- United States

- /

- Food

- /

- NasdaqGS:CPB

Index Removal Amid Cost Pressures Could Be a Game Changer for Campbell's (CPB)

Reviewed by Sasha Jovanovic

- In September 2025, Campbell's (NASDAQ: CPB) was dropped from the FTSE All-World Index following news of rising steel and aluminum tariff costs, declining unit sales, and the announcement of a US$250 million cost-saving initiative through 2028.

- This removal highlights ongoing headwinds in both operational costs and core category sales, underscoring the pressure Campbell's faces to restore growth and profitability.

- We'll explore how Campbell's efforts to combat increased input costs could shift the company's future investment outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 33 best rare earth metal stocks of the very few that mine this essential strategic resource.

Campbell's Investment Narrative Recap

To be a Campbell’s shareholder right now, you need confidence that the company can contain margin pressures and reignite growth despite external headwinds. The recent FTSE All-World Index removal has amplified concern around rising input costs and volume declines; however, the main near-term catalyst remains Campbell’s ability to execute on cost savings without sacrificing operational effectiveness, while the key risk is further margin erosion from tariffs on steel and aluminum. For now, the index exit itself isn’t a material catalyst for the stock, but it does reinforce existing challenges on core categories and profitability.

Against this backdrop, Campbell’s US$250 million cost-saving initiative, announced in September with a 2028 target, stands out as highly relevant, especially as input cost inflation shows little sign of abating. These measures are designed to offset external headwinds and support margin stability, but successful delivery will be crucial to protect earnings and avoid deeper cuts that could impact growth initiatives or product quality.

By contrast, what’s less discussed is the potential longer-term impact of sustained buy-rate reductions in Campbell’s key categories, which investors should be watching as...

Read the full narrative on Campbell's (it's free!)

Campbell's narrative projects $10.2 billion revenue and $868.6 million earnings by 2028. This requires a 0.0% yearly revenue decline and a $266.6 million earnings increase from $602.0 million today.

Uncover how Campbell's forecasts yield a $34.58 fair value, a 9% upside to its current price.

Exploring Other Perspectives

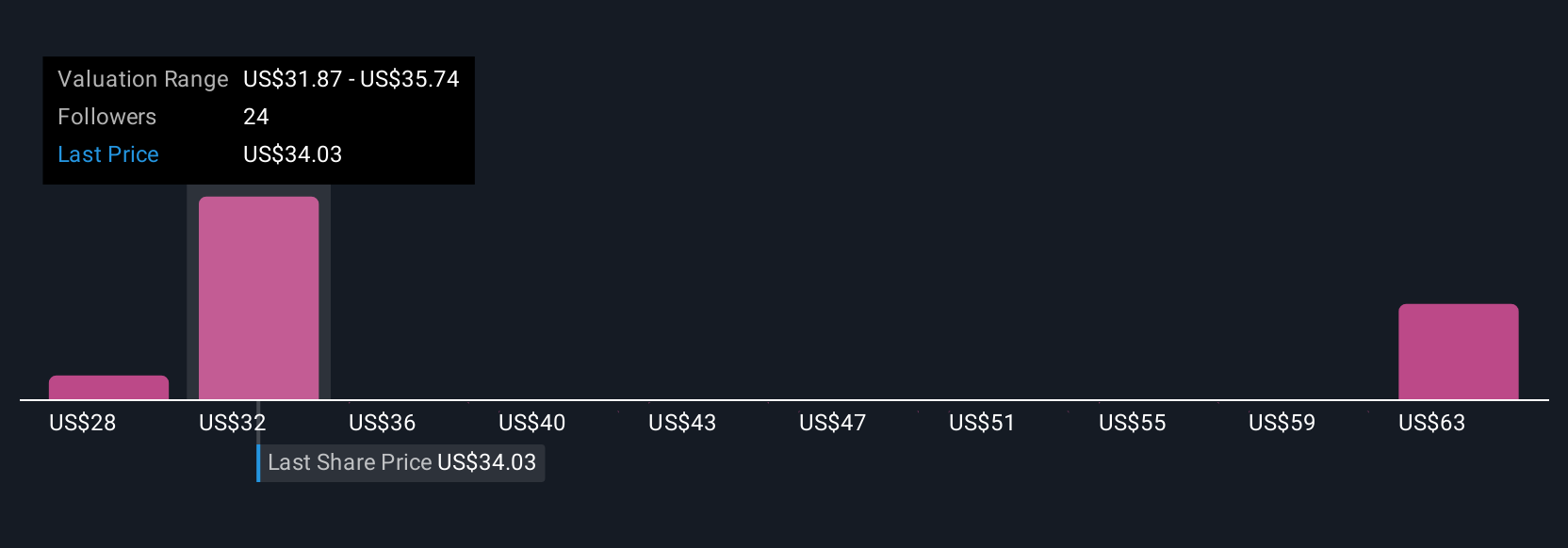

Community fair value estimates for Campbell’s (NASDAQ: CPB) cover a wide range from US$29 to US$63.91, based on eight individual viewpoints from the Simply Wall St Community. Given persistent inflation on input materials, consider how future cost pressures might influence these projections and the company’s path forward.

Explore 8 other fair value estimates on Campbell's - why the stock might be worth over 2x more than the current price!

Build Your Own Campbell's Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Campbell's research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Campbell's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Campbell's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CPB

Campbell's

Manufactures and markets food and beverage products in the United States and internationally.

6 star dividend payer and good value.

Similar Companies

Market Insights

Community Narratives