- United States

- /

- Beverage

- /

- NasdaqCM:CELH

Celsius Holdings (NasdaqCM:CELH) Sees 27% Jump As Annual Sales Climb To US$1 Billion

Reviewed by Simply Wall St

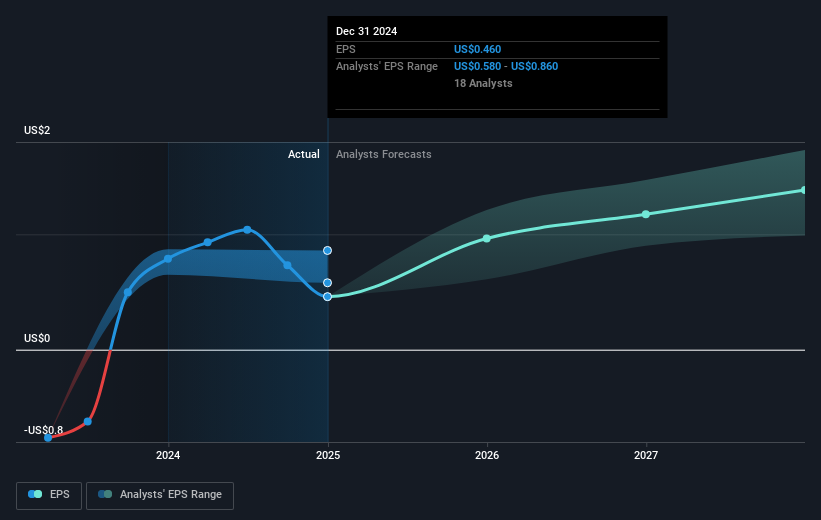

Celsius Holdings (NasdaqCM:CELH) recently recorded a 27% price increase over the last quarter, with several factors potentially influencing this upward movement. The appointment of Eric Hanson as the new President and COO, effective March 24, aligns with the company's ambitions in the functional beverage sector, perhaps boosting investor confidence. Despite reporting a net loss for Q4 2024, annual sales rose to $1.36 billion. The introduction of the CELSIUS HYDRATION product line may have contributed to positive sentiment. Meanwhile, U.S. markets experienced a modest recovery, with the S&P 500 and Nasdaq both inching higher amid easing tariff fears, providing a favorable backdrop.

We've identified 2 possible red flags for Celsius Holdings that you should be aware of.

Over the past five years, Celsius Holdings has achieved an extraordinary total return of a little over 2445%, demonstrating significant growth. Key to this performance was the acquisition of Alani Nu in 2025, aimed at capturing health-conscious millennials and Gen Z consumers, thereby diversifying Celsius's portfolio and enhancing revenue streams. The launch of the CELSIUS HYDRATION product line in early 2025 further broadened the company's market presence, reaching new consumer segments. Additionally, Celsius's expansion into new markets such as Canada and Europe during 2024 amplified its international footprint, increasing sales opportunities. The 3-for-1 stock split in November 2023 made shares more accessible, potentially attracting new investors.

Despite a volatile recent year where Celsius underperformed the U.S. Beverage industry, returning less compared to the industry's 3.8% decline, its five-year trajectory underscores substantial growth sustenance. The collaboration with PepsiCo has been instrumental, aiming to optimize distribution and supply chain efficiencies, likely contributing to reduced costs and improved margins over this duration.

Click to explore a detailed breakdown of our findings in Celsius Holdings' financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CELH

Celsius Holdings

Develops, processes, manufactures, markets, sells, and distributes functional energy drinks in the United States, North America, Europe, the Asia Pacific, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives