- United States

- /

- Energy Services

- /

- NYSE:XPRO

How Investors May Respond To Expro Group Holdings (XPRO) Industry Award for VIGILANCE Safety Technology

Reviewed by Sasha Jovanovic

- Earlier this month, Expro Group Holdings received the Best Health, Safety or Environmental Contribution – Upstream award at the 2025 Gulf Energy Awards for its VIGILANCE™ Intelligent Safety and Surveillance Solution, highlighting ongoing commitment to safety and innovation.

- Expro's recognition across eight categories, spanning ten technologies, underscores the company's broad impact and leadership in upstream and production services within the energy sector.

- We'll examine how Expro's industry award for VIGILANCE™ technology shapes its investment narrative around technology-driven operational excellence.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Expro Group Holdings Investment Narrative Recap

For shareholders in Expro Group Holdings, the investment narrative often centers on the belief that energy service providers who lead in technological innovation and win industry recognition can capture a greater share of upstream and production projects. While Expro’s recent win at the 2025 Gulf Energy Awards spotlights its strong reputation for safety and innovation, this news does not materially change the current short-term catalysts such as order backlog growth or alter the significant risks tied to offshore operational exposure and shifting global energy demand. Among recent announcements, the deployment of the Remote Clamp Installation System (RCIS) stands out for its alignment with the VIGILANCE™ win, reinforcing the company’s focus on advancing operational safety and automation in offshore environments, factors closely linked to its largest growth opportunities and also its exposure to geopolitical and regulatory risks. By contrast, one area investors should be aware of is how concentrated customer relationships could make future revenues more sensitive to contract renewals and pricing negotiations if...

Read the full narrative on Expro Group Holdings (it's free!)

Expro Group Holdings' outlook anticipates $1.7 billion in revenue and $83.2 million in earnings by 2028. This scenario is based on a projected annual revenue decline of 0.3% and an earnings increase of $11.9 million from current earnings of $71.3 million.

Uncover how Expro Group Holdings' forecasts yield a $13.40 fair value, a 8% upside to its current price.

Exploring Other Perspectives

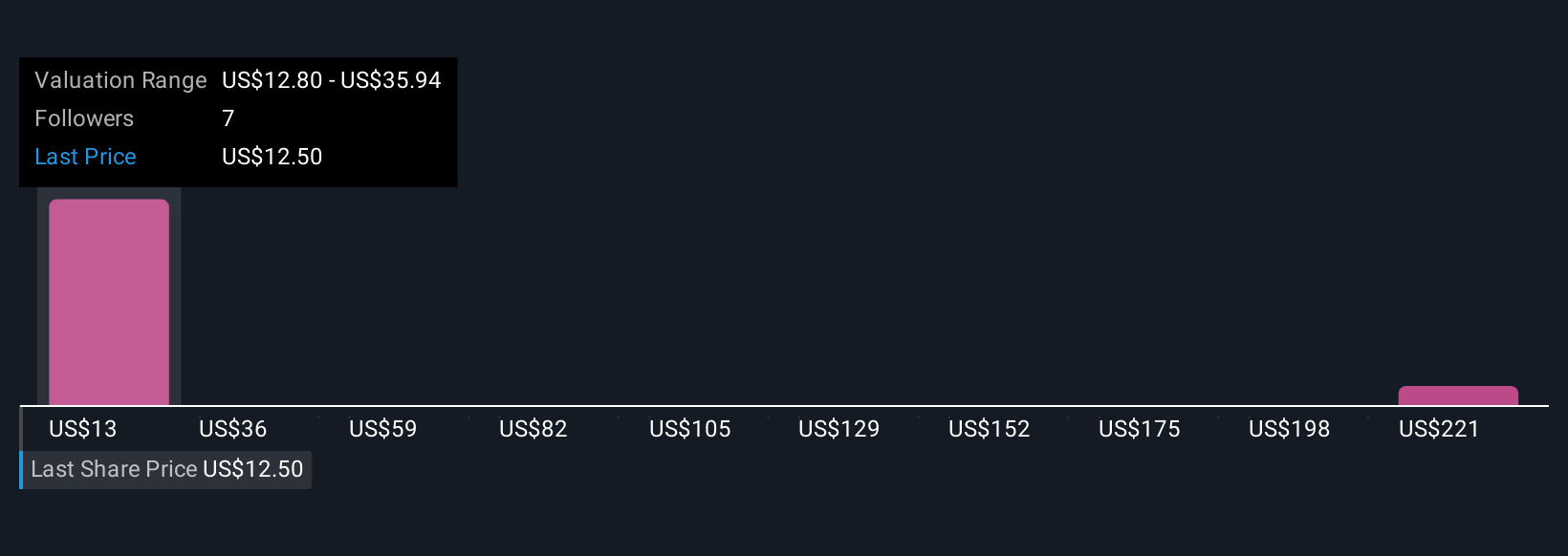

Three private investors in the Simply Wall St Community set fair value for Expro from US$13.40 up to US$244.23. As peers weigh these views, keep in mind that Expro’s revenue outlook is largely tied to persistent international energy demand and the success of its technology-driven solutions.

Explore 3 other fair value estimates on Expro Group Holdings - why the stock might be a potential multi-bagger!

Build Your Own Expro Group Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Expro Group Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Expro Group Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Expro Group Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Expro Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPRO

Expro Group Holdings

Provides energy services in North and Latin America, Europe and Sub-Saharan Africa, the Middle East and North Africa, and the Asia-Pacific.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives