- United States

- /

- Food

- /

- NasdaqGS:FARM

Take Care Before Jumping Onto Farmer Bros. Co. (NASDAQ:FARM) Even Though It's 29% Cheaper

Farmer Bros. Co. (NASDAQ:FARM) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 19% in that time.

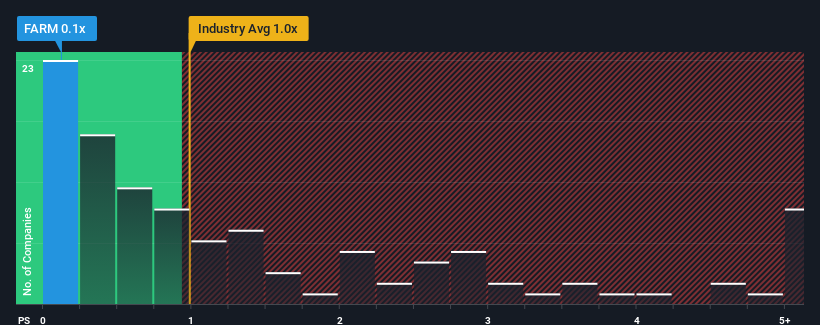

Following the heavy fall in price, Farmer Bros may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.1x, considering almost half of all companies in the Food industry in the United States have P/S ratios greater than 1x and even P/S higher than 3x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Farmer Bros

How Has Farmer Bros Performed Recently?

Farmer Bros' revenue growth of late has been pretty similar to most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. Those who are bullish on Farmer Bros will be hoping that this isn't the case.

Keen to find out how analysts think Farmer Bros' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Farmer Bros?

Farmer Bros' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Still, the latest three year period has seen an excellent 30% overall rise in revenue, in spite of its uninspiring short-term performance. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 2.8% over the next year. Meanwhile, the rest of the industry is forecast to expand by 2.7%, which is not materially different.

In light of this, it's peculiar that Farmer Bros' P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does Farmer Bros' P/S Mean For Investors?

Farmer Bros' recently weak share price has pulled its P/S back below other Food companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Farmer Bros' revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

Having said that, be aware Farmer Bros is showing 5 warning signs in our investment analysis, and 2 of those shouldn't be ignored.

If these risks are making you reconsider your opinion on Farmer Bros, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:FARM

Farmer Bros

Engages in the roasting, wholesale, equipment servicing, and distribution of coffee, tea, and other allied products in the United States.

Fair value low.

Similar Companies

Market Insights

Community Narratives