- United States

- /

- Oil and Gas

- /

- NYSE:XOM

A Fresh Look at Exxon Mobil’s Valuation After Major LNG Expansion and Battery Innovation Moves

Reviewed by Kshitija Bhandaru

Exxon Mobil (XOM) has caught the market’s eye with a one-two punch of big announcements: a major expansion in its liquefied natural gas (LNG) business and a declared breakthrough in battery technology for electric vehicles. The company is aiming to nearly double its LNG output by 2030 with new ventures in the US and Qatar, while also revealing a new graphite molecule that could extend EV battery life by as much as 30%. Taken together, these moves mark a clear bid to position Exxon Mobil as a leader not just in traditional energy, but also in the rapidly evolving clean tech and storage space.

These developments come at a time when Exxon Mobil’s stock performance has been more measured than explosive. The share price is up just above 5% year-to-date and less than a percentage point over the past year. This is despite a string of ambitious project announcements, ongoing shareholder rewards, and expanding operations in key growth markets. Momentum has picked up over the past three months as the company’s efforts in both LNG and battery innovation have become clearer. However, investors have reasons to debate if the company’s long-term bets are being fully recognized in today's pricing.

With these landmark initiatives now in play and recent price action showing modest improvement, is Exxon Mobil shaping up to be a bargain in plain sight or has the market already priced in the company’s next phase of growth?

Most Popular Narrative: 10.7% Undervalued

According to the most widely followed narrative, Exxon Mobil is trading at a noticeable discount to its estimated fair value, with projections pointing toward 10.7% undervaluation. This viewpoint is anchored by a moderate discount rate and detailed company-specific forecasts over the next five years.

The focus on profitability and high value assets will lead to steady earnings growth. Share buybacks will be the primary driver of EPS growth. Exxon may make opportunistic acquisitions, in both fossil fuel and renewable assets.

Eager to find out what’s fueling this bullish outlook? The narrative hinges on disciplined efficiency, escalating margins, and a savvy approach to capital returns. There is a surprising quantitative twist embedded in the earnings and margin forecasts, setting the stage for compelling long-term potential. Find out which profit levers are powering this valuation and how this framework reimagines Exxon Mobil’s path forward.

Result: Fair Value of $126.39 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, shifting global demand or an unexpected pivot toward renewables could quickly challenge Exxon Mobil’s current approach, which is focused on margins.

Find out about the key risks to this Exxon Mobil narrative.Another View: Is the Market Missing Something?

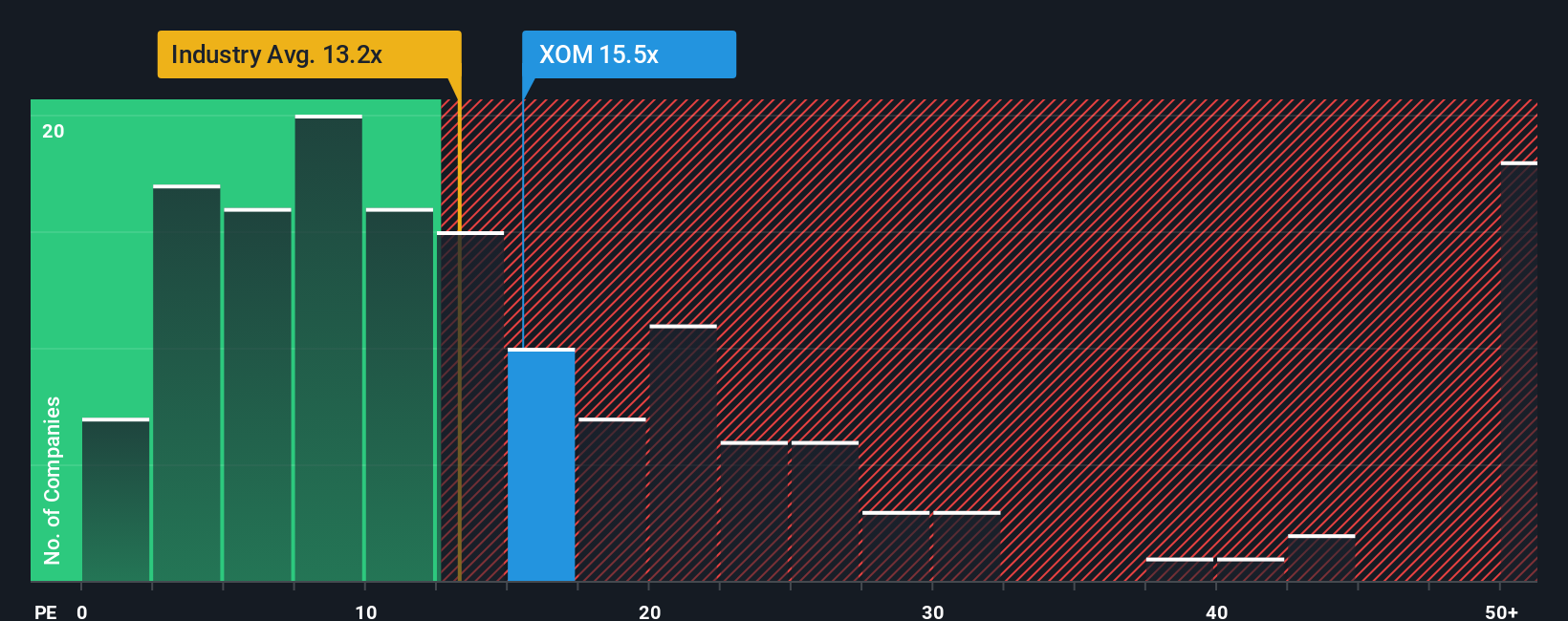

Looking at valuation from a different angle, Exxon Mobil actually trades at a higher ratio than the industry average. This suggests the market might be assigning a premium, so is value hiding or is risk being ignored?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Exxon Mobil to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Exxon Mobil Narrative

If you see the story unfolding differently or want to examine the numbers on your own terms, you can craft a custom narrative in just minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Exxon Mobil.

Looking for more investment ideas?

Don’t let opportunity pass you by. The Simply Wall Street Screener brings you smarter ways to find tomorrow’s top stocks, tailored for every kind of investor.

- Supercharge your search for future trendsetters by checking out AI-fueled opportunities with AI penny stocks as they make waves in innovation.

- Hunt for high-yield potential by uncovering companies with standout returns using our gateway to dividend stocks with yields > 3% that can deliver more income for your portfolio.

- Spot tomorrow's hidden values before the crowd moves in by tapping into our platform for undervalued stocks based on cash flows based on forward-looking cash flows and fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exxon Mobil might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XOM

Exxon Mobil

Engages in the exploration and production of crude oil and natural gas in the United States, Canada, the United Kingdom, Singapore, France, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives