- United States

- /

- Energy Services

- /

- NYSE:VTOL

Executive Reshuffle Might Change The Case For Investing In Bristow Group (VTOL)

Reviewed by Simply Wall St

- On August 21, 2025, Bristow Group announced that Elizabeth Matthews, Senior Vice President, General Counsel, Head of Government Affairs, and Corporate Secretary, has departed the company effective immediately as part of an organizational restructuring.

- The redistribution of these key roles across the executive leadership team signals a significant shift in Bristow's internal governance structure and decision-making processes.

- We'll examine how the sudden departure of a multi-role executive could alter Bristow Group's investment narrative and leadership outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Bristow Group Investment Narrative Recap

To own Bristow Group shares, investors must have confidence in the company's ability to drive long-term growth from government contracts, offshore transport demand, and ambitious air mobility expansion, while effectively managing capital needs and operating costs. The restructuring and departure of a key executive has not materially altered Bristow’s main catalyst, execution on major government search and rescue contract ramps, nor does it directly impact the most pressing risk around persistent supply chain pressures. These core drivers of value and risk remain unchanged in the short term.

Among recent announcements, the updated earnings guidance delivered on August 5, 2025, stands out as the most relevant. Strong revenue and earnings projections for 2025 and 2026 reinforce the investment case, underlining that the company continues to target solid growth despite leadership changes, suggesting operational focus on contract transitions and expansion initiatives remains intact.

By contrast, investors should remain aware of how ongoing supply chain bottlenecks can still disrupt Bristow’s growth ambitions and cash flows in ways that...

Read the full narrative on Bristow Group (it's free!)

Bristow Group's outlook anticipates $1.9 billion in revenue and $129.4 million in earnings by 2028. This reflects a 9.0% annual revenue growth rate and a $10.3 million earnings increase from the current $119.1 million.

Uncover how Bristow Group's forecasts yield a $47.50 fair value, a 23% upside to its current price.

Exploring Other Perspectives

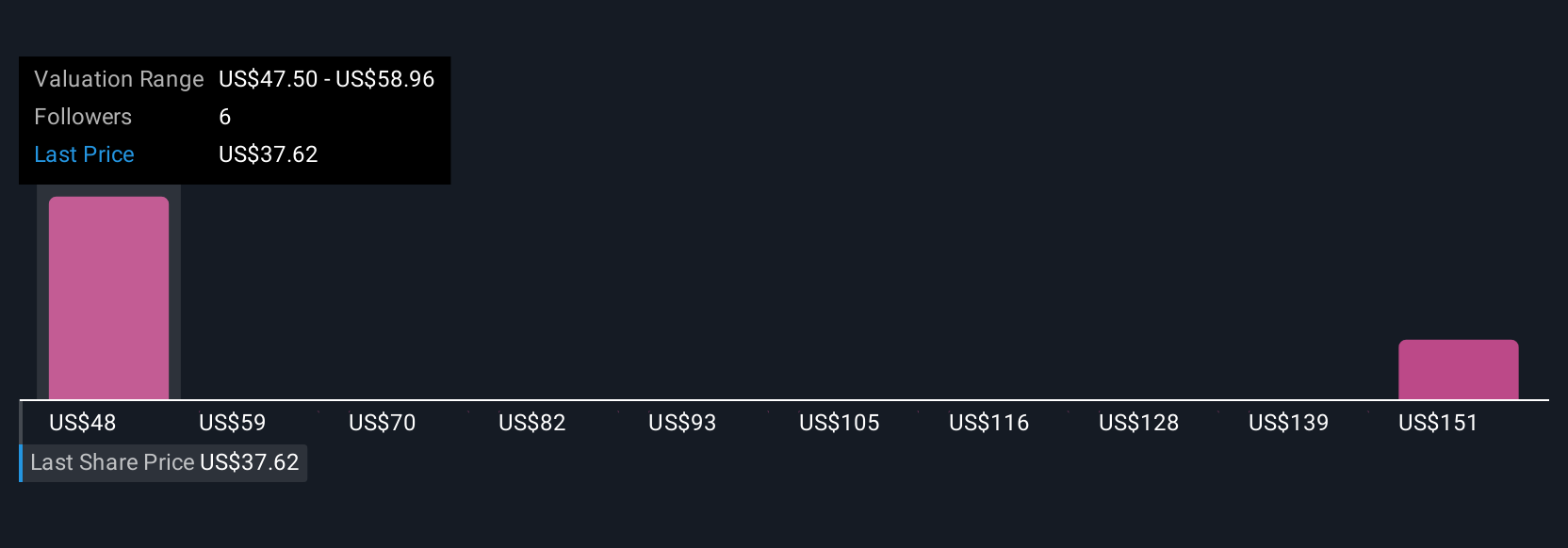

Private fair value estimates from two Simply Wall St Community members span a wide US$47.50 to US$161.14 range. Supply chain risk may limit execution on large contracts, so consider several viewpoints as you assess Bristow's prospects.

Explore 2 other fair value estimates on Bristow Group - why the stock might be worth over 4x more than the current price!

Build Your Own Bristow Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bristow Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Bristow Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bristow Group's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 28 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bristow Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VTOL

Bristow Group

Provides vertical flight solutions to integrated, national, and independent offshore energy companies and government agencies.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives