- United States

- /

- Marine and Shipping

- /

- NYSE:GSL

US Market's Hidden Gems: 3 Small Caps With Strong Potential

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it is up 11% over the past year with earnings forecast to grow by 15% annually. In this environment, identifying small-cap stocks with strong potential can be a strategic move for investors seeking to uncover hidden opportunities in a steady market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| West Bancorporation | 169.96% | -1.41% | -8.52% | ★★★★★★ |

| Morris State Bancshares | 9.62% | 4.26% | 5.10% | ★★★★★★ |

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Wilson Bank Holding | 0.00% | 7.88% | 8.09% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Global Ship Lease (GSL)

Simply Wall St Value Rating: ★★★★★☆

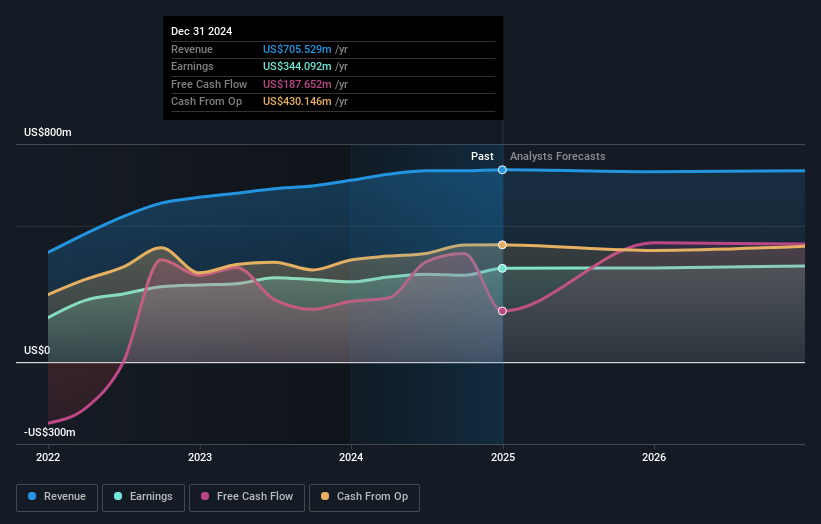

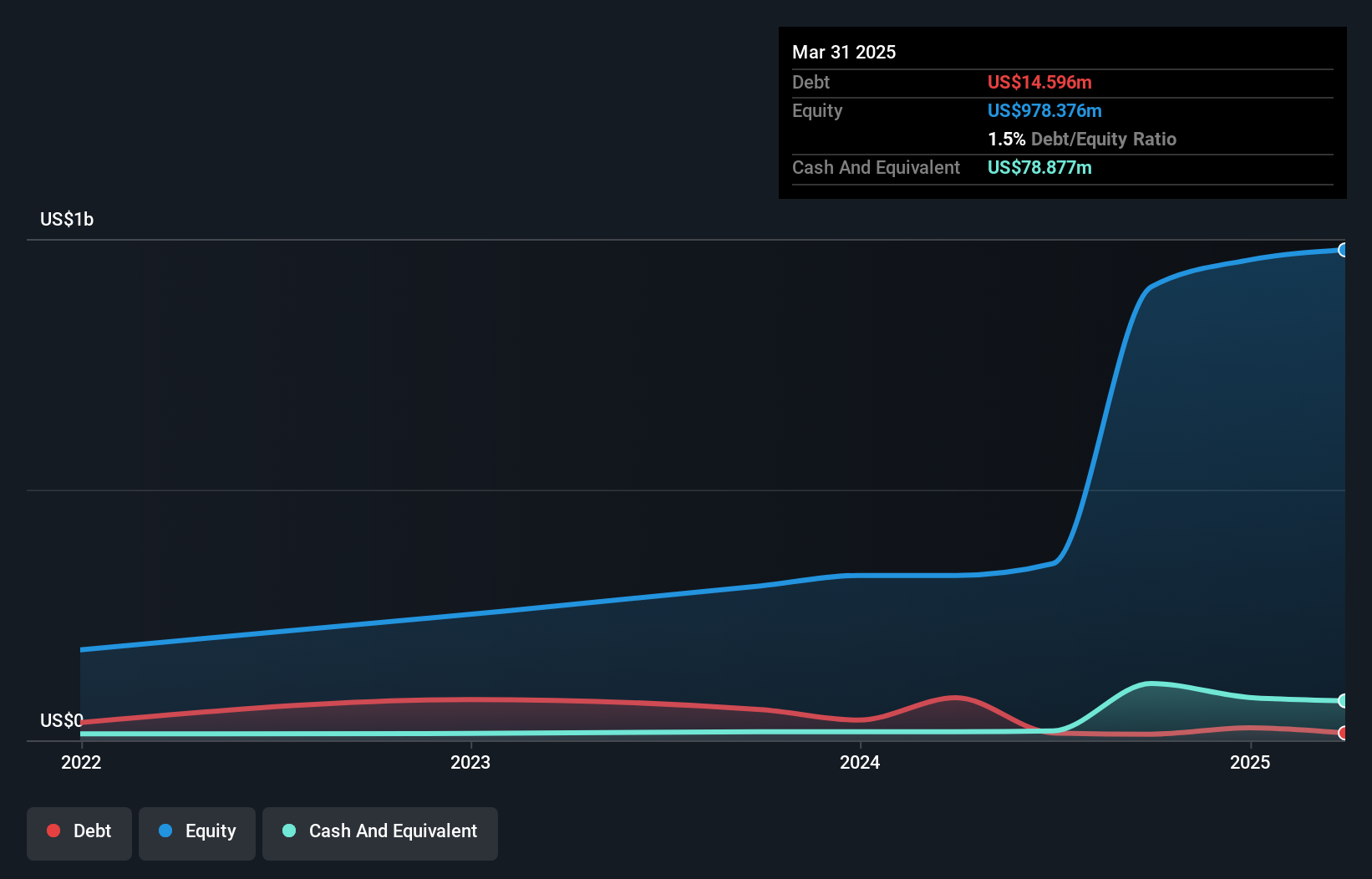

Overview: Global Ship Lease, Inc. owns and charters containerships under fixed-rate agreements to container shipping companies globally, with a market capitalization of approximately $993.23 million.

Operations: The company generates revenue primarily from its transportation and shipping segment, amounting to $715.23 million.

Global Ship Lease, a nimble player in the shipping industry, has shown impressive financial resilience. Over the past year, earnings grew by 20%, outpacing the industry's negative trend of -5%. The company’s debt to equity ratio significantly improved from 207% to 35% over five years, indicating strong financial management. Trading at nearly 80% below estimated fair value, it offers a compelling opportunity for investors seeking undervalued assets. Despite potential market volatility due to its aging fleet and geopolitical risks, GSL's strategic focus on midsized vessels and robust charter coverage provides a stable foundation for future growth and revenue stability.

Innovex International (INVX)

Simply Wall St Value Rating: ★★★★★☆

Overview: Innovex International, Inc. designs, manufactures, sells, and rents mission-critical engineered products to the oil and natural gas industry worldwide with a market cap of approximately $1.12 billion.

Operations: Innovex generates revenue primarily from its Oil Well Equipment & Services segment, which accounts for $773.22 million. The company's market cap stands at approximately $1.12 billion.

Innovex International, a nimble player in the energy services sector, has shown remarkable performance with earnings surging by 97% over the past year, outpacing industry growth of 7.8%. Despite a one-off gain of US$51 million impacting recent results, the company maintains strong financial health with interest payments well covered at 37.9 times EBIT. Recent activities include repurchasing 395,234 shares for US$5.9 million and filing a shelf registration for US$70 million to support its ESOP offering. Innovex's revenue is expected to grow annually by over 10%, although earnings might decrease by nearly 18% per year in the short term.

Bristow Group (VTOL)

Simply Wall St Value Rating: ★★★★☆☆

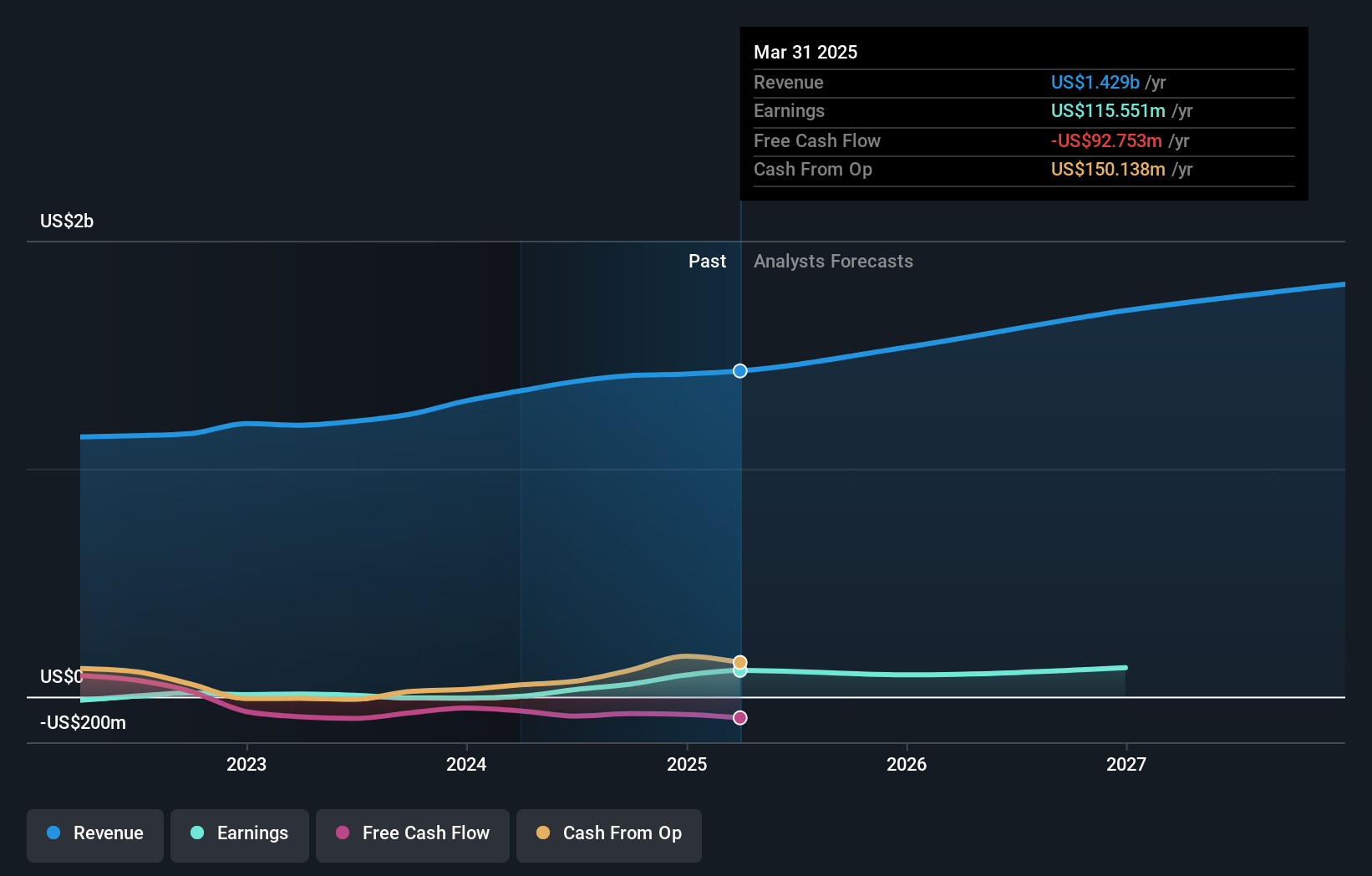

Overview: Bristow Group Inc. offers vertical flight solutions primarily to offshore energy companies and government agencies, with a market cap of $1.04 billion.

Operations: Bristow Group generates revenue primarily through Offshore Energy Services ($975.95 million) and Government Services ($333.43 million). The company's net profit margin trends are noteworthy for analysis, providing insights into its financial performance.

Bristow Group, a nimble player in the energy services sector, has shown resilience with its earnings growth of 8478.4% surpassing industry averages. Despite a high net debt to equity ratio of 54.9%, its interest payments are comfortably covered at 5.6 times by EBIT, indicating solid financial health. Trading at a price-to-earnings ratio of 9x compared to the US market's 18.7x suggests undervaluation relative to peers. Recent strategic moves include expanding partnerships for advanced air mobility and securing government contracts for stable cash flows, although challenges like regulatory hurdles and competition remain on the horizon.

Turning Ideas Into Actions

- Embark on your investment journey to our 279 US Undiscovered Gems With Strong Fundamentals selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GSL

Global Ship Lease

Engages in owning and chartering of containerships under fixed-rate charters to container shipping companies worldwide.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives