Freshpet is trading at a PE ratio of 77.5x, which is dramatically higher than the Food industry average of 18.0x and the peer average of 17.4x. At first glance, this might make the stock look expensive relative to its sector. However, Simply Wall St’s proprietary "Fair Ratio" model takes things a step further by factoring in Freshpet’s expected earnings growth, profit margins, company size, industry, and risk profile. For Freshpet, the Fair PE Ratio is 31.7x, which is much lower than the current 77.5x but higher than the industry and peer averages.

Because the actual PE is well above the Fair Ratio, Freshpet appears overvalued on this metric, even after accounting for its growth profile and sector risks.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Freshpet Narrative

Earlier, we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is your story or belief about a company, combining what you expect for its future revenue, earnings, and margins, and linking directly to a financial forecast and a fair value. Narratives make sense of the numbers by connecting what is happening in the real world with your personal outlook on Freshpet, turning forecasts into something personal and actionable.

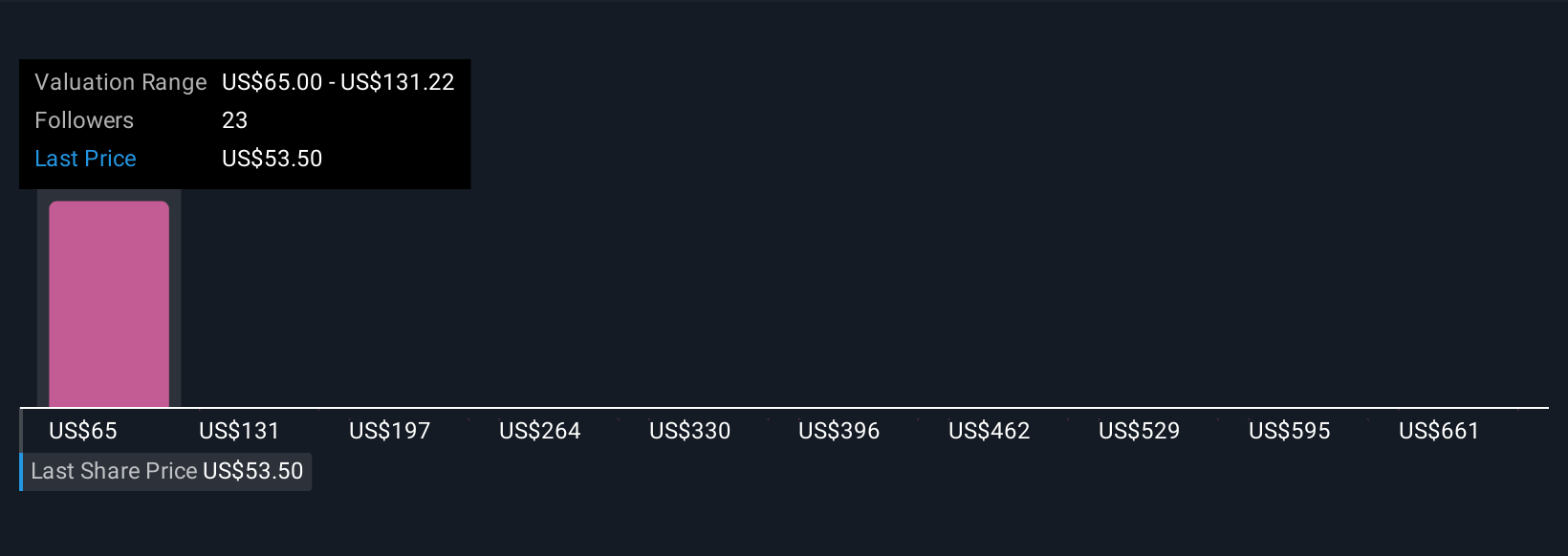

Simply Wall St's Narratives tool, found in the Community page and used by millions of investors, makes this process easy and accessible for everyone. As new information such as earnings or news becomes available, Narratives are regularly updated to help you check your assumptions and compare your calculated fair value to the current share price. This approach supports more informed decision-making. For example, some investors currently estimate Freshpet's fair value as high as $116, anticipating robust margin and revenue growth from new digital initiatives and operating efficiencies. Others see it as low as $48, citing margin risks and cautious consumer spending. With Narratives, you can quickly see how different stories drive different target prices and create your own to reflect what you believe is most probable for Freshpet's future.

Do you think there's more to the story for Freshpet? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FRPT

Freshpet

Manufactures, distributes, and markets natural fresh meals and treats for dogs and cats in the United States, Canada, and Europe.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives