- United States

- /

- Food

- /

- NasdaqGS:CALM

Cal-Maine Foods (CALM): Exploring the Valuation After a Recent 20% Share Price Decline

Reviewed by Kshitija Bhandaru

Cal-Maine Foods (CALM) has caught some attention recently, with shares moving lower over the past month. Its stock dipped almost 20% in that period, which has prompted investors to re-examine what might be next for the company.

See our latest analysis for Cal-Maine Foods.

Cal-Maine Foods’ nearly 20% slump over the last month has some investors on edge, but looking at the bigger picture, it has still managed a 1-year total shareholder return just above breakeven. Despite recent weakness, the stock’s momentum appears to be fading rather than building for now. The latest share price closed at $92.58.

If you’re open to discovering what’s moving beyond the food sector, now is the perfect opportunity to see what stands out among fast growing stocks with high insider ownership.

So with shares off their recent highs and trading at a notable discount to analyst targets, is Cal-Maine Foods an undervalued pick, or is the market already accounting for future growth in its price?

Price-to-Earnings of 3.5x: Is it justified?

Cal-Maine Foods is trading on a Price-to-Earnings (P/E) ratio of just 3.5x, well below both its industry peers and the broader food sector. At $92.58, the stock looks deeply discounted compared to typical sector valuations.

The P/E ratio measures what investors are willing to pay today for a dollar of current earnings. This metric is highly relevant for established, profit-generating companies like Cal-Maine Foods. A low P/E can indicate that the market expects earnings to fall, or that the stock is being overlooked.

For context, Cal-Maine’s P/E of 3.5x stands out against the US Food industry average of 18x and an even higher peer average of 27x. This significant difference suggests that investors may be pricing in a rapid reversal of the company’s strong recent earnings, rather than treating last year’s performance as a new baseline. When compared to the estimated fair P/E of 2.9x, the stock is only slightly above what the market might regress towards in the future should conditions normalize.

Explore the SWS fair ratio for Cal-Maine Foods

Result: Price-to-Earnings of 3.5x (UNDERVALUED)

However, declining annual revenue and significant drops in net income growth could signal ongoing operational challenges. These factors may potentially hinder a near-term rebound for Cal-Maine Foods.

Find out about the key risks to this Cal-Maine Foods narrative.

Another View: What Does Our DCF Model Suggest?

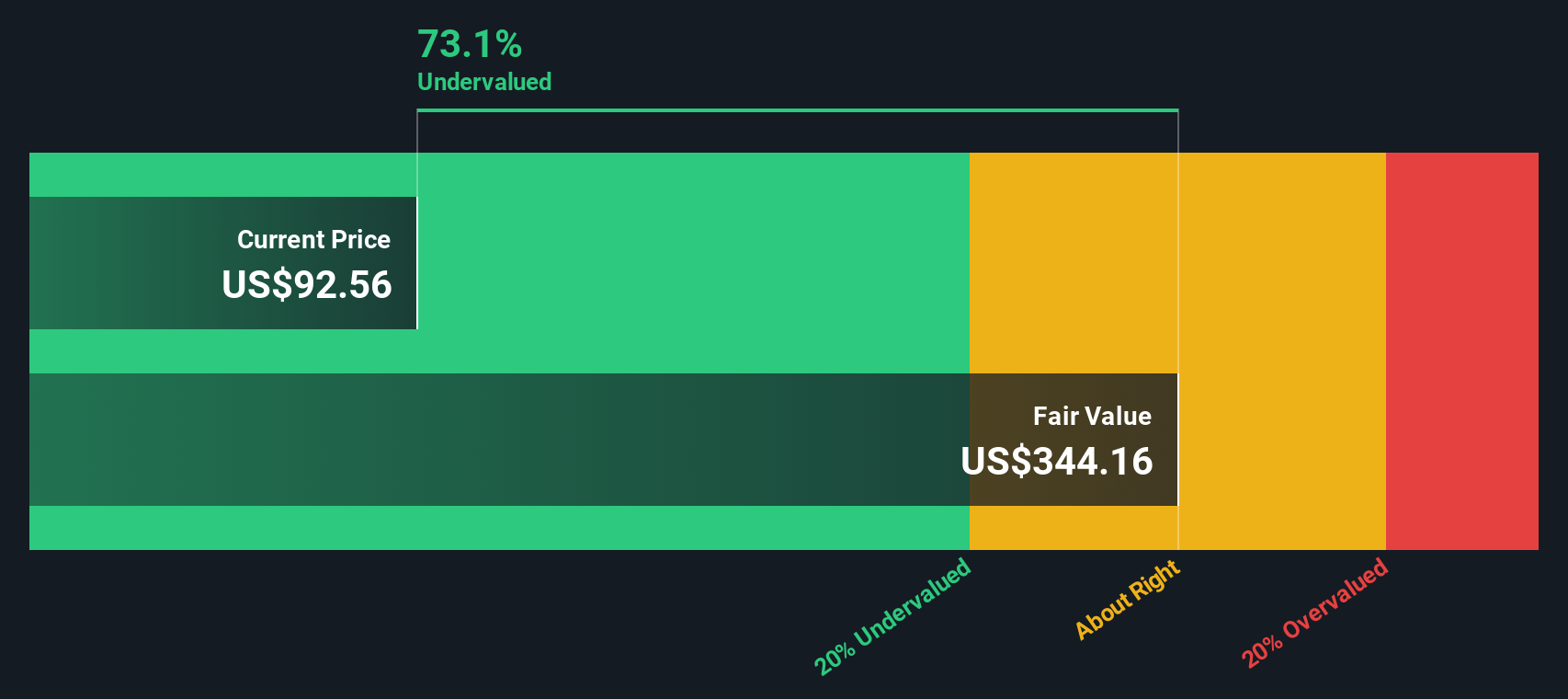

Looking past earnings multiples, the SWS DCF model presents a dramatically different picture. By focusing on long-term cash flows, our model suggests Cal-Maine Foods is trading at a significant discount to an estimated fair value. Could this disconnect signal an overlooked opportunity, or does it reflect risks not captured by cash flow forecasts?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cal-Maine Foods for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cal-Maine Foods Narrative

If you have a different perspective or enjoy diving into the numbers yourself, you can easily generate your own Cal-Maine Foods narrative in just a few minutes. Do it your way

A great starting point for your Cal-Maine Foods research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

With the right investment research tools at your fingertips, you can unlock hidden winners and take advantage of trending opportunities before most investors even notice them.

- Capture untapped growth by checking out these 23 AI penny stocks, which are pushing boundaries in automation, data analysis, and smart technology.

- Build lasting portfolio strength when you tap into these 19 dividend stocks with yields > 3%, offering steady yields and robust fundamentals for income-focused investors.

- Position yourself at the forefront of innovation with these 26 quantum computing stocks, featuring pioneers redefining what is possible in quantum computing and advanced hardware.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CALM

Cal-Maine Foods

Engages in the production, grading, packaging, marketing, and distribution of shell eggs, egg products, and prepared foods.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives