Last Update 06 Aug 25

Fair value Decreased 8.60%Despite improved consensus forecasts for revenue growth and net profit margin, the analyst price target for World Kinect has decreased from $31.00 to $28.33.

What's in the News

- Repurchased 1,350,000 shares for $35.26 million in Q2 2025, completing a total buyback of 8,011,402 shares for $208.11 million under the 2020 program.

- Recognized $367 million in non-cash intangible asset impairments in Q2 2025, primarily $359 million in goodwill.

- Added to the Russell 2000 Dynamic Index.

- Increased quarterly dividend by 18% to $0.20 per share.

Valuation Changes

Summary of Valuation Changes for World Kinect

- The Consensus Analyst Price Target has fallen from $31.00 to $28.33.

- The Consensus Revenue Growth forecasts for World Kinect has significantly risen from -2.9% per annum to -1.5% per annum.

- The Net Profit Margin for World Kinect has significantly risen from 0.61% to 0.90%.

Key Takeaways

- Sharper focus on core and recurring business lines, with operational efficiency initiatives, supports sustainable profit and margin improvement.

- Expansion into renewables and energy transition services positions the company for higher-margin growth amid increased global demand for sustainable solutions.

- Ongoing divestitures, declining core demand, and structural market shifts threaten growth, margins, and diversification, while new energy transitions demand costly reinvestment.

Catalysts

About World Kinect- Operates as an energy management company in the United States, the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

- World Kinect's accelerated portfolio transformation-divesting underperforming, less scalable, and more volatile land and marine assets-should lead to a greater focus on core, recurring, and ratable business lines with stronger returns and growth prospects, supporting improvement in earnings quality, net margins, and long-term profitability.

- The company's deepening investment in renewables, sustainability consulting, and energy transition services aligns with the rising demand for low-carbon and sustainable fuels, positioning it to capture higher-margin, secular growth opportunities as decarbonization mandates become more prevalent, positively impacting both future revenues and net margin mix.

- Strong performance and expansion in global aviation fuel and services, particularly in Europe and government-related segments, tap into the continued growth of global trade and air travel, underpinning stable to rising volumes and delivering organic revenue growth.

- Ongoing operational efficiency initiatives-including further streamlining of back-office and finance operations-signal a sustainable reduction in operating expenses, driving improved operating leverage and expanding bottom-line growth.

- The robust balance sheet and available liquidity enable opportunistic M&A and organic investments in strategically important markets, supporting long-term revenue expansion and potential scale-driven margin gains.

World Kinect Future Earnings and Revenue Growth

Assumptions

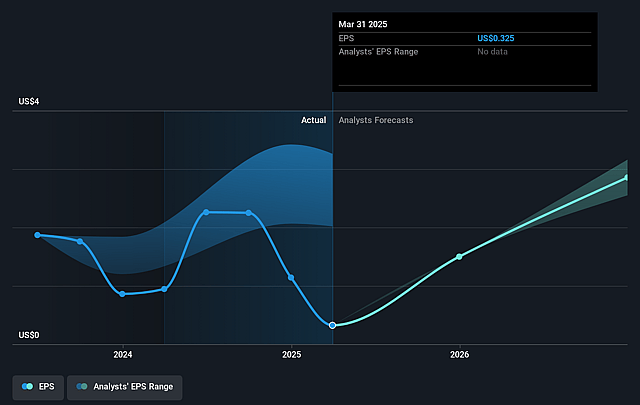

How have these above catalysts been quantified?- Analysts are assuming World Kinect's revenue will decrease by 1.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from -1.1% today to 0.9% in 3 years time.

- Analysts expect earnings to reach $330.9 million (and earnings per share of $-7.47) by about September 2028, up from $-428.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 5.1x on those 2028 earnings, up from -3.4x today. This future PE is lower than the current PE for the US Oil and Gas industry at 12.6x.

- Analysts expect the number of shares outstanding to decline by 4.36% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.75%, as per the Simply Wall St company report.

World Kinect Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Secular decline in the Land segment-due to ongoing divestitures, underperformance, and lower core liquid fuels demand-suggests shrinking addressable market and continued revenue headwinds, which could materially pressure long-term top-line growth.

- Margin compression risk as World Kinect continues to shed higher revenue but lower-margin (sometimes loss-making) activities, transitioning to a smaller, "core" portfolio that may ultimately limit operating leverage and constrain net margin improvement.

- Marine segment remains subject to global trade uncertainty and highly competitive, spot-driven market dynamics, which magnifies earnings volatility and threatens the sustainability of gross profit in this legacy line of business, impacting both revenues and bottom-line results.

- Company's ability to access new, higher-growth energy markets may be impaired by slow organic growth, uncertain M&A pipeline, and potential over-reliance on the legacy aviation segment-raising the risk of customer concentration and a less diversified earnings base.

- Broad shifts toward electrification, alternative fuels, and regulatory decarbonization mandates-combined with regionally variable demand for sustainability services-could structurally reduce long-term volumes, compress gross profit, and require significant reinvestment just to offset declines in traditional fuels businesses.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $28.333 for World Kinect based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $33.0, and the most bearish reporting a price target of just $26.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $37.1 billion, earnings will come to $330.9 million, and it would be trading on a PE ratio of 5.1x, assuming you use a discount rate of 7.8%.

- Given the current share price of $25.94, the analyst price target of $28.33 is 8.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.