- United States

- /

- Oil and Gas

- /

- NYSEAM:LEU

How Should Investors React to Centrus Energy’s 27.8% Drop After Regulatory Headlines?

Reviewed by Bailey Pemberton

Trying to figure out what to do with Centrus Energy stock? You are not alone. This stock has kept investors on their toes all year long. After an astonishing run that’s seen the share price skyrocket 325.2% year-to-date and an unbelievable 3,080.1% over five years, Centrus just posted a weekly drop of 27.8%. It is an attention-grabbing turn for a company that has already delivered a 2.8% return in the last month and a 247.8% jump over the past year. These dramatic moves have many investors weighing whether it’s an underrated bargain or if the risks are finally catching up.

What is behind the recent turbulence? Headlines about new nuclear technology partnerships and growing global demand for enriched uranium have fueled long-term optimism, but a recent shift in regulatory expectations seems to have tapped the brakes, at least in the short run. These factors are feeding into how the market thinks about Centrus’s prospects, as well as its price tag.

If you are looking at Centrus from a pure value perspective, it might be surprising to learn that its valuation score comes in at zero out of six checks for undervaluation. Not exactly a ringing endorsement from standard models, but as any seasoned investor knows, there is often more to the story than what the simple numbers show.

Let’s break down how Centrus stacks up on the classic valuation yardsticks. Then, I will share a more insightful way of sizing up its true value to close out the article.

Centrus Energy scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Centrus Energy Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today's value to reflect the time value of money. This approach aims to determine what the entire business is worth if you owned all its future cash profits right now.

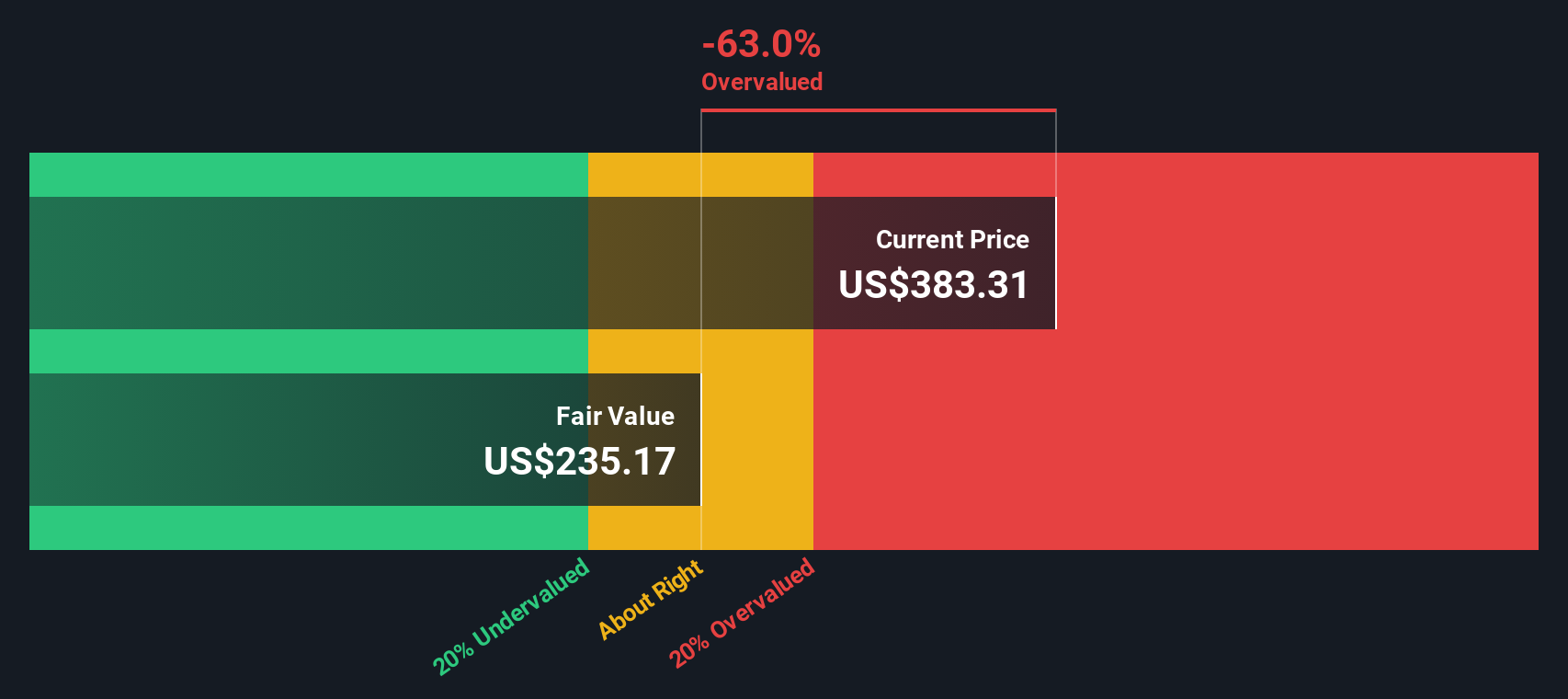

Centrus Energy's latest reported Free Cash Flow stands at $109.59 million. Analyst estimates see moderate fluctuations in the years ahead, with projections rising to $157 million by 2029. Beyond those five years, additional growth estimates are extrapolated based on industry forecasts and trends, giving a ten-year span of projected Free Cash Flows. These figures are all in US dollars and remain below the billion-dollar mark.

After running these projections through the DCF model, the intrinsic value comes out to $235.17 per share. At the moment, Centrus stock trades at a significant premium, with the DCF indicating the shares are about 33.9% overvalued compared to this calculated fair value.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Centrus Energy may be overvalued by 33.9%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Centrus Energy Price vs Earnings (PE Ratio)

For companies like Centrus Energy that are consistently profitable, the Price-to-Earnings (PE) ratio is a practical and well-recognized way to measure value. It expresses how much investors are willing to pay today for each dollar of current earnings. Generally, companies with stronger growth prospects and lower perceived risks trade at higher PE ratios, while slower-growing or riskier companies warrant a lower ratio.

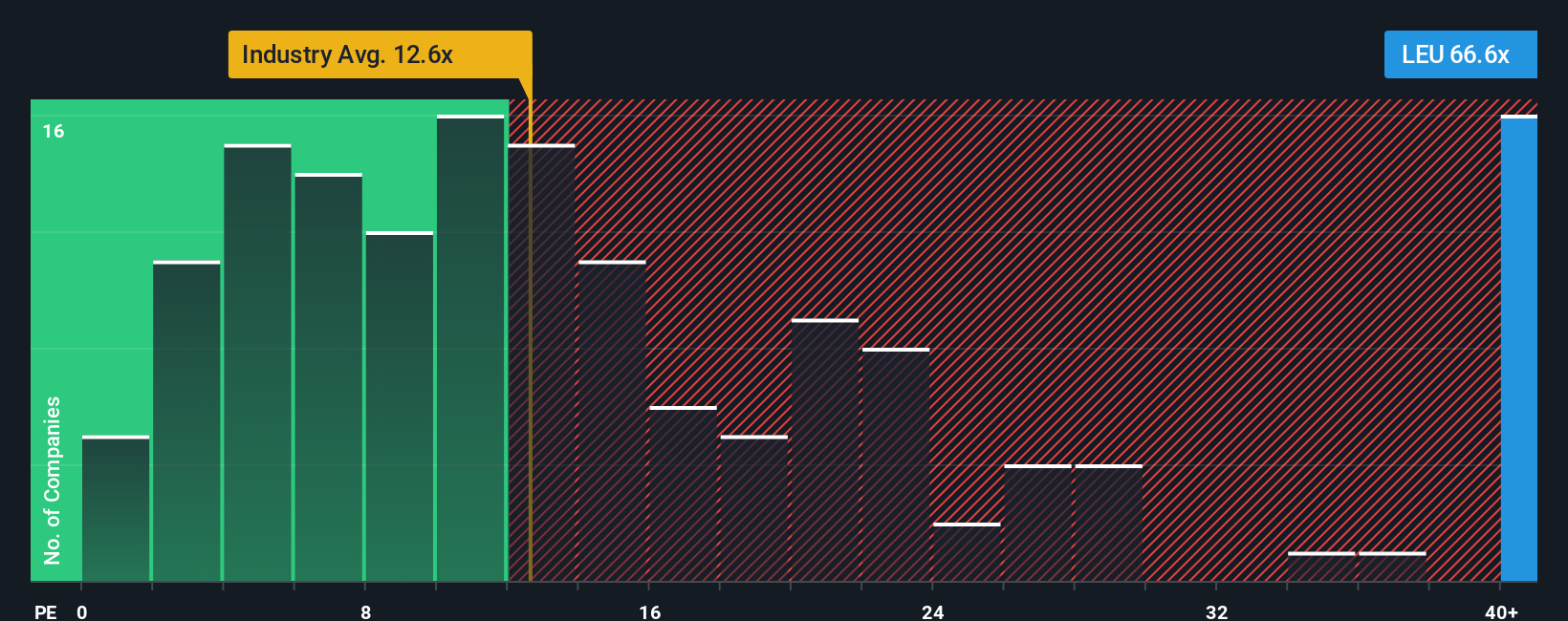

Centrus Energy is currently trading at a lofty PE ratio of 54.7x. To put this figure in perspective, the industry average for oil and gas firms sits at just 12.9x. Centrus’s closest peers trade around 14.5x. At first glance, this premium might seem extreme, but raw multiples only tell part of the story, as they do not account for company-specific advantages or vulnerabilities.

This is where Simply Wall St’s proprietary Fair Ratio comes into play. Unlike a generic industry or peer comparison, the Fair Ratio is tailored to Centrus, factoring in its unique growth profile, profit margins, size, market conditions, and risks. For Centrus, the Fair Ratio is calculated at 11.8x, which is far below the company’s current PE ratio. This sizable gap suggests the market price is factoring in far more optimism or less risk than is justified by the company’s fundamentals.

Comparing Centrus’s PE ratio to its Fair Ratio, it is clear that the shares are currently overvalued based on this analysis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Centrus Energy Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives are a simple but powerful tool that allows any investor to move beyond just the numbers. This lets you add your own story and assumptions about a company’s future. Instead of only looking at static models or consensus forecasts, Narratives let you connect your personal perspective on Centrus Energy — what you think about its technology, its industry, and its management — with your expectations for future revenue, margins, and fair value.

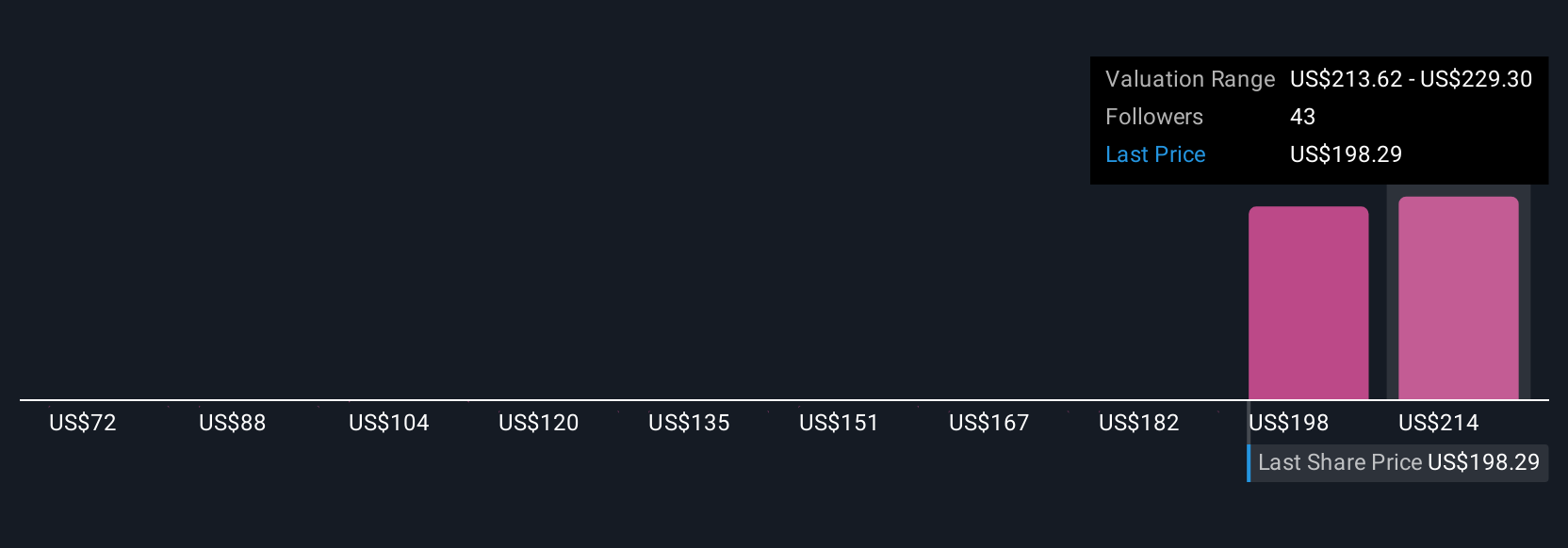

On Simply Wall St’s Community page, you can easily build a Narrative that links your outlook directly to a fair value estimate, helping you see whether Centrus is under- or over-valued compared to its current price. This dynamic approach updates automatically as news or financial results are released, so your fair value is always based on the latest information. For Centrus, some investors might believe in a future brimming with multi-year government contracts and evolving nuclear demand, setting fair value toward the very top of analyst targets. Others may focus on execution risks and market realities, landing at the lower end. Narratives ensure you can make buy or sell decisions based on a story and valuation you truly believe in.

Do you think there's more to the story for Centrus Energy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:LEU

Centrus Energy

Supplies nuclear fuel components for the nuclear power industry in the United States, Belgium, Japan, the Netherlands, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives