The board of The Campbell's Company (NASDAQ:CPB) has announced that it will pay a dividend of $0.39 per share on the 2nd of February. Based on this payment, the dividend yield on the company's stock will be 5.3%, which is an attractive boost to shareholder returns.

Campbell's' Future Dividend Projections Appear Well Covered By Earnings

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. The last payment made up 76% of earnings, but cash flows were much higher. In general, cash flows are more important than earnings, so we are comfortable that the dividend will be sustainable going forward, especially with so much cash left over for reinvestment.

Looking forward, earnings per share is forecast to rise by 37.4% over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 57%, which would make us comfortable with the sustainability of the dividend, despite the levels currently being quite high.

Check out our latest analysis for Campbell's

Campbell's Has A Solid Track Record

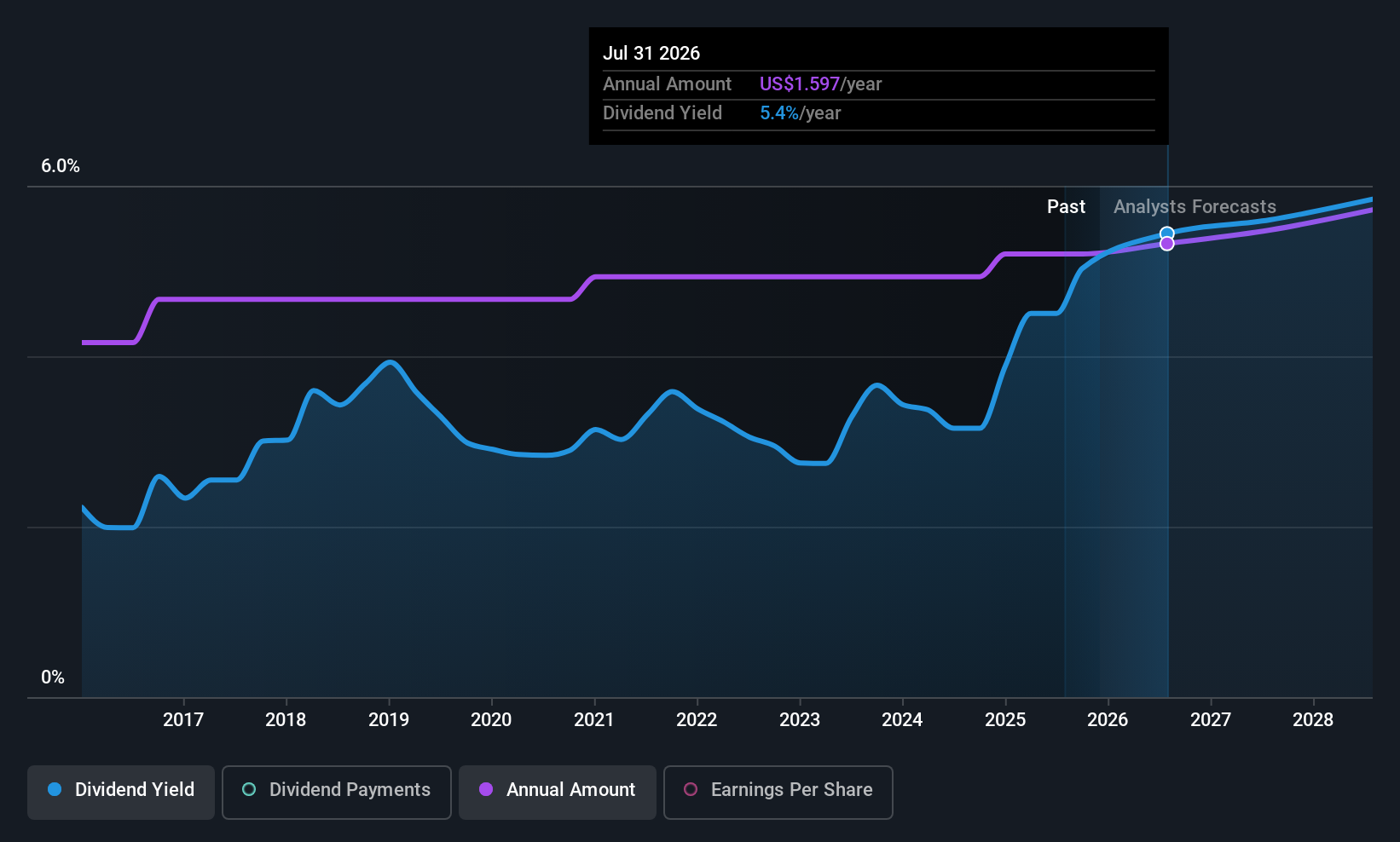

Even over a long history of paying dividends, the company's distributions have been remarkably stable. Since 2015, the dividend has gone from $1.25 total annually to $1.56. This means that it has been growing its distributions at 2.3% per annum over that time. Dividends have grown relatively slowly, which is not great, but some investors may value the relative consistency of the dividend.

Campbell's May Find It Hard To Grow The Dividend

The company's investors will be pleased to have been receiving dividend income for some time. However, Campbell's' EPS was effectively flat over the past five years, which could stop the company from paying more every year. Earnings are not growing quickly at all, and the company is paying out most of its profit as dividends. When a company prefers to pay out cash to its shareholders instead of reinvesting it, this can often say a lot about that company's dividend prospects.

In Summary

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Campbell's' payments, as there could be some issues with sustaining them into the future. The company has been bring in plenty of cash to cover the dividend, but we don't necessarily think that makes it a great dividend stock. Overall, we don't think this company has the makings of a good income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Case in point: We've spotted 2 warning signs for Campbell's (of which 1 can't be ignored!) you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CPB

Campbell's

Manufactures and markets food and beverage products in the United States and internationally.

6 star dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026