Key Takeaways

- Portfolio streamlining, cost removal, and disciplined capital allocation position the company for accelerated margin expansion, earnings growth, and well-timed strategic acquisitions.

- Early leadership in renewables, aviation profitability, and rapid digitization could unlock new revenue streams, sustainable margin gains, and long-term operational resilience.

- Slow diversification and heavy reliance on traditional fuels expose World Kinect to declining markets, tighter margins, rising regulatory costs, and increased operational and earnings volatility.

Catalysts

About World Kinect- Operates as an energy management company in the United States, the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

- Analysts broadly agree that portfolio streamlining and focusing on North America should boost margins, but this actually understates the step-change potential: the company is now targeting a 30% operating margin in land, up from around 25%, and internal commentary suggests that restructuring and cost removal could drive margins close to this target much earlier than expected, multiplying earnings power over the next few years.

- Analyst consensus points to improved aviation profitability as a stabilizing factor, but robust execution in European airport fuel operations and strong uptake in sustainable aviation fuels are already driving higher-than-forecast gross profit growth, indicating that aviation could be a long-term growth engine materially expanding consolidated margins and cash flow beyond current expectations.

- The company is exceptionally well-positioned to capitalize on the accelerating global demand for renewable fuels and carbon reduction solutions, having already built operational capabilities and customer relationships in renewables; this first-mover advantage could unlock large new revenue streams as regulation and customer preference shifts accelerate, substantially lifting both topline and margins.

- Management's disciplined capital allocation, boosted by recent divestitures and increased cash flow, places World Kinect in a prime spot to acquire high-value, technology-driven or renewable energy assets at distressed prices while competitors hesitate-giving the company a path to long-term double-digit compounded revenue and earnings growth through smart, well-timed M&A.

- Digitization and data-driven optimization initiatives are set to rapidly scale, with investments in energy management platforms enabling the company to secure new, higher-margin contracts and deeply embed itself into large customer operations, leading to sustainable net margin expansion and increased predictability of earnings.

World Kinect Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on World Kinect compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming World Kinect's revenue will decrease by 3.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 0.0% today to 0.5% in 3 years time.

- The bullish analysts expect earnings to reach $169.2 million (and earnings per share of $8.66) by about July 2028, up from $18.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 12.4x on those 2028 earnings, down from 84.7x today. This future PE is greater than the current PE for the US Oil and Gas industry at 12.3x.

- Analysts expect the number of shares outstanding to decline by 4.17% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.08%, as per the Simply Wall St company report.

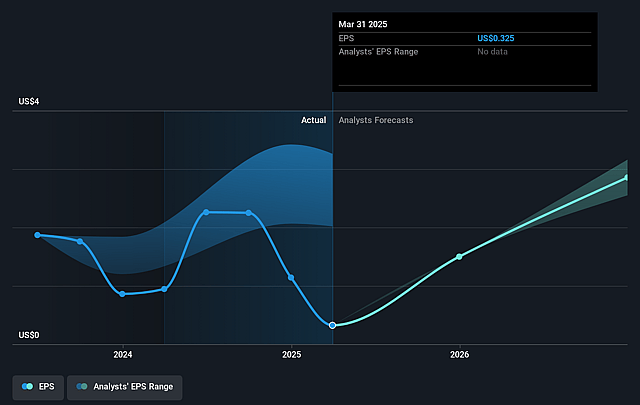

World Kinect Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating global shift toward decarbonization and electrification, especially in key markets like California and Europe, is leading to declining demand for traditional fuels and reducing World Kinect's addressable market, resulting in pressure on long-term revenues and potential for continued volume declines.

- World Kinect's relatively slow pace of diversification away from traditional liquid fuels, and the persistent dependence on core North American and aviation segments, increases its vulnerability as fossil fuel demand structurally declines, threatening future market share and revenue growth.

- The company operates in a sector with persistently thin and pressured net margins, due to ongoing commodity price volatility, intense competition, and high operational complexity, placing sustained downward pressure on long-term profitability and earnings.

- Regulatory and compliance risks are rising, especially with new environmental standards and market-specific taxes or mandates targeting fossil fuel distribution, which could materially increase World Kinect's cost base and further erode net margins.

- Increasing supply chain disruptions and geopolitical uncertainties, as evidenced by challenges in international marine and land fuel markets, contribute to greater earnings volatility and operational risk, potentially impacting both gross profit stability and future cash flow generation.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for World Kinect is $35.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of World Kinect's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $35.0, and the most bearish reporting a price target of just $26.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $36.2 billion, earnings will come to $169.2 million, and it would be trading on a PE ratio of 12.4x, assuming you use a discount rate of 7.1%.

- Given the current share price of $28.26, the bullish analyst price target of $35.0 is 19.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.