- United States

- /

- Oil and Gas

- /

- NYSE:XOM

Retail Investors Still Trust in Exxon Mobil Corporation (NYSE:XOM)

With commodity prices rising, oil companies are gaining interest, as they keep beating the earnings while offering attractive yields. The market is facing the reality that oil is not dead yet. It is hard to talk about the yield in that sector without mentioning Exxon Mobil Corporation (NYSE: XOM) that offers an attractive dividend of 6.10%.

See our latest analysis for Exxon Mobil

Earnings Results

- Non-GAAP EPS: US$1.58 (beat by US$0.06)

- GAAP EPS: US$1.57 (beat by US$0.07)

- Revenue: US$73.7b (beat by US$1.74b)

- Revenue growth – 59.7% Y/Y

The company is anticipating future annual capital investments in the US$20-25b range with a significant increase in low-carbon spending. From 2022 onwards, the share repurchase program is authorized to a tune of US$10b.

Finally, from Q4 2021, the dividend will be increased to US$0.88 per share. This hike will ensure it remains on the S&P 500 dividend aristocrat list.

According to the latest reports, Exxon could add as many as 67 wells for the Yellowtail development cluster offshore Guyana. The campaign is scheduled to run from mid-2023 through 2032. The cluster could theoretically run production of 250,000 barrels per day of oil and 450 million cubic feet of natural gas per day.

A Look Into the Ownership

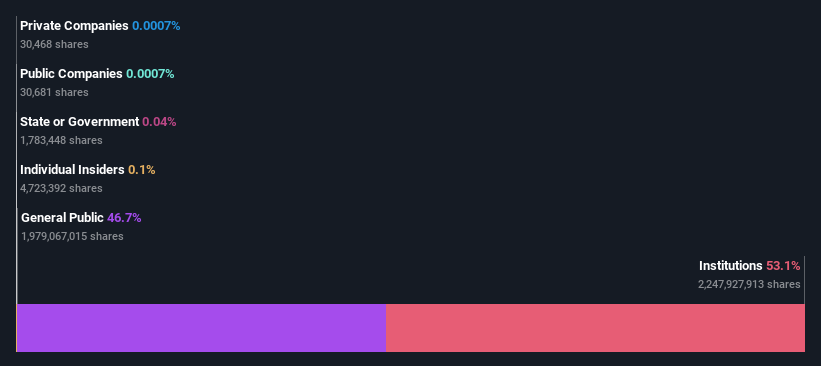

Exxon Mobil has a market capitalization of US$271b, so it's too big to fly under the radar. We'd expect to see both institutions and retail investors owning a portion of the company. Our analysis of the ownership of the company, below, shows that institutions own shares in the company. Let's take a closer look to see what the different types of shareholders can tell us about Exxon Mobil.

What Does The Institutional Ownership Tell Us About Exxon Mobil?

We can see that Exxon Mobil does have institutional investors, and they hold a good portion of the company's stock. This implies the analysts working for those institutions have looked at the stock, and they like it.

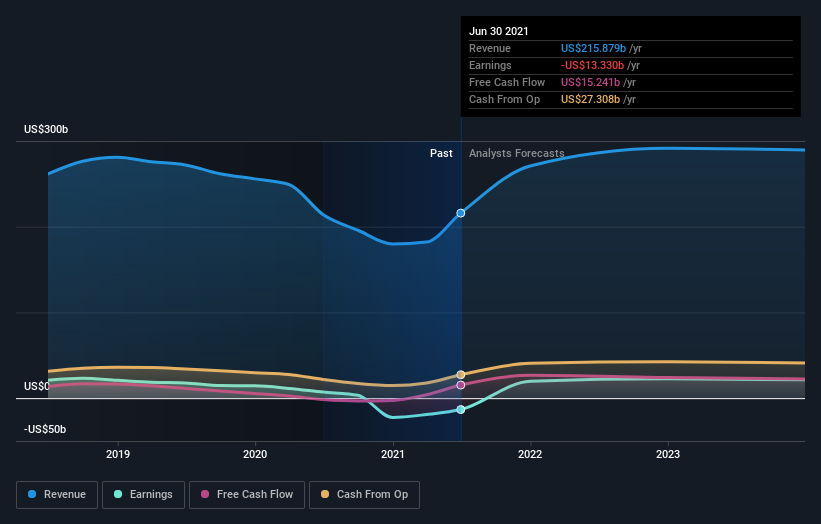

But just like anyone else, they could be wrong. When multiple institutions own a stock, there's always a risk of being in a 'crowded trade.' When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see Exxon Mobil's historic earnings and revenue below, but keep in mind there's always more to the story.

Investors should note that institutions actually own more than half the company, so they can collectively wield significant power. Hedge funds don't have many shares in Exxon Mobil. Our data shows that the largest shareholder is The Vanguard Group, Inc., with 8.3% of shares outstanding. With 6.4% and 6.0% of the shares outstanding respectively, BlackRock, Inc. and State Street Global Advisors, Inc. are the second and third largest shareholders.

On studying our ownership data, we found that 25 of the top shareholders collectively own less than 50% of the share register, implying that no single individual has a majority interest.

While studying institutional ownership for a company can add value to your research, it is also an excellent practice to research analyst recommendations to understand a stock's expected performance better. Quite a few analysts cover the stock so that you could look into forecast growth quite easily.

Insider Ownership Of Exxon Mobil

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions, too much power is concentrated within this group.

Our data suggests that insiders own under 1% of Exxon Mobil Corporation in their names. Being so large, we would not expect insiders to hold a large proportion of the stock. Collectively, they own US$303m of stock. Arguably recent buying and selling are just as important to consider. You can click here to see if insiders have been buying or selling.

General Public Ownership

The general public, with a 47% stake in the company, will not easily be ignored. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Next Steps:

For such a high market cap stock, we find it interesting to see significant general public ownership. Exxon Mobil has traditionally been a stock known for an excellent dividend yield, allowing many retirees to keep it in their passive income portfolios.

We are glad to see that the retail market did not lose faith in the company despite the recent turmoil.

To truly gain insight, we need to consider other information, too. For instance, we've identified 1 warning sign for Exxon Mobil that you should be aware of. Also, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12 months ending on the previous date of the month the financial statement is dated. This may not be consistent with full-year annual report figures.

If you're looking to trade Exxon Mobil, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Exxon Mobil might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:XOM

Exxon Mobil

Engages in the exploration and production of crude oil and natural gas in the United States, Canada, the United Kingdom, Singapore, France, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives