- United States

- /

- Food

- /

- NasdaqGS:BYND

Beyond Meat, Inc.'s (NASDAQ:BYND) Stock Retreats 27% But Revenues Haven't Escaped The Attention Of Investors

Beyond Meat, Inc. (NASDAQ:BYND) shares have had a horrible month, losing 27% after a relatively good period beforehand. For any long-term shareholders, the last month ends a year to forget by locking in a 64% share price decline.

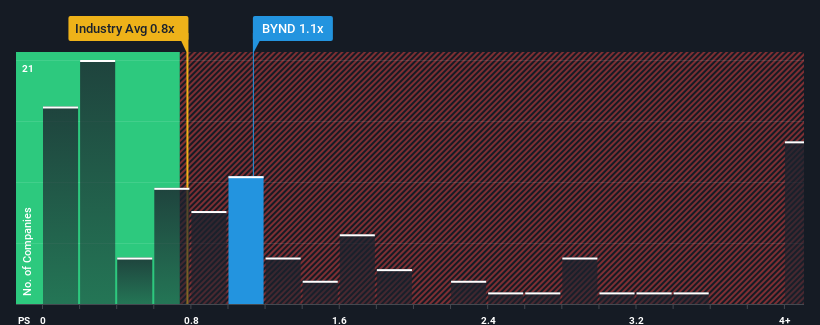

Even after such a large drop in price, it's still not a stretch to say that Beyond Meat's price-to-sales (or "P/S") ratio of 1.1x right now seems quite "middle-of-the-road" compared to the Food industry in the United States, where the median P/S ratio is around 0.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Beyond Meat

How Beyond Meat Has Been Performing

Beyond Meat hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Beyond Meat's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Beyond Meat's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 21%. The last three years don't look nice either as the company has shrunk revenue by 13% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the eleven analysts covering the company suggest revenue should grow by 2.4% per year over the next three years. With the industry predicted to deliver 2.6% growth each year, the company is positioned for a comparable revenue result.

With this information, we can see why Beyond Meat is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Key Takeaway

With its share price dropping off a cliff, the P/S for Beyond Meat looks to be in line with the rest of the Food industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A Beyond Meat's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Food industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

Before you take the next step, you should know about the 2 warning signs for Beyond Meat (1 is potentially serious!) that we have uncovered.

If these risks are making you reconsider your opinion on Beyond Meat, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Beyond Meat might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:BYND

Beyond Meat

A plant-based meat company, engages in the development, manufacture, marketing, and sale of plant-based meat products under the Beyond brand name in the United States and internationally.

Imperfect balance sheet very low.

Similar Companies

Market Insights

Community Narratives