- United States

- /

- Beverage

- /

- NasdaqGS:COKE

How Coke Consolidated’s (COKE) Q3 2025 Dividend Declaration Has Changed Its Investment Story

Reviewed by Simply Wall St

- Coca-Cola Consolidated, Inc. recently announced that its Board of Directors declared a third quarter 2025 dividend of US$0.25 per share, payable on August 8, 2025, to stockholders of record as of July 25, 2025.

- This dividend affirmation can often be interpreted as a measure of management's confidence in the company's ability to generate ongoing returns for shareholders.

- We'll explore how this continued commitment to shareholder payouts shapes Coca-Cola Consolidated's investment narrative and overall stability.

What Is Coca-Cola Consolidated's Investment Narrative?

To be a shareholder in Coca-Cola Consolidated, you need to believe in the company's ability to generate stable cash flows, maintain its profitability in the competitive beverage sector, and continue returning value through dividends and buybacks. The newly declared third-quarter dividend of US$0.25 per share marks a sharp reduction from the previous two quarters, which each saw US$2.50 per share paid out. This move could be viewed as a return to more typical payout levels following earlier special or elevated dividends, rather than a sign of distress. Short-term catalysts remain focused on operational execution, the benefits of recent business expansions, and how the stock split plays into liquidity and visibility. While this dividend announcement did prompt a 1.21% share price increase today, it is unlikely to be a material catalyst or risk changer in the near term, as the company’s broader strengths and recent growth metrics continue to shape sentiment. However, investors should remain alert to the impact of elevated debt and evolving capital allocation. On the other hand, higher debt levels could start to weigh more meaningfully on future flexibility.

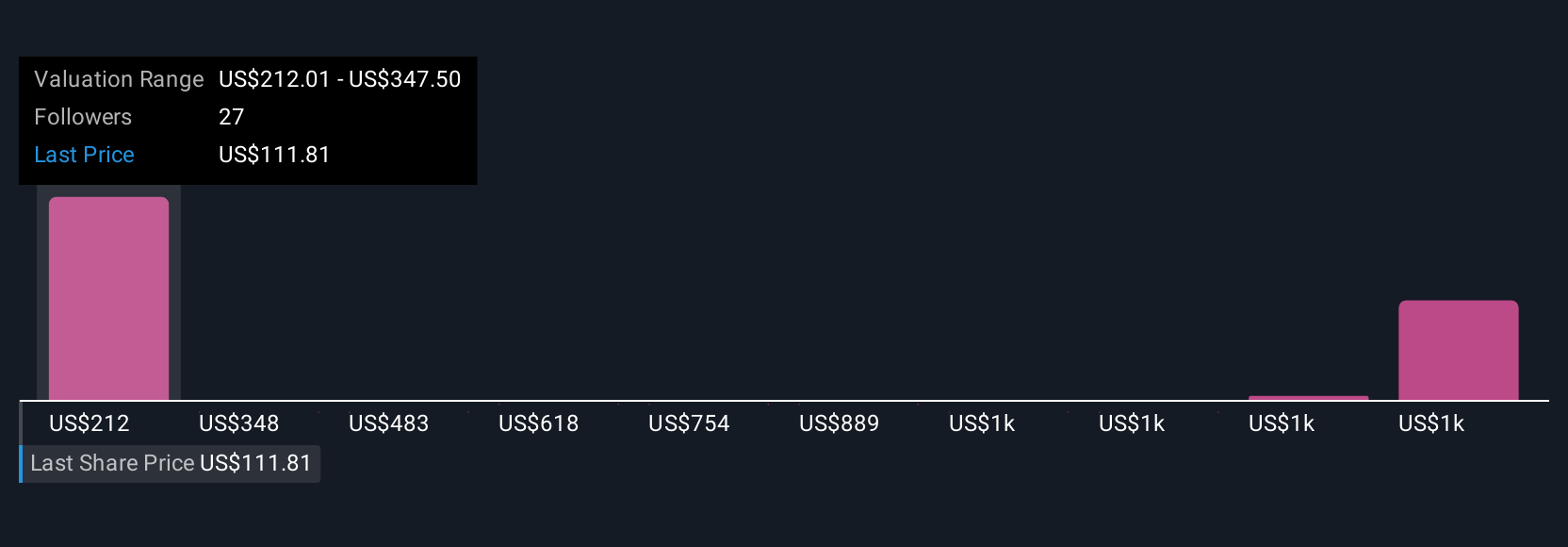

Coca-Cola Consolidated's shares have been on the rise but are still potentially undervalued by 46%. Find out what it's worth.Exploring Other Perspectives

Build Your Own Coca-Cola Consolidated Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coca-Cola Consolidated research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Coca-Cola Consolidated research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coca-Cola Consolidated's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COKE

Coca-Cola Consolidated

Manufactures, markets, and distributes nonalcoholic beverages primarily products of The Coca-Cola Company in the United States.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives