- United States

- /

- Beverage

- /

- NasdaqGS:COKE

Coca-Cola Consolidated (NasdaqGS:COKE) Reports Strong Earnings Growth With US$179 Million Q4 Net Income

Reviewed by Simply Wall St

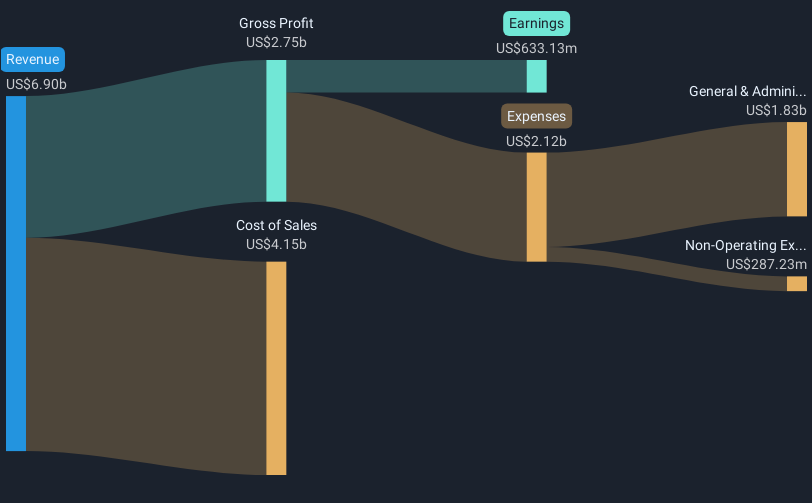

Coca-Cola Consolidated (NasdaqGS:COKE) has reported a notable 14.50% price increase over the past quarter. Several factors likely influenced this uptick. The company's robust financial performance, marked by a rise in fourth-quarter sales to $1,747 million and a substantial increase in net income, showcased its strong market position. The completion of a share buyback program, with 42,895 shares repurchased for $51.64 million, likely bolstered investor confidence. Additionally, a declared dividend of $2.50 per share likely appealed to income-seeking investors. During this period, the broader market saw declines, with the Dow Jones Industrial Average dropping 1.6% for the week, while major indices like the S&P 500 also recorded losses. Despite these broader market challenges, Coca-Cola Consolidated's strategic initiatives and robust financials may have contributed to its positive share price movement, providing a distinct contrast to the general market trend, which was relatively flat for the quarter.

Take a closer look at Coca-Cola Consolidated's potential here.

Coca-Cola Consolidated has seen a very large total shareholder return over the past five years. A significant factor contributing to this performance was the impressive profit growth, with earnings increasing by 40% annually. The company's decision to execute an extensive share buyback program, initiated in May 2024, also played a role in elevating share value. A particularly impactful strategy was the announcement of a dividend increase in August 2024, where quarterly dividends rose from US$0.50 to US$2.50, attracting income-focused investors. Furthermore, Coca-Cola Consolidated's return over the last year outperformed both the US market and the US Beverage industry, which saw a 23.7% rise and 5.1% decline, respectively.

The company's financial prowess was also highlighted by its valuation, trading at 34% below the estimated fair value of US$2,187.29. These elements, coupled with high-quality earnings, reinforced investor confidence, solidifying Coca-Cola Consolidated's market position over this period.

- Get the full picture of Coca-Cola Consolidated's valuation metrics and investment prospects—click to explore.

- Gain insight into the risks facing Coca-Cola Consolidated and how they might influence its performance—click here to read more.

- Got skin in the game with Coca-Cola Consolidated? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COKE

Coca-Cola Consolidated

Manufactures, markets, and distributes nonalcoholic beverages primarily products of The Coca-Cola Company in the United States.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives