- United States

- /

- Oil and Gas

- /

- NYSE:WKC

Did Analyst Spotlight on Value Metrics Just Shift World Kinect's (WKC) Investment Narrative?

Reviewed by Sasha Jovanovic

- In recent days, analyst reports have highlighted World Kinect Corporation as one of the market’s strongest value stocks, supported by Zacks Rank #1 (Strong Buy) status and favorable value ratings compared to industry peers.

- This analyst attention emphasizes the company’s earnings outlook and suggests rising interest from value-focused investors due to its attractive valuation metrics.

- We’ll explore how the analyst recognition for World Kinect’s superior valuation metrics could influence the company’s future investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

World Kinect Investment Narrative Recap

To own shares in World Kinect, you need to believe in the company’s evolving focus on its core, higher-quality business lines while managing through unprofitable segments and volatility in its legacy markets. While the recent spotlight from Zacks as a top value pick could reinforce attention from value-focused investors, it does not materially shift the near-term catalyst, which remains the execution of the portfolio transition, or the key risk of continued margin pressure if traditional business lines underperform further. Of the recent announcements, the disclosure of significant non-cash goodwill impairments in Q2 stands out for shareholders tracking the company’s shift toward higher-return activities. These write-downs reflect the ongoing streamlining of less profitable assets, directly relating to the main catalyst, improving profitability by focusing on core segments, which could affect future earnings stability and investor confidence. In contrast, investors should also be aware of emerging risks related to shrinking demand for traditional fuels, especially as...

Read the full narrative on World Kinect (it's free!)

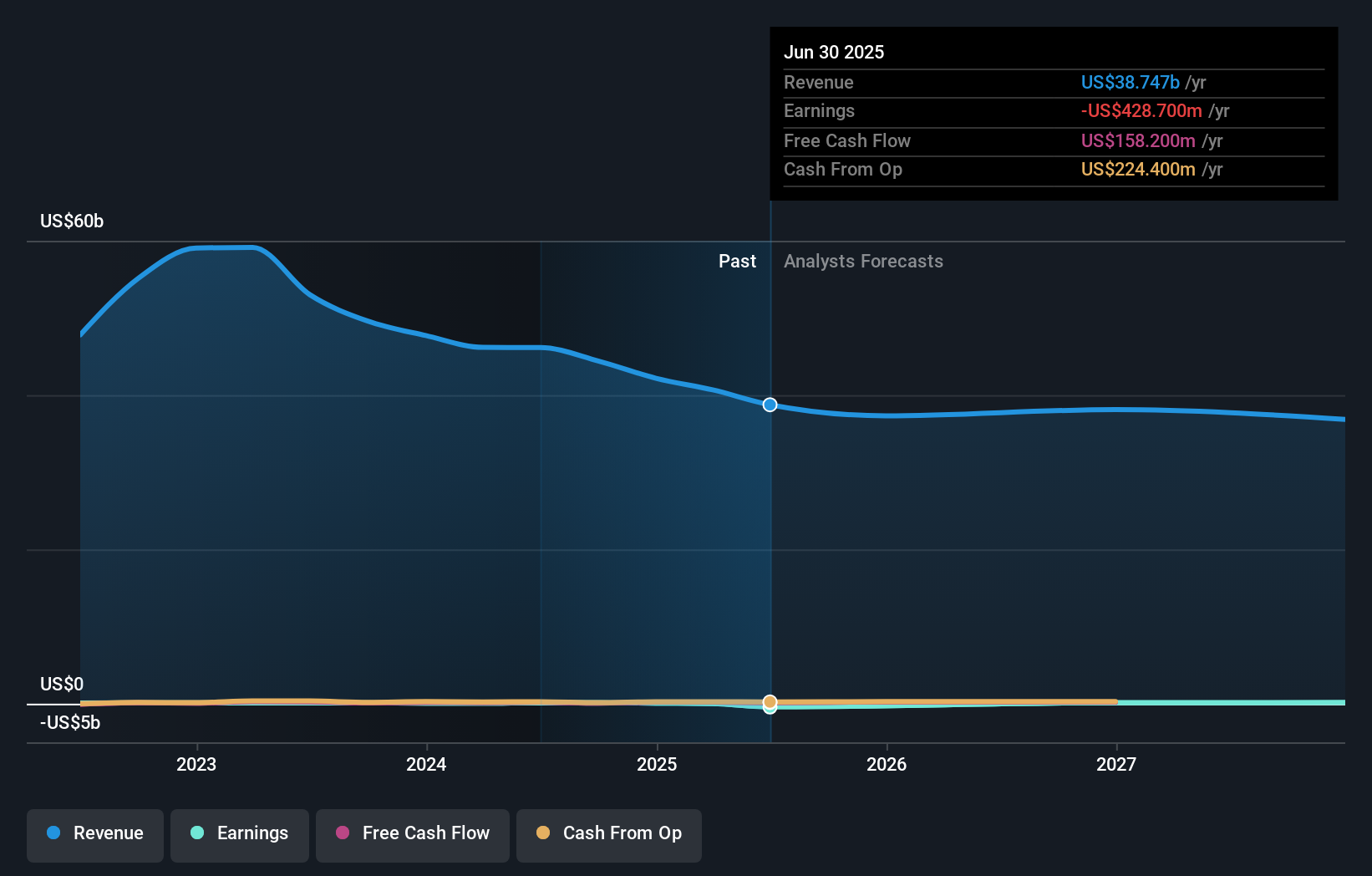

World Kinect's narrative projects $37.1 billion revenue and $330.9 million earnings by 2028. This requires a 1.5% annual revenue decline and a $759.6 million increase in earnings from the current level of $-428.7 million.

Uncover how World Kinect's forecasts yield a $28.33 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Community fair value estimates span from US$28.33 to US$80.05, reflecting just two distinct user projections on Simply Wall St. As many market voices weigh in, margin pressure from declining legacy businesses continues to shape performance outlook.

Explore 2 other fair value estimates on World Kinect - why the stock might be worth over 3x more than the current price!

Build Your Own World Kinect Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your World Kinect research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free World Kinect research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate World Kinect's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 32 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if World Kinect might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WKC

World Kinect

Operates as an energy management company in the United States, the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Very undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026