- United States

- /

- Food

- /

- NasdaqGS:BYND

Beyond Meat, Inc. (NASDAQ:BYND) Stock Rockets 50% As Investors Are Less Pessimistic Than Expected

Those holding Beyond Meat, Inc. (NASDAQ:BYND) shares would be relieved that the share price has rebounded 50% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 25% in the last twelve months.

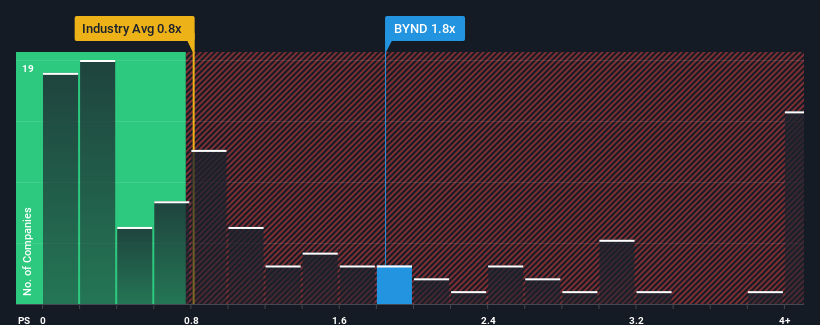

After such a large jump in price, given close to half the companies operating in the United States' Food industry have price-to-sales ratios (or "P/S") below 0.8x, you may consider Beyond Meat as a stock to potentially avoid with its 1.8x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Beyond Meat

What Does Beyond Meat's P/S Mean For Shareholders?

Beyond Meat hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Beyond Meat's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Beyond Meat's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 21% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 13% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 2.3% per year during the coming three years according to the eleven analysts following the company. With the industry predicted to deliver 2.9% growth each year, the company is positioned for a comparable revenue result.

In light of this, it's curious that Beyond Meat's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Final Word

Beyond Meat shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Given Beyond Meat's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Beyond Meat (at least 1 which doesn't sit too well with us), and understanding these should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Beyond Meat, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Beyond Meat might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:BYND

Beyond Meat

A plant-based meat company, engages in the development, manufacture, marketing, and sale of plant-based meat products under the Beyond brand name in the United States and internationally.

Low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives