- United States

- /

- Food

- /

- NasdaqGM:FRPT

Freshpet (FRPT): Evaluating the Company's Valuation Following CFO Transition Announcement

Reviewed by Kshitija Bhandaru

Freshpet (FRPT) is making a leadership change in its finance department as Ivan Garcia, currently Vice President of Finance, steps in as Interim CFO. The transition will take effect on October 17, 2025. Outgoing CFO Todd Cunfer will stay on to support Garcia during this handover while the company initiates a search for a permanent successor, a move that tends to draw interest from investors.

See our latest analysis for Freshpet.

After a rocky stretch, Freshpet’s 1-day share price slipped 4.4% after the CFO news, but the stock had actually gained 6.1% over the past week. Momentum remains shaky, as the year-to-date share price return is down a steep 64.5%. The 1-year total shareholder return sits at -63.2%. Overall, investor sentiment is still cautious despite previous bouts of optimism.

If you’re considering what else is trending in the market, now’s a great time to open your search to fast growing stocks with high insider ownership.

With shares now sitting at a significant discount to analyst price targets after months of volatility, the big question is whether Freshpet is undervalued or if the market has already factored in its future growth prospects.

Most Popular Narrative: 35% Undervalued

Freshpet’s most popular narrative sees its fair value at $79.31, well above the last close price of $51.29, highlighting a significant valuation gap that has caught investor attention.

Operational improvements and implementation of new production technologies at Ennis and other facilities have driven higher yields, quality, and throughput. This has led to a significant reduction in CapEx ($100 million less over 2025-26) along with enhanced gross and EBITDA margins, setting the business up for improving net earnings and cash generation.

Just how bold are the profit and revenue projections behind this valuation? The latest narrative hinges on major efficiency gains and offers a surprisingly aggressive path for future margins. Click through to get the story behind these numbers.

Result: Fair Value of $79.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing pet adoptions and rising competition could quickly test these optimistic forecasts. This could put pressure on both Freshpet's revenue growth and future market share.

Find out about the key risks to this Freshpet narrative.

Another View: Price Ratio Raises Questions

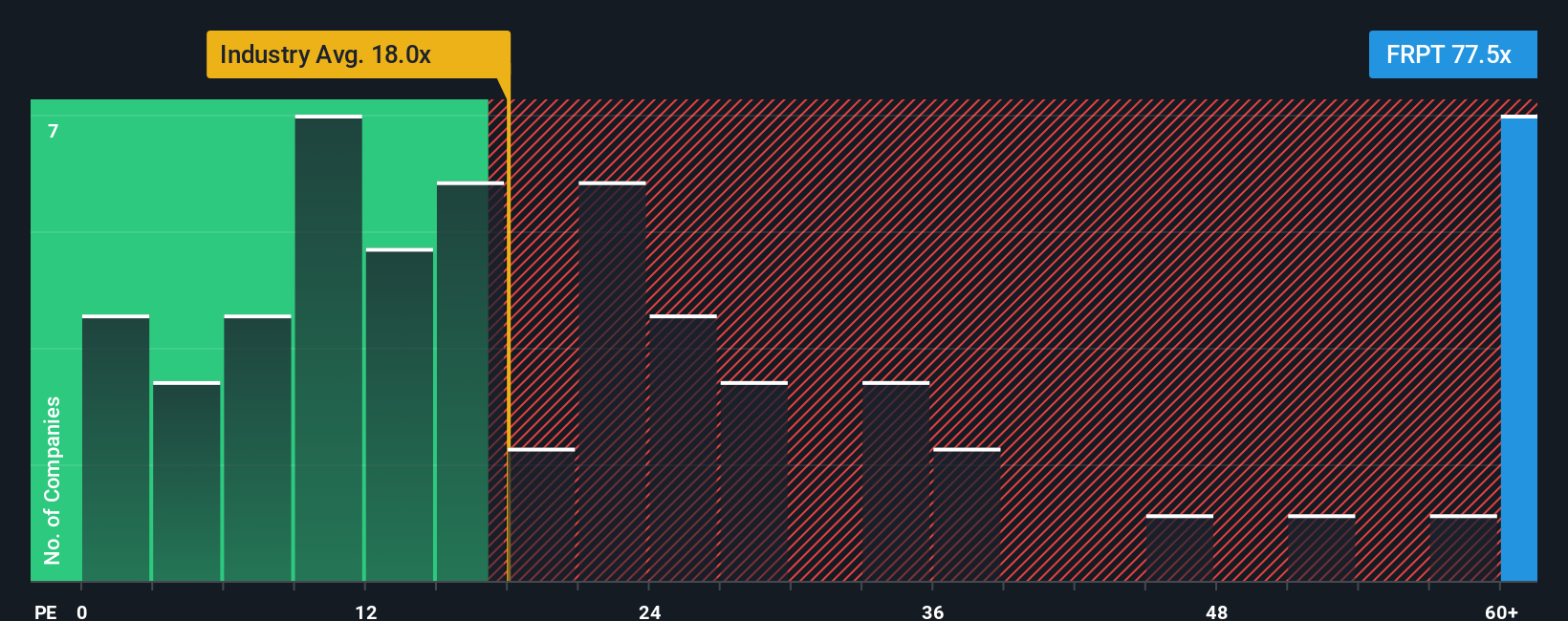

While the SWS DCF model points to shares being undervalued, Freshpet's price-to-earnings ratio stands out as high. At 74.3x, it more than quadruples the industry average of 17.9x, peers at 21.6x, and far exceeds its fair ratio estimate of 32x. Such a premium suggests significant expectations are already embedded in the price. Could this indicate more risk than opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Freshpet Narrative

Keep in mind, if the current story does not quite fit your view or you would rather dig into the numbers yourself, you can build your own in just a few minutes with Do it your way.

A great starting point for your Freshpet research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Step up your investing game by tapping into market-changing trends. Here are three ways you can spot your next big opportunity with confidence. Don’t let them pass you by!

- Capitalize on fast-moving market upswings by checking out these 872 undervalued stocks based on cash flows that could represent real bargains based on strong cash flows.

- Unlock income opportunities with these 18 dividend stocks with yields > 3%, where high-yield potential meets stable fundamentals for growth and returns.

- Position yourself ahead of the curve by following these 24 AI penny stocks shaping innovation at the core of the artificial intelligence revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FRPT

Freshpet

Manufactures, distributes, and markets natural fresh meals and treats for dogs and cats in the United States, Canada, and Europe.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives