- United States

- /

- Food

- /

- NasdaqCM:EDBL

Take Care Before Jumping Onto Edible Garden AG Incorporated (NASDAQ:EDBL) Even Though It's 27% Cheaper

Edible Garden AG Incorporated (NASDAQ:EDBL) shares have retraced a considerable 27% in the last month, reversing a fair amount of their solid recent performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 97% loss during that time.

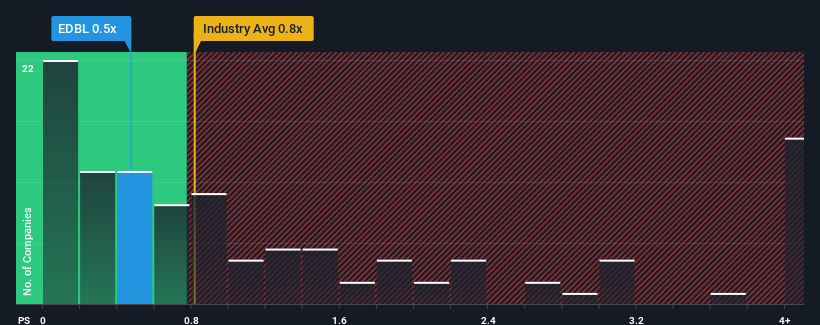

Even after such a large drop in price, it's still not a stretch to say that Edible Garden's price-to-sales (or "P/S") ratio of 0.5x right now seems quite "middle-of-the-road" compared to the Food industry in the United States, where the median P/S ratio is around 0.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Edible Garden

What Does Edible Garden's P/S Mean For Shareholders?

Recent times haven't been great for Edible Garden as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Edible Garden.Is There Some Revenue Growth Forecasted For Edible Garden?

Edible Garden's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 7.9% last year. The latest three year period has also seen an excellent 37% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 32% as estimated by the lone analyst watching the company. That's shaping up to be materially higher than the 1.9% growth forecast for the broader industry.

In light of this, it's curious that Edible Garden's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does Edible Garden's P/S Mean For Investors?

Edible Garden's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Edible Garden currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Having said that, be aware Edible Garden is showing 4 warning signs in our investment analysis, and 3 of those are a bit concerning.

If you're unsure about the strength of Edible Garden's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Edible Garden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:EDBL

Edible Garden

Edible Garden AG Incorporated, together with its subsidiaries, operate as a controlled environment agriculture farming company.

Excellent balance sheet slight.

Market Insights

Community Narratives