- United States

- /

- Food

- /

- NasdaqGS:CALM

Did Wall Street’s Positive View Amid Industry Gloom Just Shift Cal-Maine Foods' (CALM) Investment Narrative?

Reviewed by Sasha Jovanovic

- In recent coverage, Wall Street analysts issued a positive outlook on Cal-Maine Foods, highlighting the company's robust revenue growth, profitable earnings, and strong free cash flow amid a period when many peer stocks received negative forecasts.

- This upbeat view on Cal-Maine is particularly notable given the rarity of broadly bearish analyst sentiment across the market.

- We’ll explore how Cal-Maine’s strong financial performance distinctively shapes its investment narrative at a time of generally downbeat analyst outlooks.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Cal-Maine Foods' Investment Narrative?

To be a Cal-Maine Foods shareholder, you need conviction in the company's ability to sustain its exceptionally strong financial results despite industry headwinds and broad analyst pessimism. Recent Wall Street coverage, which called out Cal-Maine as a rare bright spot while most peers faced downgrades, puts renewed attention on its robust revenue growth, high-quality earnings, and substantial free cash flow. For the short term, this positive analyst sentiment might boost investor confidence, but is unlikely to shift major catalysts such as volatile egg prices, avian flu risks, or uncertainty around margins. The company’s strategic push for expansion through M&A and ongoing boardroom changes remain primary drivers. While the upbeat Wall Street view highlights healthier fundamentals versus the sector, it doesn’t fully erase concerns around future earnings declines or dividend sustainability flagged by previous analysis. In short, the recent analyst upgrade is an encouraging signal, but it does not materially change the big risks or growth levers that matter most to Cal-Maine’s outlook.

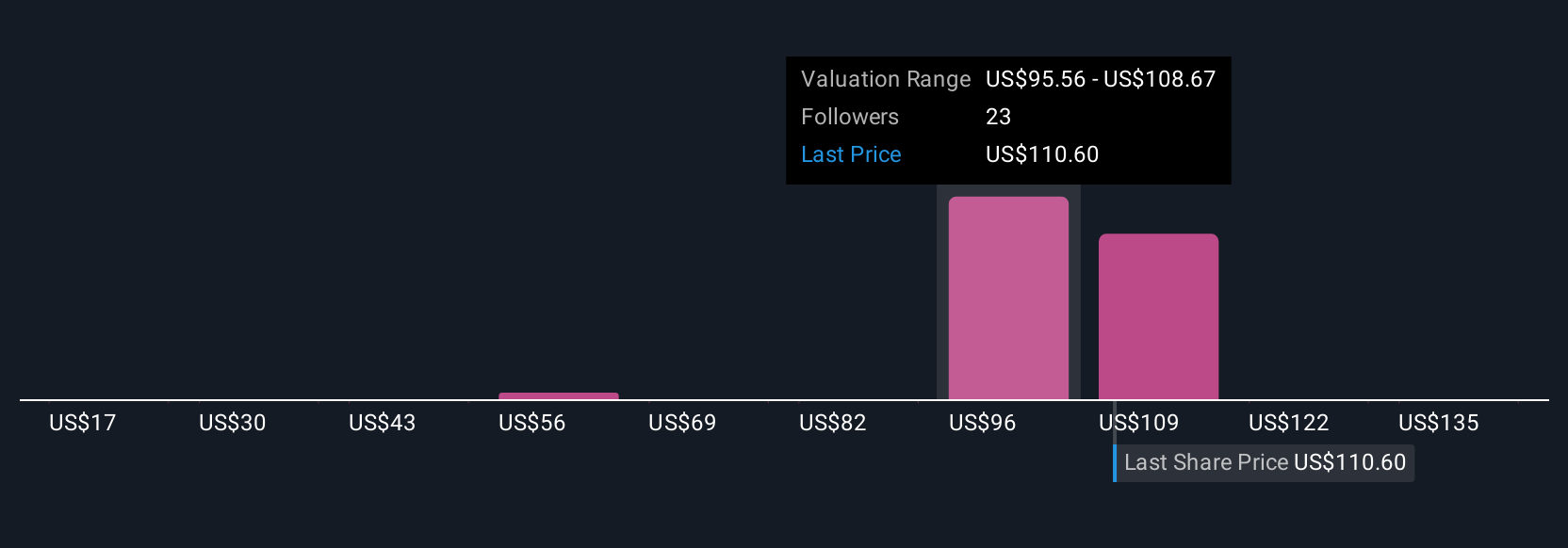

But against this optimism, keep in mind the sharp forecasts for declining future profit growth. Despite retreating, Cal-Maine Foods' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 17 other fair value estimates on Cal-Maine Foods - why the stock might be worth less than half the current price!

Build Your Own Cal-Maine Foods Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cal-Maine Foods research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Cal-Maine Foods research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cal-Maine Foods' overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CALM

Cal-Maine Foods

Engages in the production, grading, packaging, marketing, and distribution of shell eggs, egg products, and prepared foods.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives