- United States

- /

- Beverage

- /

- NasdaqCM:CELH

Will Mixed Wall Street Views on Incentives and Integration Change Celsius Holdings' (CELH) Long-Term Narrative?

Reviewed by Sasha Jovanovic

- In recent days, several Wall Street firms have reiterated generally positive views on Celsius Holdings while others voiced concerns about higher incentive costs, slowing brand momentum, and operational integration hurdles following its Alani Nu and Pepsi system transition.

- This mix of optimism and caution underscores how execution on cost control and distribution partnerships may be increasingly central to the company’s long-term story.

- Next, we’ll explore how concerns over higher incentive costs and integration challenges could influence Celsius Holdings’ broader investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Celsius Holdings Investment Narrative Recap

To own Celsius, you generally have to believe that health focused energy drinks can keep gaining share and that the PepsiCo partnership and Alani Nu integration will translate strong shelf presence into profitable growth. The latest analyst moves, including price target cuts tied to higher incentive costs and market share pressure, sharpen focus on execution: near term, the key catalyst is smooth distribution integration, while the biggest risk is that rising SG&A and incentive spending outpace revenue growth. Overall, the recent news intensifies existing concerns rather than creating new ones.

Among the recent developments, Piper Sandler’s price target cut to US$61, tied to higher incentive costs and reduced 2026 and 2027 sales estimates, feels most relevant. It directly challenges the thesis that Celsius can leverage PepsiCo scale and the Alani Nu and Rockstar transitions without seeing profitability squeezed, and it puts more weight on upcoming quarters to show that integration and cost synergy targets can offset elevated spending.

Yet even as many analysts remain constructive, investors should be aware that rising incentive costs and integration expenses could...

Read the full narrative on Celsius Holdings (it's free!)

Celsius Holdings’ narrative projects $3.7 billion revenue and $532.9 million earnings by 2028.

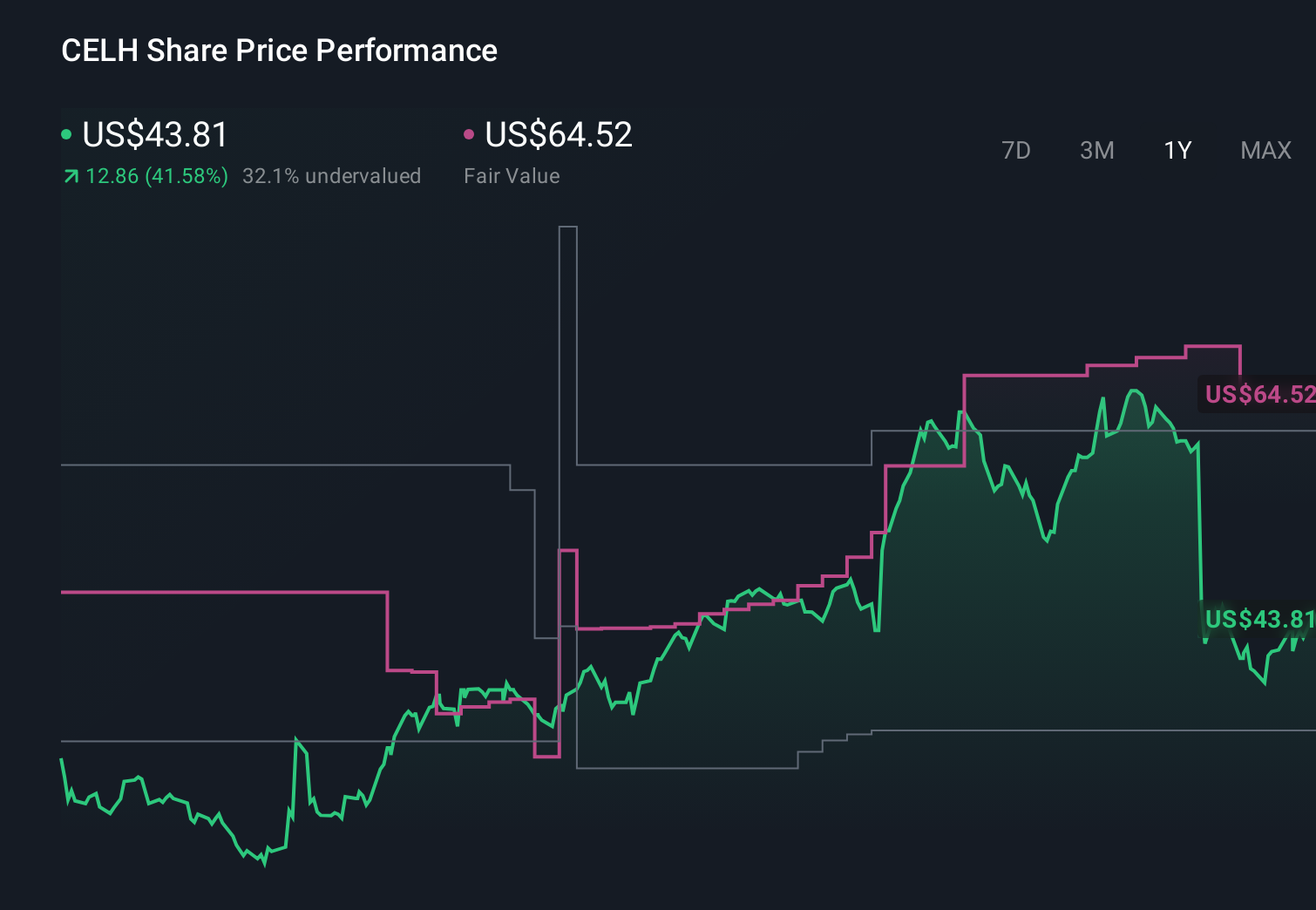

Uncover how Celsius Holdings' forecasts yield a $64.52 fair value, a 55% upside to its current price.

Exploring Other Perspectives

Twenty nine members of the Simply Wall St Community value Celsius between US$35.70 and US$80.00, reflecting very different assumptions about its future. Against this backdrop, concerns about higher incentive costs and integration hurdles highlight why it can help to compare several independent views on the company’s outlook.

Explore 29 other fair value estimates on Celsius Holdings - why the stock might be worth 14% less than the current price!

Build Your Own Celsius Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Celsius Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Celsius Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Celsius Holdings' overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CELH

Celsius Holdings

Develops, processes, manufactures, markets, sells, and distributes functional energy drinks in the United States, North America, Europe, the Asia Pacific, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion