- United States

- /

- Energy Services

- /

- NYSE:XPRO

Expro’s New RCIS Technology Could Be a Game Changer for Expro Group Holdings (XPRO)

Reviewed by Sasha Jovanovic

- Expro has completed the first full deployment of its Remote Clamp Installation System (RCIS) in the North Sea, enabling hands-free installation of control line clamps and reducing installation time by approximately two minutes per clamp.

- The RCIS technology, developed in collaboration with industry partners, represents a significant shift toward safer, more automated, and efficient offshore well completion processes.

- We'll explore how Expro's breakthrough in automated well completions could influence its long-term technology leadership and industry positioning.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Expro Group Holdings Investment Narrative Recap

To believe in Expro Group Holdings as a shareholder, you'd need confidence in the company’s ability to lead technological innovation in offshore oilfield services, maintaining strong order growth in a market facing decarbonization pressures and customer caution. The successful RCIS deployment demonstrates progress on automation and efficiency, yet this does not immediately shift the primary catalyst, which remains customer activity and offshore project approvals, nor does it offset the biggest risk: continued exposure to global project cycles and regulatory pressures. Among recent announcements, Expro’s upcoming third quarter earnings call on October 23, 2025, stands out. Investors may watch for management’s take on how the RCIS deployment and recent contract wins are contributing to revenue stability, order backlog, and overall operational performance, providing context to the main near-term drivers. In contrast, investors should also be aware of how sustained dependence on international and deepwater projects still exposes Expro to...

Read the full narrative on Expro Group Holdings (it's free!)

Expro Group Holdings' outlook anticipates $1.7 billion in revenue and $83.2 million in earnings by 2028. This forecast is based on a 0.3% annual decline in revenue and an earnings increase of $11.9 million, up from current earnings of $71.3 million.

Uncover how Expro Group Holdings' forecasts yield a $12.80 fair value, a 8% upside to its current price.

Exploring Other Perspectives

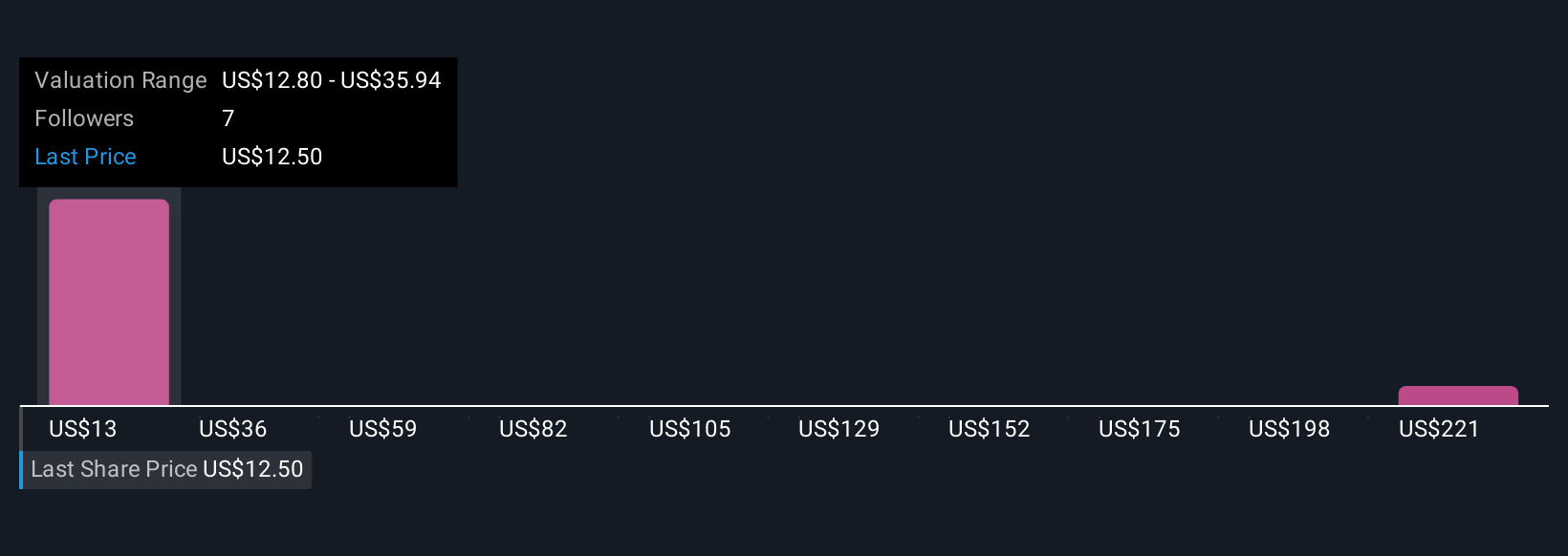

Simply Wall St Community members provided three fair value estimates for Expro, ranging from US$12.80 to a high of US$244.23 per share. While new automation technology could improve operational efficiency, broad customer caution and slow project approvals remain key hurdles for revenue growth, encouraging you to consider different perspectives on performance and risk.

Explore 3 other fair value estimates on Expro Group Holdings - why the stock might be worth just $12.80!

Build Your Own Expro Group Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Expro Group Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Expro Group Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Expro Group Holdings' overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 33 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Expro Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPRO

Expro Group Holdings

Provides energy services in North and Latin America, Europe and Sub-Saharan Africa, the Middle East and North Africa, and the Asia-Pacific.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives