- United States

- /

- Energy Services

- /

- NYSE:INVX

US Market's Top 3 Undiscovered Gems for Your Portfolio

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 1.6%, contributing to a 12% climb over the past year, with earnings forecasted to grow by 14% annually. In this dynamic environment, identifying stocks that are not only resilient but also poised for growth can be key to enhancing your portfolio's potential.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| West Bancorporation | 169.96% | -1.41% | -8.52% | ★★★★★★ |

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| Pure Cycle | 5.11% | 1.07% | -4.05% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Vantage | 6.72% | -16.62% | -15.47% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Innovex International (INVX)

Simply Wall St Value Rating: ★★★★★☆

Overview: Innovex International, Inc. specializes in designing, manufacturing, selling, and renting mission-critical engineered products for the global oil and natural gas industry with a market cap of $1.15 billion.

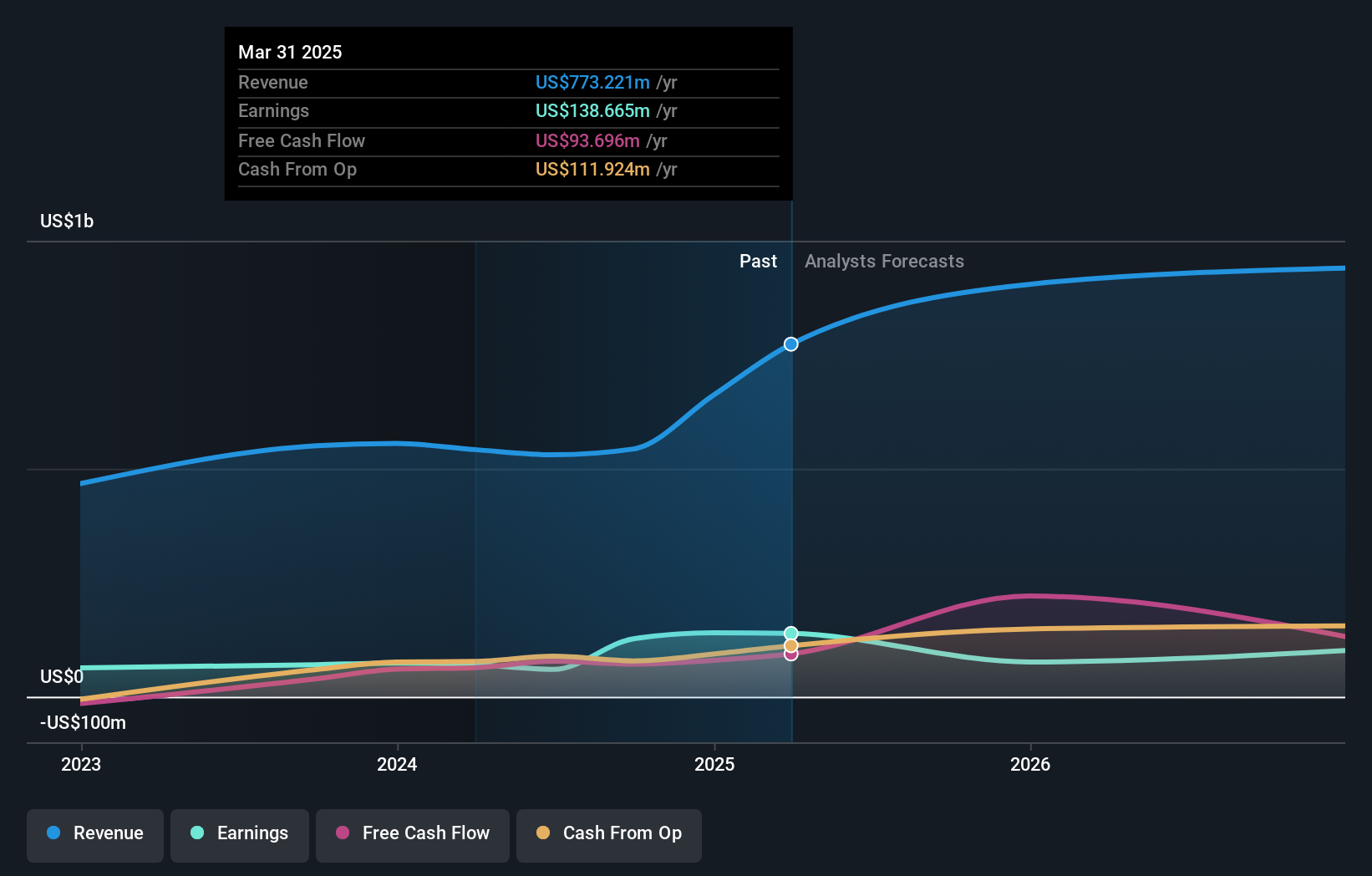

Operations: Innovex International generates revenue primarily from its Oil Well Equipment & Services segment, totaling $773.22 million. The company's cost structure and financial performance details are not specified in the provided data.

Innovex International, a nimble player in the energy services sector, has showcased impressive earnings growth of 97.3% over the past year, surpassing industry averages. Despite this growth, recent financials reveal a net income dip to US$14.76 million from US$16.42 million the previous year due to significant one-off gains and impairment charges amounting to $2.92 billion impacting results. The company appears undervalued by 9.5% compared to its estimated fair value and maintains robust interest coverage at 37.9 times EBIT against debt obligations, reflecting strong operational efficiency amidst rapid market changes.

- Click here and access our complete health analysis report to understand the dynamics of Innovex International.

Assess Innovex International's past performance with our detailed historical performance reports.

SandRidge Energy (SD)

Simply Wall St Value Rating: ★★★★★★

Overview: SandRidge Energy, Inc. operates in the acquisition, development, and production of oil, natural gas, and natural gas liquids primarily in the U.S. Mid-Continent region with a market cap of $408.84 million.

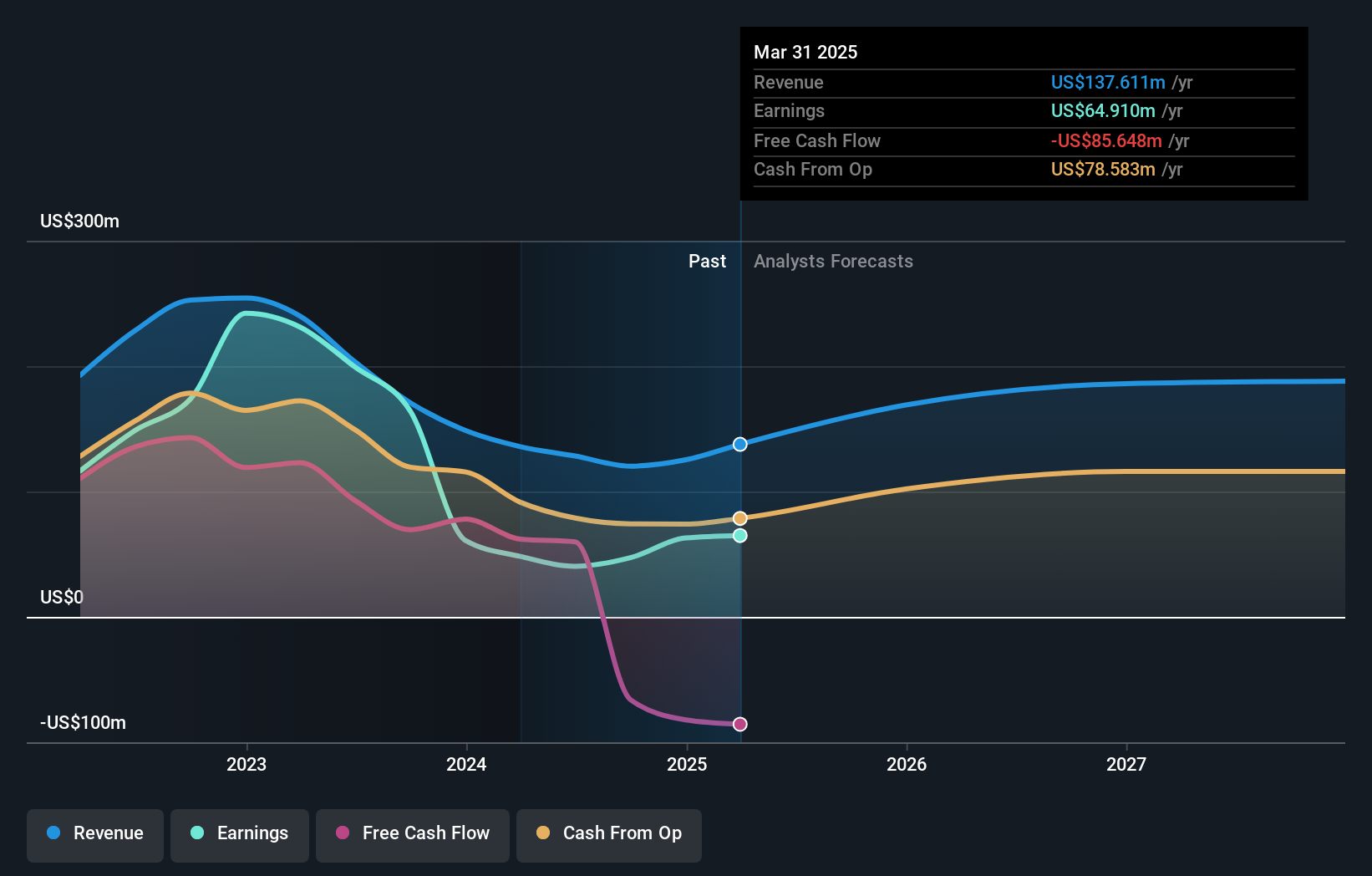

Operations: SandRidge Energy generates revenue of $137.61 million from its activities in oil, natural gas, and natural gas liquids.

SandRidge Energy, a nimble player in the energy sector, has shown impressive earnings growth of 34.6% over the past year, outpacing its industry peers who saw a -9.8% change. The company's price-to-earnings ratio stands at 6.4x, significantly lower than the US market average of 18.1x, suggesting potential undervaluation. Despite being debt-free and having reduced its debt from five years ago when it had an 11.8% debt-to-equity ratio, SandRidge is not yet free cash flow positive but continues to focus on strategic buybacks with recent repurchases amounting to $5.1 million for 452,230 shares in early 2025.

Bristow Group (VTOL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bristow Group Inc. offers vertical flight solutions to offshore energy companies and government agencies, with a market cap of approximately $962.25 million.

Operations: Bristow Group generates revenue primarily from Offshore Energy Services, contributing $975.95 million, and Government Services, adding $333.43 million. The company has a market cap of approximately $962.25 million.

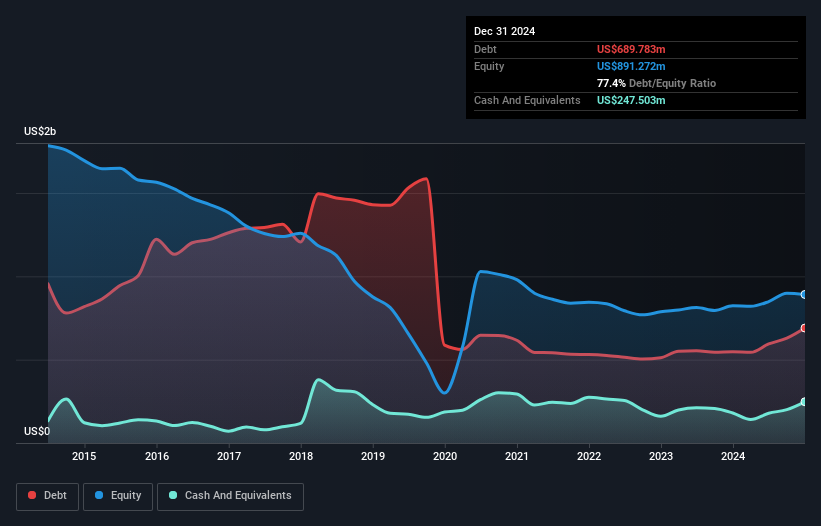

Bristow Group, a notable player in the aviation sector, is making strategic moves to bolster its position. The recent expansion of its partnership with Vertical Aerospace aims to introduce advanced air mobility solutions, potentially reshaping commercial operations. Despite a high net debt-to-equity ratio of 54.9%, Bristow's earnings skyrocketed by 8478% over the past year, outpacing industry growth. The company trades at an attractive price-to-earnings ratio of 8.4x compared to the US market's 18.1x and has reduced its debt-to-equity from 97.4% to 75.4% over five years, suggesting improved financial health and operational efficiency prospects ahead.

Key Takeaways

- Get an in-depth perspective on all 284 US Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INVX

Innovex International

Designs, manufactures, sells, and rents mission critical engineered products to the oil and natural gas industry worldwide.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives