- United States

- /

- Oil and Gas

- /

- NYSEAM:LEU

Will Army’s Nuclear Microreactor Initiative Reshape Centrus Energy's (LEU) Strategic Outlook?

Reviewed by Sasha Jovanovic

- Earlier this week, the U.S. Army announced the Janus Program, targeting the deployment of portable nuclear microreactors at military bases by 2028, with ambitions to supply up to 20 megawatts of electricity without constant refueling.

- This initiative signals growing government commitment to advanced nuclear technologies, creating new avenues for companies involved in nuclear fuel supply and next-generation reactor development, such as Centrus Energy.

- We’ll now examine how increased military demand for compact nuclear reactors could shift the outlook for Centrus Energy’s investment narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Centrus Energy Investment Narrative Recap

To be a shareholder in Centrus Energy, one must believe that advanced nuclear technology and government-backed national security priorities will sustain demand for enriched fuel and next-generation reactor capabilities. The Army’s newly announced Janus Program reinforces government enthusiasm for microreactors, but it does not materially alter the biggest near-term catalyst, capacity expansion at Centrus' Piketon facility, or address the most pressing risk of execution delays in scaling enrichment operations and converting backlog into revenue. Recent headlines have focused on Centrus’ September expansion announcement in Piketon, Ohio, which is expected to add substantial job growth and depends in part on the allocation of federal funds. This multi-billion-dollar project directly shapes the capacity required to fulfill future contracts generated by increased military and energy infrastructure demand, acting as the company’s key operational and earnings lever as the sector evolves. Yet, despite renewed optimism about government orders, investors should be aware that regulatory slowdowns or setbacks in awarding DOE contracts could still threaten...

Read the full narrative on Centrus Energy (it's free!)

Centrus Energy is projected to reach $640.9 million in revenue and $70.3 million in earnings by 2028. This scenario assumes annual revenue growth of 13.6%, but earnings are expected to decrease by $34.5 million from the current $104.8 million.

Uncover how Centrus Energy's forecasts yield a $258.05 fair value, a 32% downside to its current price.

Exploring Other Perspectives

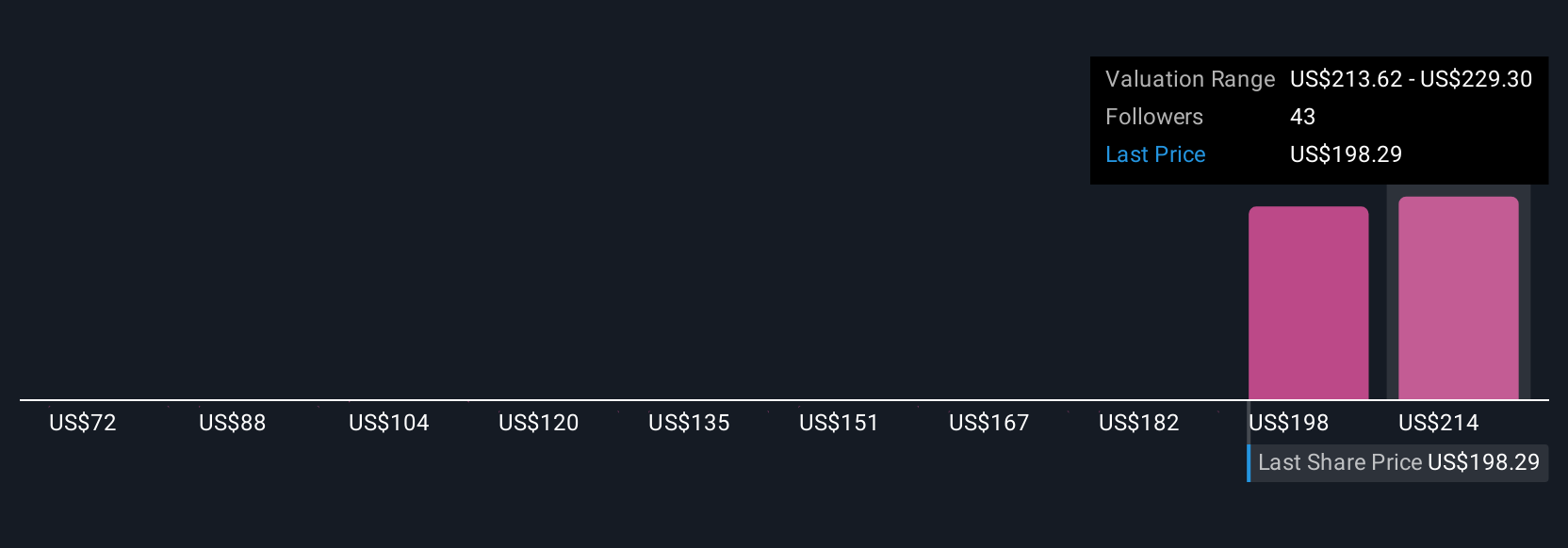

Fair value opinions in the Simply Wall St Community span from US$72.48 to US$310, with 9 investor perspectives reflecting broad disagreement. While many see opportunity in US national security-driven demand, execution delays in enrichment scaling remain a central theme that could affect future returns; consider how differently others are seeing the road ahead.

Explore 9 other fair value estimates on Centrus Energy - why the stock might be worth less than half the current price!

Build Your Own Centrus Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Centrus Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Centrus Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Centrus Energy's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:LEU

Centrus Energy

Supplies nuclear fuel components for the nuclear power industry in the United States, Belgium, Japan, the Netherlands, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives