- United States

- /

- Oil and Gas

- /

- NYSE:WES

Positive Earnings Surprise Prediction Could Be a Game Changer for Western Midstream Partners (WES)

Reviewed by Sasha Jovanovic

- In recent days, analyst commentary has highlighted that Western Midstream Partners (WES) is showing a positive Expected Surprise Prediction (ESP), raising expectations for a potential earnings outperformance in its upcoming report.

- This ESP figure, which compares the Most Accurate Estimate to consensus forecasts, is closely watched by investors as it offers an early signal that actual results may exceed projections, potentially boosting market sentiment ahead of earnings.

- We’ll explore how this increased optimism for a positive earnings surprise informs the outlook for Western Midstream Partners' investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Western Midstream Partners Investment Narrative Recap

To be a Western Midstream Partners shareholder, you need to believe in the ongoing strength of US energy demand and WES’s ability to deliver reliable cash flows from its fee-based pipeline and processing network. The recent analyst attention on WES’s positive Expected Surprise Prediction (ESP) adds near-term optimism, but doesn't materially change the biggest short-term catalyst: continued strong throughput driven by stable producer activity. The largest immediate risk remains any slowdown in producer drilling or rapid policy change affecting US oil and gas output, as these could quickly hit revenue and margins.

One recent announcement that stands out is the affirmation of WES’s quarterly cash distribution at US$0.910 per unit for Q2 2025. This move provides income consistency for unitholders and signals management’s confidence in near-term cash generation, keeping distributable earnings in focus as investors weigh upcoming earnings against the backdrop of the ESP signal. These factors tie directly to the company’s key catalyst: ongoing throughput strength and organic contract wins supporting predictable returns.

However, in contrast to this sense of stability, investors should be aware that with WES’s growth plans requiring large capital outlays for new infrastructure...

Read the full narrative on Western Midstream Partners (it's free!)

Western Midstream Partners' narrative projects $4.5 billion in revenue and $1.7 billion in earnings by 2028. This requires 7.1% yearly revenue growth and an increase in earnings of $0.5 billion from the current $1.2 billion.

Uncover how Western Midstream Partners' forecasts yield a $40.33 fair value, a 3% upside to its current price.

Exploring Other Perspectives

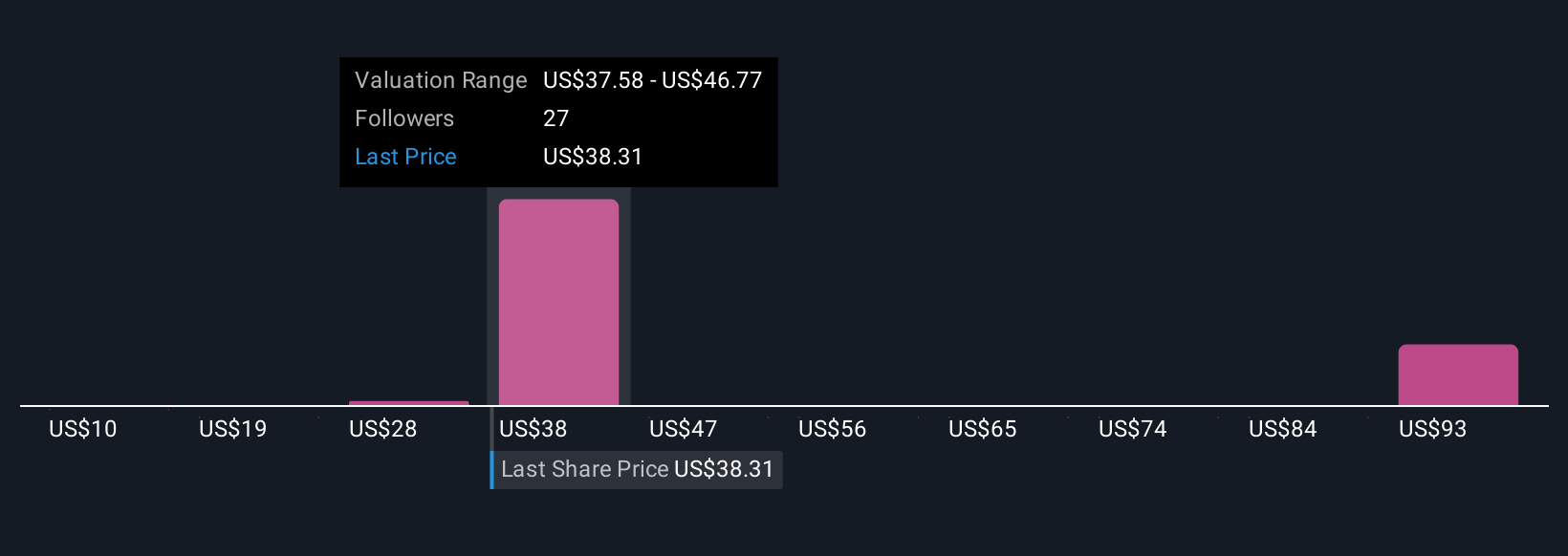

Fair value estimates from five Simply Wall St Community members range from US$10 to US$101.93 per unit. While some see room for significant upside, ongoing capital-intensive expansion projects could pressure future returns if energy demand or producer activity falters, so consider how your outlook aligns with theirs.

Explore 5 other fair value estimates on Western Midstream Partners - why the stock might be worth over 2x more than the current price!

Build Your Own Western Midstream Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Western Midstream Partners research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Western Midstream Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Western Midstream Partners' overall financial health at a glance.

No Opportunity In Western Midstream Partners?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Western Midstream Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WES

Western Midstream Partners

Operates as a midstream energy company primarily in the United States.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives