- United States

- /

- Energy Services

- /

- NYSE:WTTR

Select Water Solutions (NYSE:WTTR) Is Increasing Its Dividend To $0.06

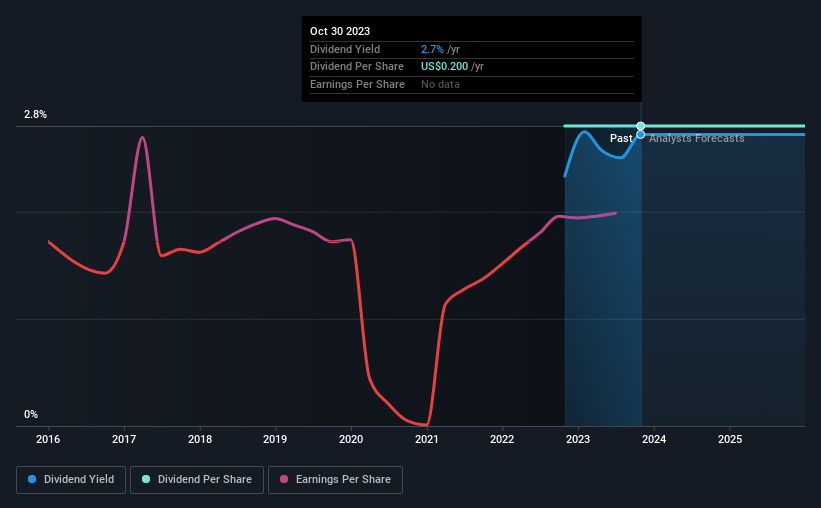

Select Water Solutions, Inc.'s (NYSE:WTTR) periodic dividend will be increasing on the 17th of November to $0.06, with investors receiving 20% more than last year's $0.05. This will take the dividend yield to an attractive 2.7%, providing a nice boost to shareholder returns.

View our latest analysis for Select Water Solutions

Select Water Solutions' Dividend Is Well Covered By Earnings

A big dividend yield for a few years doesn't mean much if it can't be sustained. Before making this announcement, Select Water Solutions was paying a whopping 145% as a dividend, but this only made up 33% of its overall earnings. While the business may be attempting to set a balanced dividend policy, a cash payout ratio this high might expose the dividend to being cut if the business ran into some challenges.

According to analysts, EPS should be several times higher next year. Assuming the dividend continues along recent trends, we think the payout ratio will be 11%, which makes us pretty comfortable with the sustainability of the dividend.

Select Water Solutions Is Still Building Its Track Record

Without a track record of dividend payments, we can't make a judgement on how stable it has been. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

The Dividend Looks Likely To Grow

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Select Water Solutions has impressed us by growing EPS at 25% per year over the past five years. Earnings have been growing rapidly, and with a low payout ratio we think that the company could turn out to be a great dividend stock.

Our Thoughts On Select Water Solutions' Dividend

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. While the low payout ratio is a redeeming feature, this is offset by the minimal cash to cover the payments. We don't think Select Water Solutions is a great stock to add to your portfolio if income is your focus.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Taking the debate a bit further, we've identified 3 warning signs for Select Water Solutions that investors need to be conscious of moving forward. Is Select Water Solutions not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:WTTR

Select Water Solutions

Provides water management and chemical solutions to the energy industry in the United States.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives