- United States

- /

- Beverage

- /

- NasdaqGS:COCO

Assessing Vita Coco (COCO) Valuation After Q2 2025 Earnings Beat and Ongoing Growth Momentum

Reviewed by Kshitija Bhandaru

Vita Coco Company (COCO) delivered strong second quarter results for 2025, topping expectations for both revenue and earnings. The stock’s recent gains reflect positive sentiment following this financial outperformance, even as analysts flag a few ongoing challenges.

See our latest analysis for Vita Coco Company.

Vita Coco’s share price has seen steady upward momentum, hitting an all-time high of $42.82 and closing at $42.52 after a year packed with upbeat headlines, from innovative product launches to its ambitious sustainability drive. The company’s strong fundamental performance is further underscored by a 1-year total shareholder return of nearly 49%, showing that recent growth is not just a short-term story but part of a broader trend that has captured investor interest.

If the latest run from Vita Coco has you searching for fresh opportunities, now could be the perfect moment to explore fast growing stocks with high insider ownership.

Yet after such a strong run and with shares trading near analyst targets, the question remains: is Vita Coco undervalued, or are investors already pricing in every bit of future growth? Is there still a real buying opportunity here?

Most Popular Narrative: 0.6% Undervalued

With Vita Coco’s last close at $42.52 and the most commonly cited fair value at $42.78, the latest narrative sees only a modest upside from current levels. This suggests most analysts are aligned that the stock's remarkable run has nearly closed the value gap.

Heightened investment in international markets (notably Europe) is resulting in accelerating sales growth and market share gains. Management expects international revenues to ultimately rival the Americas business, which could significantly impact consolidated revenues and earnings power.

Want to find out the financial forecasts that back up this surprisingly tight valuation? The real story lies in bold international bets and margin boosts built into the model. Curious about the numbers that drive this razor-thin fair value margin? Dive into the full narrative to see which expansion targets and profit assumptions could be a game changer.

Result: Fair Value of $42.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing tariff uncertainty and volatile freight costs could erode margins. This may pose a real test for Vita Coco’s growth trajectory.

Find out about the key risks to this Vita Coco Company narrative.

Another View: Valuation Gaps Widen

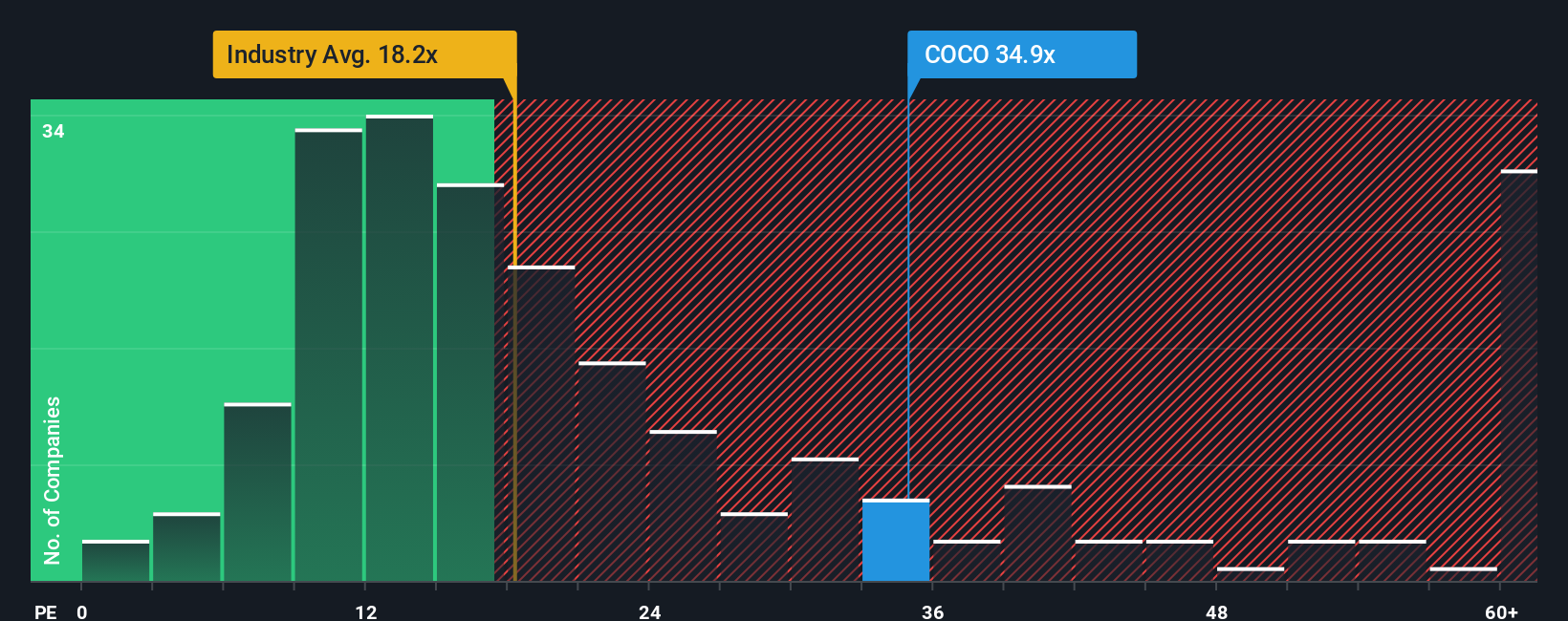

While the most popular fair value estimate suggests Vita Coco is just slightly undervalued, the market’s price-to-earnings ratio tells a different story. Shares trade at 37.5 times earnings, much higher than both the global beverage industry average of 17.7x and their fair ratio of 18.9x. This premium suggests investors may be paying up for future growth that is already mostly priced in. Does this heighten the risk for latecomers or present a fresh opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vita Coco Company Narrative

If you want to challenge these conclusions or dive deeper on your own, you can shape a personal perspective in just a few minutes. Do it your way.

A great starting point for your Vita Coco Company research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let today’s market pass you by. Open up new opportunities and give your portfolio an edge using these actionable Simply Wall Street tools:

- Spot the potential in undervalued companies and snap up bargains before the crowd by using these 896 undervalued stocks based on cash flows.

- Tap into reliable income sources and boost your returns by checking out these 19 dividend stocks with yields > 3% with market-beating dividends over 3%.

- Get in early on tomorrow’s AI game changers by searching these 24 AI penny stocks at the frontier of innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COCO

Vita Coco Company

Develops, markets, and distributes coconut water products under the Vita Coco brand name in the United States, Canada, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives