Key Takeaways

- Accelerating energy transition, regulations, and technological shifts will erode World Kinect's traditional fuel business, placing sustained pressure on margins and long-term earnings potential.

- Reduced diversification and rising competition in fuel logistics heighten volatility and operational risk, undermining margin stability and price leadership prospects.

- Strategic divestitures, operational efficiencies, and diversified exposure position World Kinect for margin expansion, resilient cash flow, and sustained long-term earnings growth.

Catalysts

About World Kinect- Operates as an energy management company in the United States, the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

- The rapid global transition to renewable energy sources and electrification is expected to further reduce long-term demand for traditional fuels, shrinking World Kinect's total addressable market and leaving its core fuel distribution business exposed to inevitable volume declines and lower long-term revenue growth.

- Stricter carbon regulations, particularly in North America and Europe, will increase compliance costs and force continual capital outlays for adaptation, which will erode net margins and require ongoing restructuring or asset write-downs that depress future earnings potential.

- Increased adoption of electric vehicles and alternative propulsion technologies across the land and aviation sectors will accelerate the erosion of fossil fuel demand, negatively impacting volume growth and causing sustained pressure on both operating margins and consolidated gross profit.

- Heavy dependence on low-margin fuel distribution services, combined with recent divestitures of underperforming but geographically diverse land assets, will reduce revenue diversification and amplify vulnerability to cyclical downturns, resulting in greater quarter-to-quarter earnings volatility and limiting the company's ability to achieve stable margin expansion.

- Growing technological disruption and industry consolidation in fuel logistics is expected to intensify competition, diminish World Kinect's prospects for price leadership, and compress net margins further as operational efficiency initiatives are quickly offset by shrinking market share and rising operational risk across its core end markets.

World Kinect Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on World Kinect compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming World Kinect's revenue will decrease by 3.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 0.0% today to 0.5% in 3 years time.

- The bearish analysts expect earnings to reach $167.1 million (and earnings per share of $6.87) by about July 2028, up from $18.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 9.4x on those 2028 earnings, down from 87.5x today. This future PE is lower than the current PE for the US Oil and Gas industry at 12.5x.

- Analysts expect the number of shares outstanding to decline by 4.17% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.03%, as per the Simply Wall St company report.

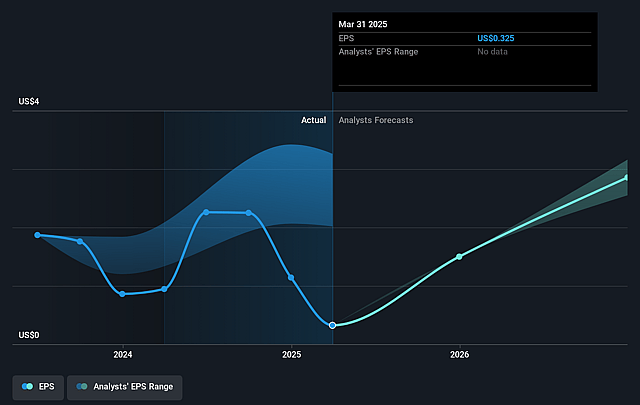

World Kinect Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- World Kinect's successful divestiture of underperforming and asset-intensive businesses in Brazil and the U.K. allows it to refocus capital and management attention on higher growth and higher margin core activities in North America, which could support improved returns on invested capital and stronger net margins in the long term.

- Continued strong momentum in the aviation segment, notably year-over-year growth in both volumes and gross profit, highlights the company's ability to capitalize on resilient global air travel and the growth in airports fueling and sustainable fuels, supporting top line revenue and margin improvement.

- The ongoing implementation of cost reduction, platform consolidation, and headcount optimization initiatives is expected to deliver sustained improvements in operating margins and free cash flow, directly benefiting net earnings and potentially enabling higher shareholder returns through buybacks and dividends.

- With a diversified business across marine, land, and aviation, plus a broad geographic footprint, World Kinect is well positioned to benefit from long-term growth in global trade and logistics, supporting revenue stability and reducing earnings volatility even amid changing trade and tariff policies.

- The company's disciplined approach to working capital management, opportunistic M&A pursuit, and investment in digital and operational efficiency create a strong balance sheet and sustaining free cash flow generation, which provide resilience and the ability to capture long-term growth opportunities that can underpin earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for World Kinect is $26.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of World Kinect's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $35.0, and the most bearish reporting a price target of just $26.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $36.3 billion, earnings will come to $167.1 million, and it would be trading on a PE ratio of 9.4x, assuming you use a discount rate of 7.0%.

- Given the current share price of $29.2, the bearish analyst price target of $26.0 is 12.3% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.