- United States

- /

- Energy Services

- /

- NYSE:WHD

How Will Cactus’ (WHD) Steady Dividend Amid Earnings Decline Shape Its Investment Narrative?

Reviewed by Sasha Jovanovic

- Cactus, Inc. announced that its Board of Directors approved a quarterly cash dividend of US$0.14 per share, with payment scheduled for December 18, 2025, to shareholders of record as of December 1, 2025, and a corresponding distribution for CC Unit holders.

- This dividend affirmation comes alongside Cactus reporting third quarter and nine-month results that reflect declines in both revenue and net income compared to the same period last year.

- We'll examine how the decision to maintain the dividend in the face of weaker financial results could shape Cactus’ investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Cactus Investment Narrative Recap

To own Cactus, Inc., investors need confidence in the company’s ability to drive resilience through margin improvement, international expansion, and product innovation, even during periods of extended downturn in U.S. energy activity. The recent decision to maintain the quarterly dividend, despite softer revenue and net income, does not materially alter the near-term outlook; the biggest catalyst remains the execution of growth in international markets, while the main risk continues to be persistent weakness in U.S. land drilling and completion activity.

Among recent announcements, the formation of a joint venture with Baker Hughes stands out as most relevant to revenue catalysts. This partnership is expected to enhance Cactus’ customer reach, especially in the Middle East, where energy infrastructure investment could support a more durable earnings base, helping balance out volatility in North American activity.

However, in contrast to the maintained dividend, investors should still be attentive to the continuing risk presented by...

Read the full narrative on Cactus (it's free!)

Cactus' narrative projects $1.7 billion revenue and $232.7 million earnings by 2028. This requires 15.3% yearly revenue growth and a $51.5 million earnings increase from $181.2 million today.

Uncover how Cactus' forecasts yield a $48.38 fair value, a 12% upside to its current price.

Exploring Other Perspectives

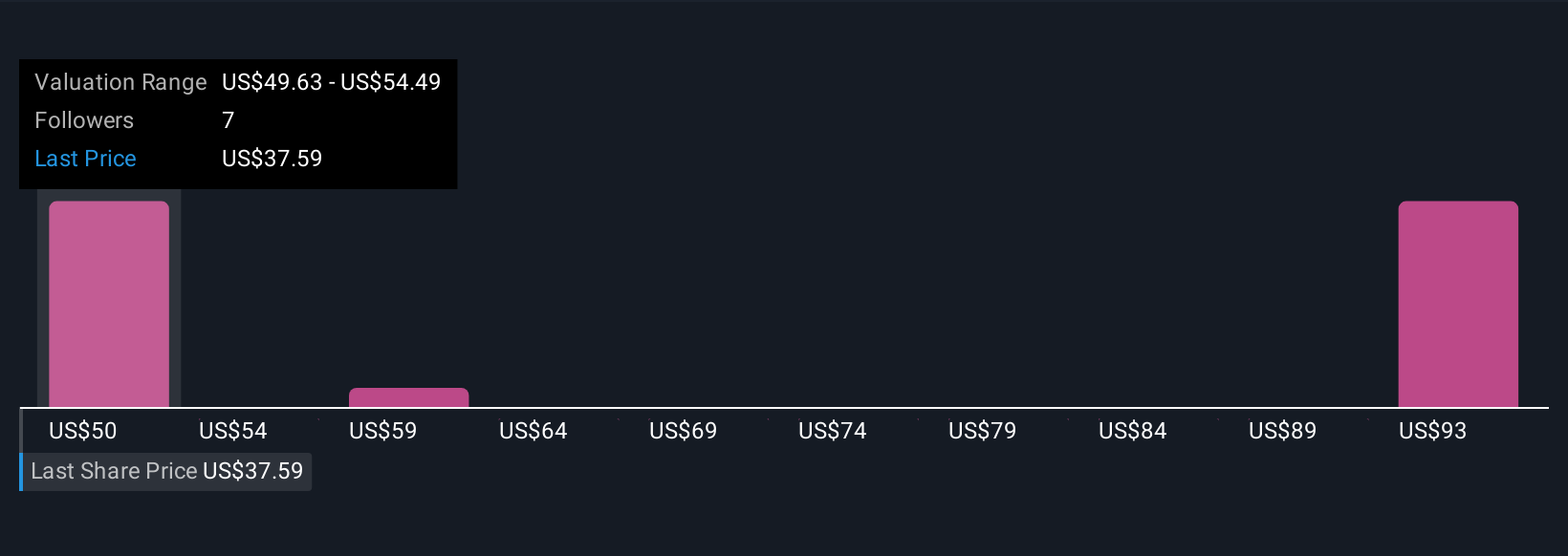

Fair value estimates from three Simply Wall St Community members range from US$48.38 to US$80.74 per share, reflecting a broad spectrum of individual outlooks. While some expect international growth to drive future gains, uncertainty around U.S. land drilling activity could impact long-term results, so be sure to compare several viewpoints.

Explore 3 other fair value estimates on Cactus - why the stock might be worth just $48.38!

Build Your Own Cactus Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cactus research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cactus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cactus' overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WHD

Cactus

Designs, manufactures, sells, and rents engineered pressure control and spoolable pipe technologies in the United States, Australia, Canada, the Middle East, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives