- United States

- /

- Food

- /

- NasdaqGM:FRPT

Freshpet (FRPT): Assessing Valuation After Recent Share Price Swings

Reviewed by Kshitija Bhandaru

See our latest analysis for Freshpet.

Freshpet’s share price has lost some steam over the past year, as the 1-year total shareholder return slid by just over 60%. While recent price moves show fading momentum, the bigger picture reflects a business still posting solid underlying revenue and earnings growth. This suggests market sentiment is shifting as investors reassess future expectations.

If you’re watching these shifts and want to see what else the market is rewarding lately, it could be the perfect time to discover fast growing stocks with high insider ownership

With shares trading far below analyst targets despite continued growth, investors are left to consider whether Freshpet is currently undervalued or if the market has already priced in future gains. Is this a buying opportunity, or has optimism run ahead of fundamentals?

Most Popular Narrative: 37% Undervalued

Freshpet’s widely followed narrative assigns a higher fair value than the current share price. This highlights a gap shaped largely by operating trends and strategic upgrades that are driving optimism about the company’s long-term margin expansion and top-line growth.

Operational improvements and implementation of new production technologies at Ennis and other facilities have driven higher yields, quality, and throughput. This has led to a significant reduction in CapEx ($100 million less over 2025-26) and enhanced gross/EBITDA margins, setting the business up for improving net earnings and cash generation.

Want to know what’s fueling Freshpet’s premium valuation? The magic lies in bold revenue acceleration, efficiency wins, and major upgrades to financial metrics. Which specific improvements are driving this optimism? See the precise growth targets and margin leaps that shape this standout narrative.

Result: Fair Value of $84.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower category growth and intensifying competition from new and established brands remain key risks that could challenge Freshpet’s outlook and valuation narrative.

Find out about the key risks to this Freshpet narrative.

Another View: Is Freshpet Really a Bargain?

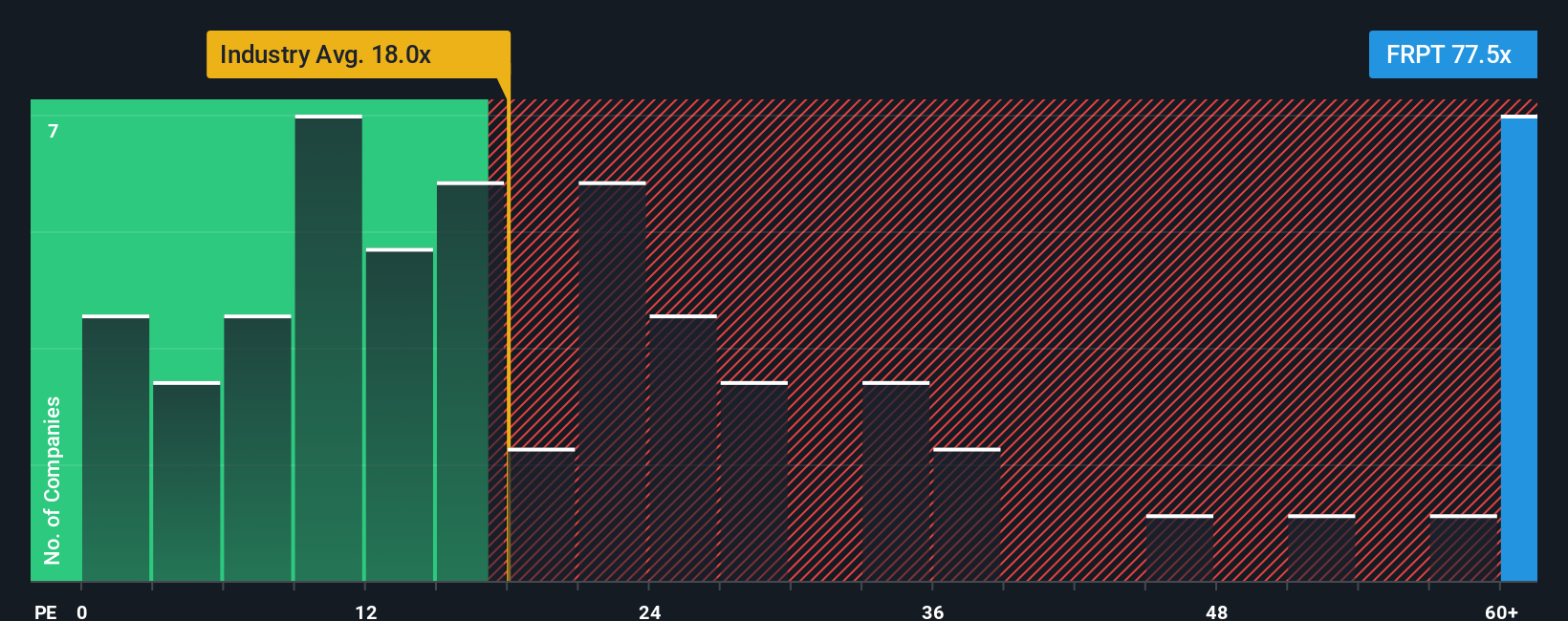

While narrative-based models see Freshpet as undervalued, a look at its price-to-earnings ratio paints a different picture. Freshpet trades at 77.2x earnings, much higher than the US Food industry average of 18.1x, its peers at 21.9x, and the fair ratio of 31.7x. This premium raises questions about the risk investors are accepting or the potential rewards ahead. Could the market eventually adjust toward the fair ratio, or is Freshpet’s growth story justifying today’s lofty price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Freshpet Narrative

If you see things differently or want to dig into the numbers yourself, you can craft your own perspective on Freshpet’s story in just minutes with Do it your way.

A great starting point for your Freshpet research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Great investors never settle for just one opportunity. With the right tools, you can uncover tomorrow’s leaders and sharpen your portfolio with unique, data-driven insights.

- Tap into rapid innovation by tracking these 26 quantum computing stocks, which are set to transform computing and industry far beyond today’s possibilities.

- Strengthen your income stream by finding these 19 dividend stocks with yields > 3%, offering attractive yields and consistent financial health for resilient returns.

- Stay at the forefront of medical breakthroughs by following these 31 healthcare AI stocks, as they harness the power of artificial intelligence to reshape healthcare outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FRPT

Freshpet

Manufactures, distributes, and markets natural fresh meals and treats for dogs and cats in the United States, Canada, and Europe.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives