- United States

- /

- Oil and Gas

- /

- NYSEAM:LEU

Centrus Energy (NYSEAM:LEU) Extends HALEU Contract With U.S. Energy Department

Reviewed by Simply Wall St

Centrus Energy (NYSEAM:LEU) has recently experienced significant share price growth, surging 221% over the last quarter. A key catalyst was the U.S. Department of Energy's decision to extend Centrus' contract for HALEU production until June 2026. This extension highlights a strengthened partnership with the DOE, reinforcing Centrus' role in nuclear energy advancements. Additionally, the appointment of Richard Emery as Acting General Counsel following Shahram Ghasemian's resignation may add continuity to the management team. These developments, coupled with the company's strong earnings, contrast the broader market's flat performance and underscore this notable quarterly increase.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent extension of Centrus Energy's contract with the U.S. Department of Energy is likely to bolster the company's revenue prospects and validate its ongoing investment in HALEU production. This partnership could further solidify Centrus Energy's standing as a leader in domestic nuclear enrichment. The contract extension may also align with existing $2 billion LEU commitments, potentially driving increased revenue and improving the company's overall market position.

Over the past five years, Centrus Energy's total shareholder returns have exceeded 1,000%, showcasing remarkable long-term value creation despite the inherent volatility in the nuclear energy sector. Looking at recent performance, the company has outpaced both the broader U.S. market and its industry with substantial share price appreciation over the past year. These gains are notable given the market's more subdued returns during this period.

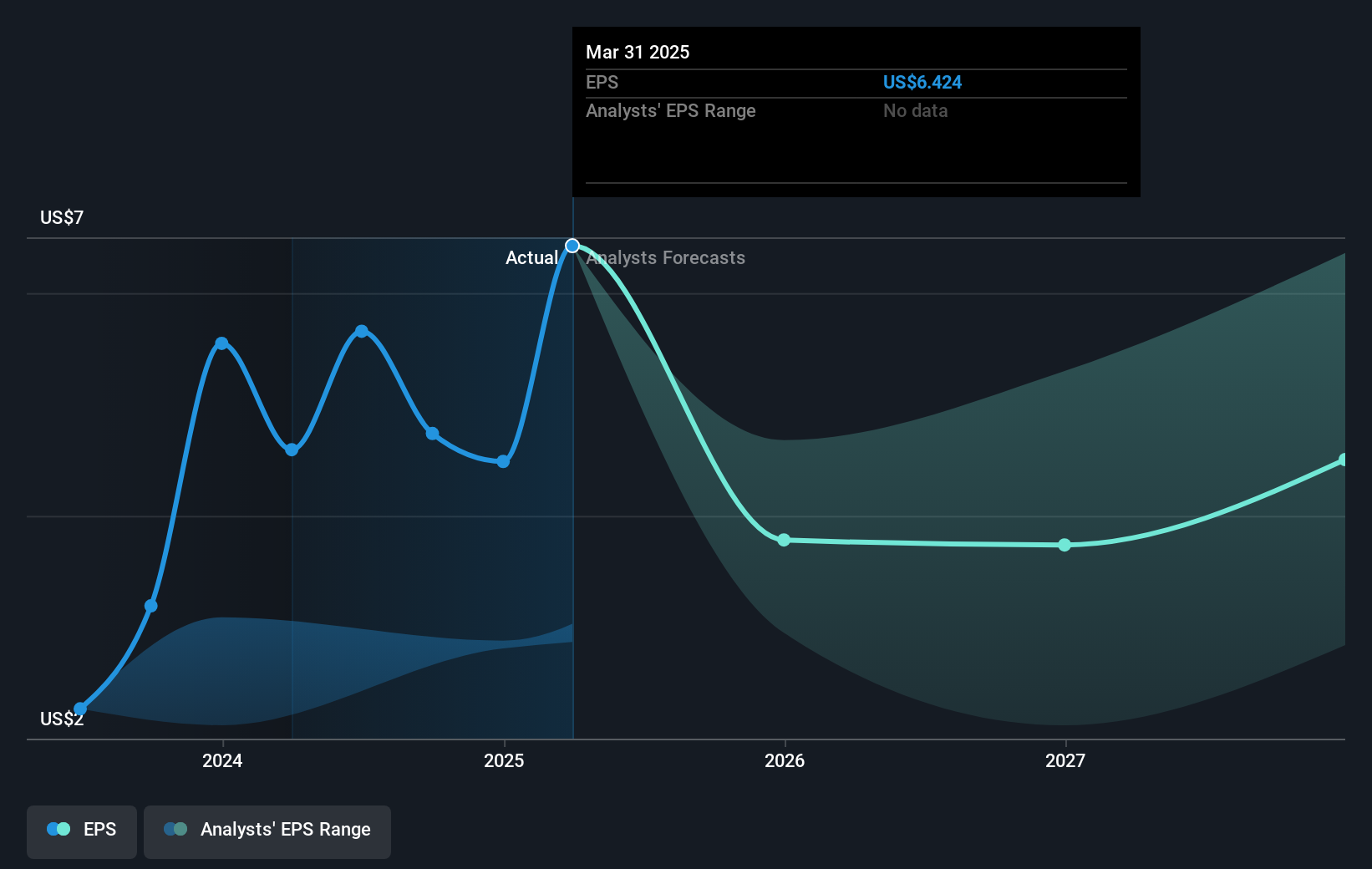

The company's longer-term financial prospects appear promising, particularly given the anticipated revenue growth from DOE contracts and investments in centrifuge manufacturing. However, these developments must be viewed in light of the earnings forecasts, which anticipate an earnings decline over the next three years. The consensus analyst price target of US$141.74, while higher than today's share price, reflects the potential for future growth, contingent upon successful execution against substantial commitments and strategic initiatives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:LEU

Centrus Energy

Supplies nuclear fuel components for the nuclear power industry in the United States, Belgium, Japan, the Netherlands, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives