- United States

- /

- Oil and Gas

- /

- NYSEAM:UEC

Uranium Energy (UEC): Assessing Valuation as Global Uranium Supply Tightens and U.S. Government Backs Domestic Stockpiles

Reviewed by Kshitija Bhandaru

Uranium Energy (UEC) is on investors’ radar as tightening global uranium supplies combine with rising demand and active U.S. government support through loan guarantees and stockpile expansion efforts. Recent actions highlight the increased focus on energy security.

See our latest analysis for Uranium Energy.

Uranium Energy’s share price has surged 95% year-to-date, buoyed by tightening supply, bullish sentiment around clean energy, and recent U.S. government support. Over the past twelve months, the stock delivered a remarkable 1-year total shareholder return of nearly 76%, adding to already exceptional multi-year results and signaling strong momentum as investor confidence grows.

If the scramble for domestic uranium sources has you looking beyond the headlines, now is a perfect time to discover fast growing stocks with high insider ownership.

With such strong gains and government tailwinds, the key question is whether Uranium Energy is still undervalued or if recent growth and future prospects are already fully reflected in the share price. Investors must decide if a buying opportunity remains, or if the market has already priced in what comes next.

Price-to-Book of 7.3x: Is it justified?

Uranium Energy trades at a price-to-book ratio of 7.3x, significantly higher than its industry peers and suggesting the stock commands a sizeable premium at its last close of $14.87.

The price-to-book ratio compares a company’s market value to its book value. This metric is a useful benchmark in asset-heavy sectors like oil and gas. For Uranium Energy, this higher multiple signals that the market is pricing in future growth or other strategic advantages that are not yet reflected in the company’s current assets.

This premium stands out when compared with the US Oil and Gas industry average of just 1.3x and the peer average of 5.8x. Investors are assigning much more value to Uranium Energy than its direct competitors, making this multiple difficult to justify based on tangible assets alone.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 7.3x (OVERVALUED)

However, there are still risks, such as volatile uranium prices or potential regulatory shifts. These factors could quickly impact expectations and investor sentiment.

Find out about the key risks to this Uranium Energy narrative.

Another View: Discounted Cash Flow Model

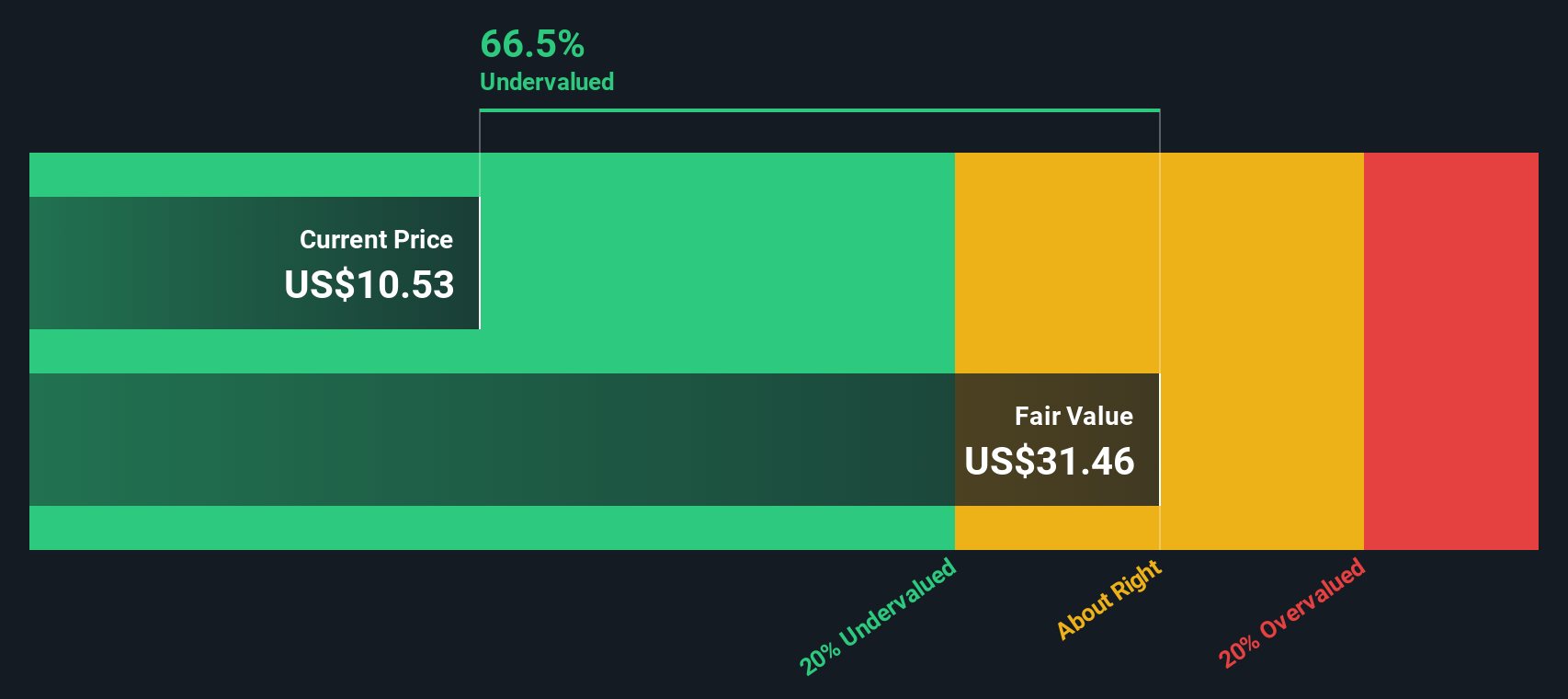

Taking a step back from asset-based multiples, our SWS DCF model offers a different perspective, focusing on Uranium Energy’s future cash flows. By this method, UEC’s current share price of $14.87 sits above our fair value estimate of $13.68, implying the stock could be overvalued based on future fundamentals versus market optimism. Which approach will investors trust more: assets or future earnings?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Uranium Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Uranium Energy Narrative

If you’d rather chart your own course or come to different conclusions, you can easily build your perspective in just a few minutes. Do it your way.

A great starting point for your Uranium Energy research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Seize your next big investing opportunity by checking out hand-picked lists of stocks primed for growth and innovation. Missing out could mean leaving potential on the table.

- Target fresh income streams and steady yields by reviewing these 18 dividend stocks with yields > 3%, which offers strong payouts and reliable track records for income-focused portfolios.

- Tap into the technology of tomorrow and see which companies stand out among these 24 AI penny stocks at the forefront of artificial intelligence breakthroughs.

- Position yourself ahead of the curve by acting on these 878 undervalued stocks based on cash flows, identified as bargains based on their underlying cash flows and upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:UEC

Uranium Energy

Engages in exploration, pre-extraction, extraction, and processing of uranium and titanium concentrates properties in the United States, Canada, and the Republic of Paraguay.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives